Long day’s journey into economic night

Economic developments in Britain since the referendum suggest that a recession is coming. And the politics of the negotiation with the EU suggest the country will suffer a prolonged period of weak economic growth.

There are currently more questions than answers in post-Brexit Britain. The short-term economic consequences of the vote are no exception. We have attempted to clarify our thinking about what we believe will happen, through a series of questions and (sometimes tentative) answers.

The pound has dropped to its lowest level in decades. Should I care?

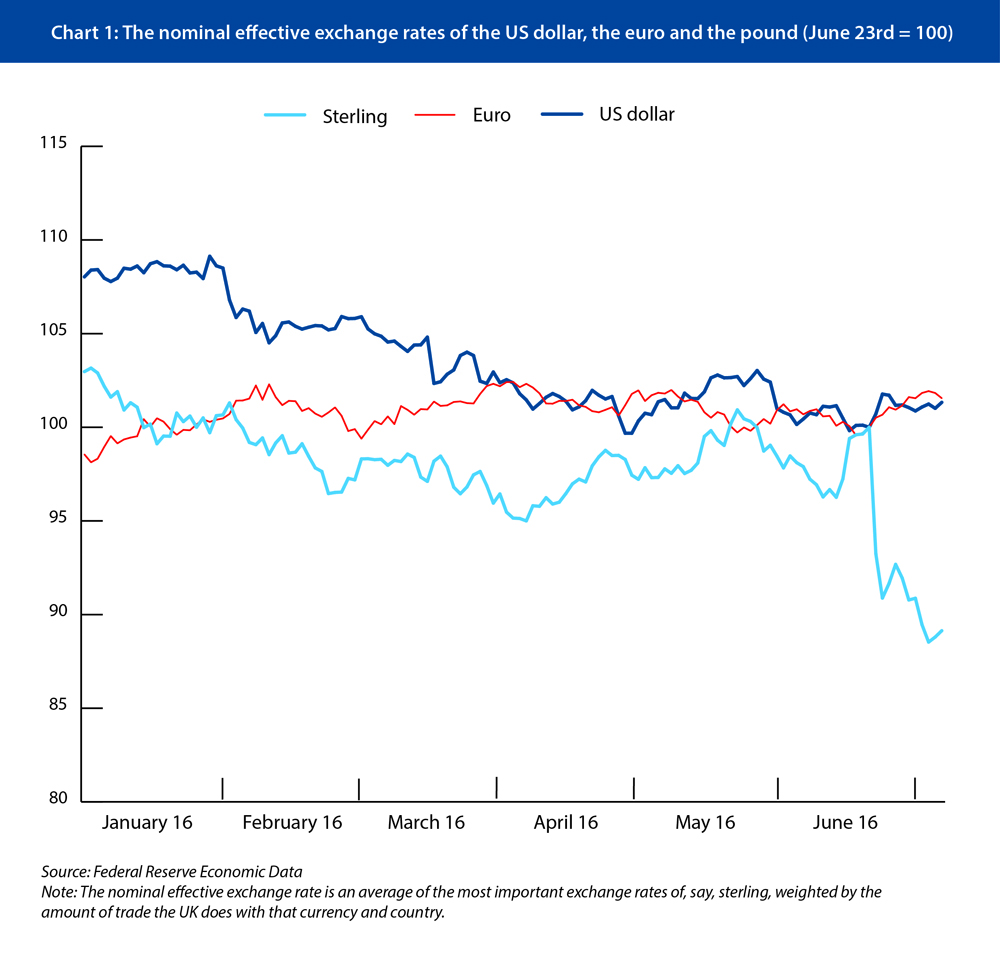

Yes. Sterling fell on a trade-weighted basis (that is, against a basket of currencies of Britain’s trade partners) by almost 11 per cent, while the euro and the US dollar are up slightly against other currencies. Such a fall in the pound shows that investors are concerned about the UK economy.

But a weaker pound is not necessarily bad, is it? The UK’s current account deficit has been growing over the last two years, and now stands at 7 per cent of GDP. That is unsustainable over the long term, so Britain needs a weaker currency to rebalance.

An economic argument should never start from a price change – such as a fall in the currency – but from the reasons for the change. The pound is falling for many reasons but two stand out. First, sterling assets will be less attractive to investors if they expect the economy to weaken and hence the Bank of England to cut interest rates (since rate cuts weaken the currency). Second, if investors increasingly fear that the UK will drop out of the EU’s single market, Britain will be a less attractive place to invest in new production facilities, and demand for housing and business property will be lower. As a result, sterling will weaken further.

Regardless of the reasons for the weaker pound, exporters will surely benefit, will they not?

