Nord Stream 2: More hot air than gas?

Some EU member-states see the Nord Stream 2 gas pipeline as Russia’s latest anti-European weapon. But even if they are right, the threat can be mitigated.

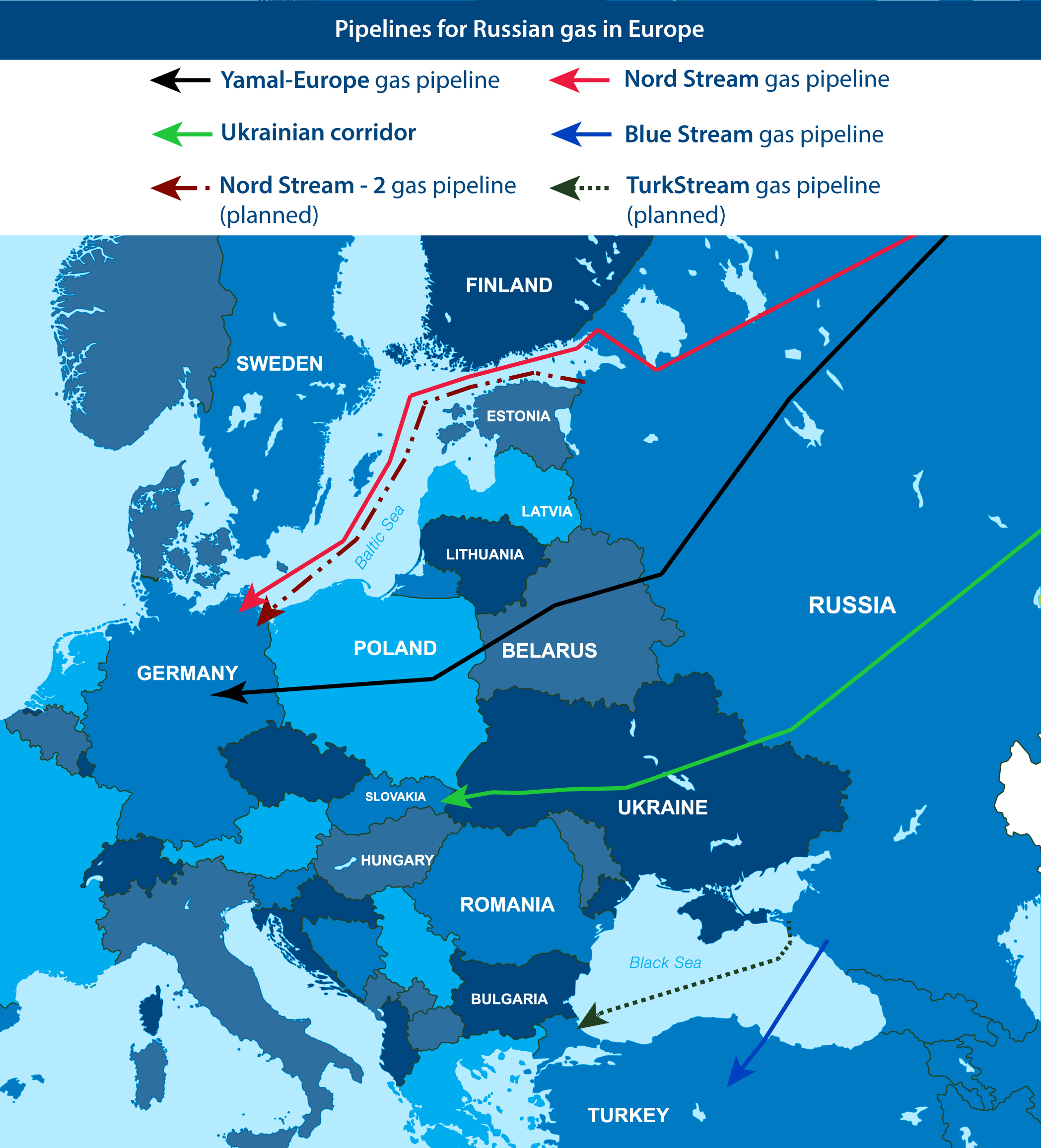

Gazprom, the state-owned Russian gas giant, wants to build a new gas pipeline, known as Nord Stream 2, in the Baltic Sea between Russia and Germany. Critics correctly point out that Western Europe would benefit from cheaper gas, while Central and Eastern Europe would still be too reliant on gas delivered through Ukraine. But Europe is less vulnerable to ‘the Russian gas weapon’ than ever, and the threat to some member-states can be mitigated if the EU continues to build a better-integrated, better-connected gas market.

If built, Nord Stream 2 would follow the path of Nord Stream 1, doubling the route’s capacity, and enabling Western Europe to import more gas as indigenous production declines. The backers of the project are Gazprom, the state-owned Russian company, and five energy companies from Germany, France, the UK, and the Netherlands. An array of studies project a moderate increase in EU gas import needs by 2040 (though previous projections have proved to be too high). However, the Western European companies partnering with Gazprom may not care whether the pipeline runs at capacity – Gazprom pays the shareholders of the Nord Stream consortium the same amount regardless of gas flows, and enticed the other energy companies to participate with asset swaps and promises of future co-operation.

According to projections from the Regional Centre for Energy Policy Research (REKK), a Hungarian think-tank, Nord Stream 2 would slightly reduce costs for Western European consumers and increase earnings for Western European transit system operators, who would sell gas to the East. Russian gas is typically cheaper than alternatives such as liquefied natural gas (LNG); if more were available, EU member-states would buy it.

Some EU member-states see Nord Stream 2 as Russia's latest weapon. But even if they are right, the threat can be mitigated.

Within the EU, Nord Stream 2 is supported particularly by Germany (which could become a more important energy hub if the project goes ahead), as well as Austria and the Netherlands. A group led by Poland and the Baltic States, however, want the pipeline cancelled. Ukraine’s reliability as a transit route is the main point of dispute. In 2016, 53 per cent of Russian gas exports to the EU came through Ukraine. Nord Stream 2’s defenders claim the new pipeline could increase security of supply, citing the pricing disputes between Russia and Ukraine that disrupted gas flows to Europe in 2006 and 2009. The European Commission vetoed, on regulatory grounds, Russia’s last attempt to circumvent its troublesome neighbour, the South Stream pipeline that would have run through Bulgaria. With Nord Stream 2, Gazprom could reduce transit through Ukraine to around a quarter of current volumes.

That cut would deprive Ukraine of much of the €1.8 billion (nearly 2 per cent of GDP) it earns annually in transit fees, undercutting the EU’s financial support for Ukraine. (Slovakia could also lose up to €800 million a year in transit fees if Russia stopped using the Ukrainian route to Europe.) The European Investment Bank has lent Ukraine billions of euros to improve its gas infrastructure, and the EU is working with Naftogaz, Ukraine’s state-owned energy company, to clean up and modernise this notoriously corrupt sector. Moreover, any additional revenues for Russia from Nord Stream 2 would soften the impact of EU sanctions against Moscow. “By supporting Nord Stream 2,” wrote the Polish minister for European affairs in the Financial Times, “the EU in effect gives succour to a regime whose aggression it seeks to punish through sanctions.”

Opponents argue Nord Stream 2 is a purely political project: current import pipelines are only running at around 60 per cent capacity. They also say it would undermine the EU’s goal of diversifying its energy sources – in 2015 Russia was the Union’s largest single supplier, ahead of Norway, and accounted for 37 per cent of the EU’s natural gas imports.

Some member-states would not benefit from additional deliveries through Germany. Slovakia’s case is illustrative. There is limited capacity for shipping gas from the West to the East. Currently, Slovakia can use the West-East pipelines to buy gas for immediate delivery at ‘spot’ prices, while gas bought under long-term contracts with Gazprom, which tends to be more expensive, comes through Ukraine. But if Ukrainian transit was minimised, those West-East pipelines would be filled up with gas under longer-term contracts. Due to this bottleneck, the volume of cheaper ‘spot’ gas flowing to Central and Eastern European countries would be lower and prices in the region would increase, according to REKK.

The bottleneck would hit Ukraine too. Since 2015 Ukraine has bought no gas direct from Gazprom, instead purchasing Russian gas indirectly from European traders. But with Nord Stream 2, Slovenia, Croatia and others would also be forced to bid for the gas flowing through Germany. The West-East ‘reverse flow’ capacity would quickly be exhausted, and Russia would have something closer to a captive market in Eastern Europe, absent more European investment in infrastructure. Moscow could use Eastern Europe’s dependence on its gas to reduce supplies and extract political concessions, all without affecting its richest customers.

It is true that Gazprom’s supply interruptions are sometimes linked to geopolitical events. For instance, Gazprom nearly doubled the price of gas exports to Ukraine in March 2014, citing unpaid debts. Ukraine had owed Gazprom substantial sums since 2009, and this rapid price increase – coming on the heels of the revolution that ousted President Viktor Yanukovych, Vladimir Putin’s man in Kiev – was suspiciously timed. Gazprom is less a normal commercial enterprise than an arm of the Russian state.

Source: 2016 Gazprom corporate brochure.

Though the European Commission opposes the project, its options are limited. “We don’t like Nord Stream 2 politically,” Anna-Kaisa Itkonen, an energy spokesperson at the Commission, told The Wall Street Journal. “This being said, there are no legal grounds for the Commission to oppose Nord Stream 2.” Brussels is trying to stretch its regulatory authority to fill this legal gap. First it requested a mandate to negotiate the principles of operation for the pipeline with Russia. This was supposedly necessary because the EU’s third energy package (TEP) applied to the part of the pipeline in EU waters, but not to the Russian section, creating a “legal void”, with different rules for third-party supplier access to the pipeline at the Russian and EU ends of the pipe, for example. The TEP requires that the company that supplies the gas cannot monopolise the pipeline it is delivered through, and Gazprom would find it difficult to comply with that requirement. Unfortunately, both the Commission’s legal service and that of the Council agreed that the TEP rules were not applicable to Nord Stream 2. It is very unlikely that the Commission would get unanimous member-state support for negotiations with Russia.

The Commission now proposes to modify the EU’s gas directive to cover all pipelines importing gas into the bloc, since its attempts to get a mandate to negotiate bilaterally with Russia have not worked so far. It wants to be able to negotiate with all third countries with pipelines entering the EU, to ensure the owners of pipelines do not monopolise the supply of gas. This is controversial. Europe’s gas companies are calling for an impact assessment. And it is far from certain that the Council will approve the proposed law change. At the moment, construction of Nord Stream 2 can go ahead as long as member-states’ regulators grant permits.

The Nord Stream 2 pipeline won’t wreck Europe’s gas market – if the EU keeps up its good work.

The delicate state of Germany’s coalition negotiations make it hard for Angela Merkel to object to Nord Stream 2 (which she has in any case described as “an economic project”): the SPD is broadly supportive of it. Denmark, however, recently passed a law allowing it to opt out of the project on security grounds, which could force a costly rerouting away from Danish waters. And the combination of Europe’s uncertain regulatory environment and new (discretionary) US sanctions on Russian energy export pipelines is making capital markets wary. Gazprom and its European partners will have to finance much of the project on their own.

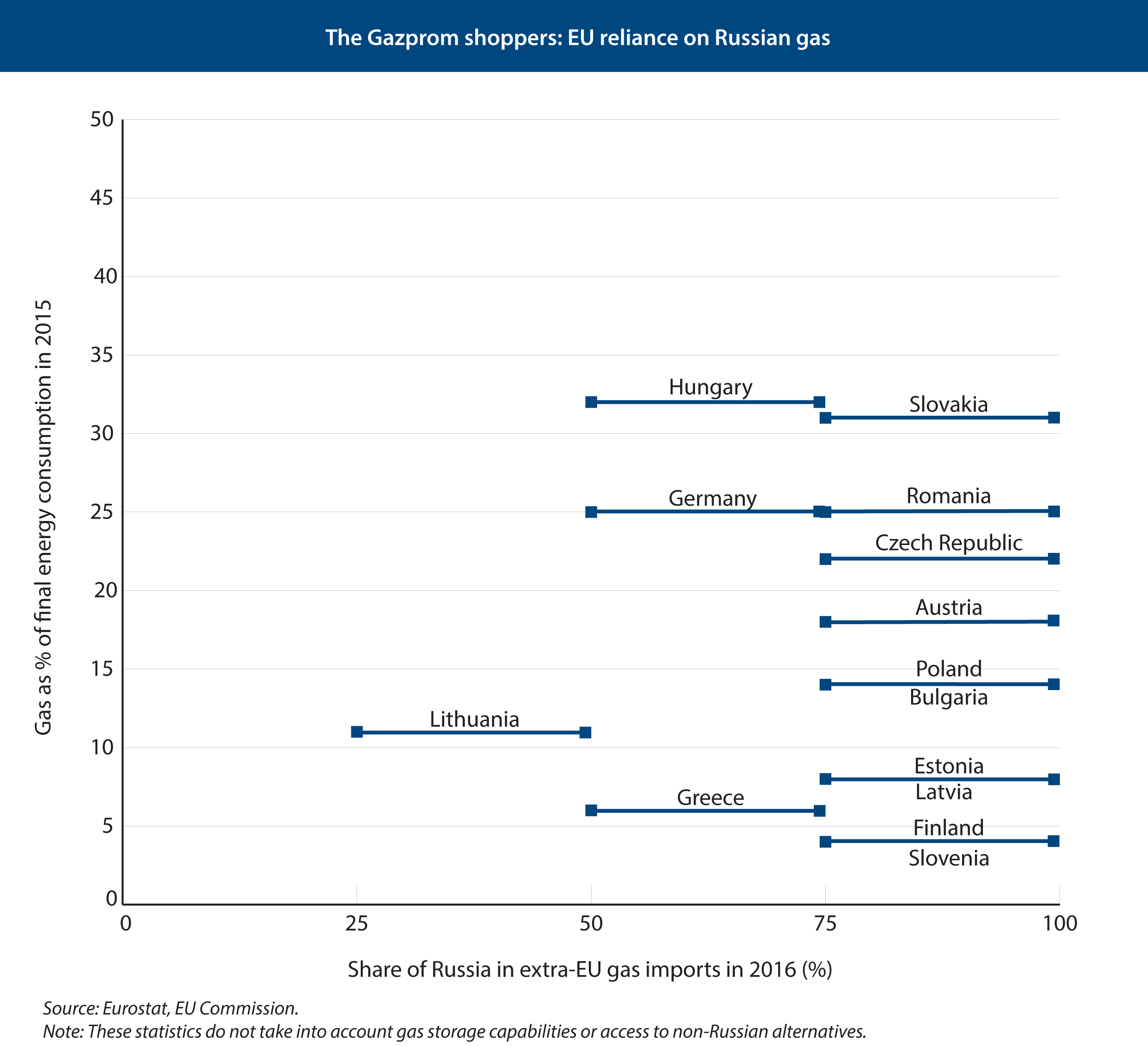

Whatever happens, Nord Stream 2 raises questions about Europe’s relationship with Russian gas. Many member-states are highly dependent on Russian gas (see chart below). Yet Russia is also dependent on selling hydrocarbons to the EU: in 2015 oil and gas accounted for 62 per cent of Russian exports, and nearly half of Russia’s total exports went to the EU. With oil prices low and plans to sell more gas to China faltering, Gazprom’s financial position is weakening, even with record-high gas sales in Europe. The Russian company has started to move to a more market-based approach, selling more gas at spot prices for immediate delivery rather than with long-term contracts linked to the price of oil, and offering discounts when contracts get too expensive. Thanks to huge gas reserves and low marginal costs, Gazprom still has the means to engage in a ‘price war’ to defend market share and deter investment by competitors. But it would suffer in such a scenario, and its hold on Europe’s gas market is slipping.

Gazprom’s diminished power is due in part to the good work of European actors. The Commission accused it of hindering competition; the company has avoided an EU fine by pledging to ensure that gas prices reflect competitive benchmarks and to permit the resale of its gas between member-states. New EU regulations establish a ‘solidarity principle’, so that member-states are supposed to help their neighbours in the event of a serious gas shortage. The EU is providing funding and political support to ‘projects of common interest’, such as a pipeline in Lithuania for that country’s new LNG terminal, and new gas interconnectors between Slovakia and Poland (which has also built an LNG terminal).

This does not mean that Poles or Lithuanians will necessarily stop buying Russian gas: Lithuania leveraged its terminal to negotiate a cheaper contract with Gazprom. One priority of the EU’s energy strategy is “empowering consumers”; and consumers may choose not to pay more in the name of diversification. Security of supply should not be defined solely in terms of Russia’s import share, but by the availability of alternative supplies in times of crisis.

The Commission reports that nearly all member-states could now withstand the temporary loss of their biggest supplier. South-Eastern Europe is the region most vulnerable to Russian gas cuts; the EU is making it more resilient by funding new interconnectors. Still, according to the Oxford Institute for Energy Studies, there is “limited scope for significantly reducing overall European dependence on Russian gas before the mid-2020s”. That is partly because European companies have long-term contracts with Gazprom running to 2030.

Nord Stream 2 will cut prices in Western Europe and create bottlenecks in the East. But Europe’s gas market is improving and the threat from Gazprom is exaggerated.

If Nord Stream 2 does go ahead, it will not be decisive for European energy security or relations with Russia – and this one pipeline should not be allowed to poison Germany’s relations with its neighbours. Wholesale gas prices in Europe fell by 50 per cent between 2013 and 2016; the medium-term outlook for availability of supplies and EU gas market integration is good. Nord Stream 2’s opponents and supporters should work together to alleviate some of its negative effects. It is important that Nord Stream 2’s beneficiaries continue to support infrastructure to improve security of supply for the whole EU. For the next budget cycle, the Commission should at least protect, and preferably increase, funding for the Connecting Europe Facility, an infrastructure fund. Over the period 2014-2020, €5.35 billion was available for energy projects. Member-states’ money would be even better spent on energy efficiency – that way Europe would need less gas, Russian or otherwise, and would make progress towards its climate goals. Europe’s continuing need for Russian gas – for reasons of proximity and price – is a reality, but it does not have to be a fatal weakness.

Noah Gordon is the current Clara Marina O’Donnell fellow at the Centre for European Reform.

Comments

Add new comment