That depends. First, a currency depreciation does not always do much to boost exports, with sterling’s fall after the 2008 financial crisis being a case in point. A falling pound does not automatically lead to a one-for-one boost to UK exports. Recent estimates have shown that a 10 per cent reduction in UK export prices leads to a 4 per cent rise in exports, which is not much. Second, Britain’s export markets need to be able to absorb more of its goods and services. Britain’s exports grew quickly after the pound’s devaluation in 1992, but the global and European economies are now growing slowly; global trade grew by just 2.5 per cent over the past year and is on course to expand by even less this year. Third, imported intermediate goods such as components or business services will become more expensive for exporters as sterling weakens. In today’s multinational production networks, a lower currency helps exporters a lot less than it did in the past. Finally, exporters need to continue to invest in facilities and innovation to remain competitive. If Brexit leads to an investment freeze, the fall in the pound might not be enough to boost exports.

Sterling has rallied at news that #May will be PM. But #Brexit will still lead to a recession

But if the UK imports less, it should help to rebalance the UK economy.

The pound is weakening because investors expect a downturn, lower interest rates and lower capital inflows. That means that imports will mostly contract because domestic demand will shrink. Poorer countries import less. But this is precisely not how one would like the UK economy to rebalance. It would be reminiscent of how Southern European members of the eurozone recently closed their current account deficits: through recession.

It is fine to be sceptical about whether sterling’s fall will have a positive economic impact, but the markets seem to disagree with you: the stock market is up!

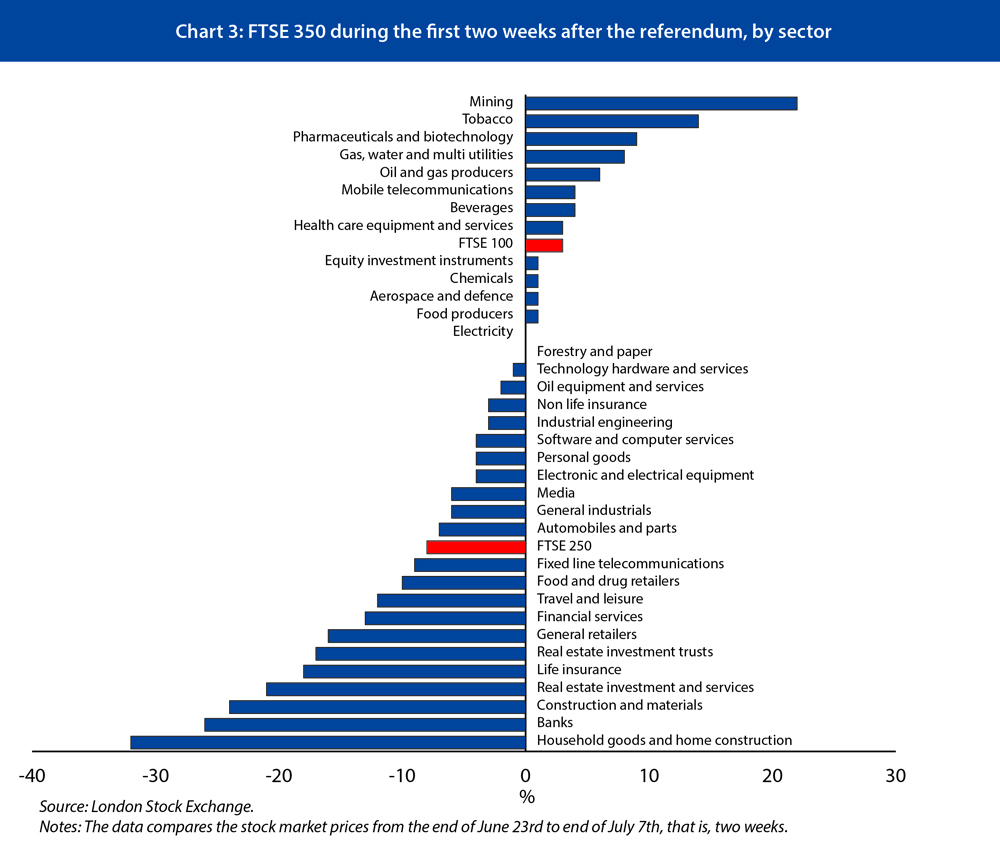

The impact of the referendum result on the stock market could have been worse. But we need to be careful here: the average stock prices of large multinational companies tell us next to nothing about the UK’s economic prospects. We need to dig deeper. The FTSE 100 (the index of the 100 largest companies on the UK market) is indeed 5.3 per cent higher than its level on the eve of the referendum. But if we look at the FTSE 250, which contains the 101st to 350th largest companies on the UK market, we see that these businesses have done a lot worse. The FTSE 250 is still down almost 4 per cent compared to the day of the referendum. Not to mention that, from the perspective of international investors, the value of British stocks has fallen a lot further because of the weakening of sterling.

Wait a minute, are you saying that big companies benefit from Brexit, but it hurts small and medium-sized businesses (SMEs)? The Brexiters often claimed the opposite.

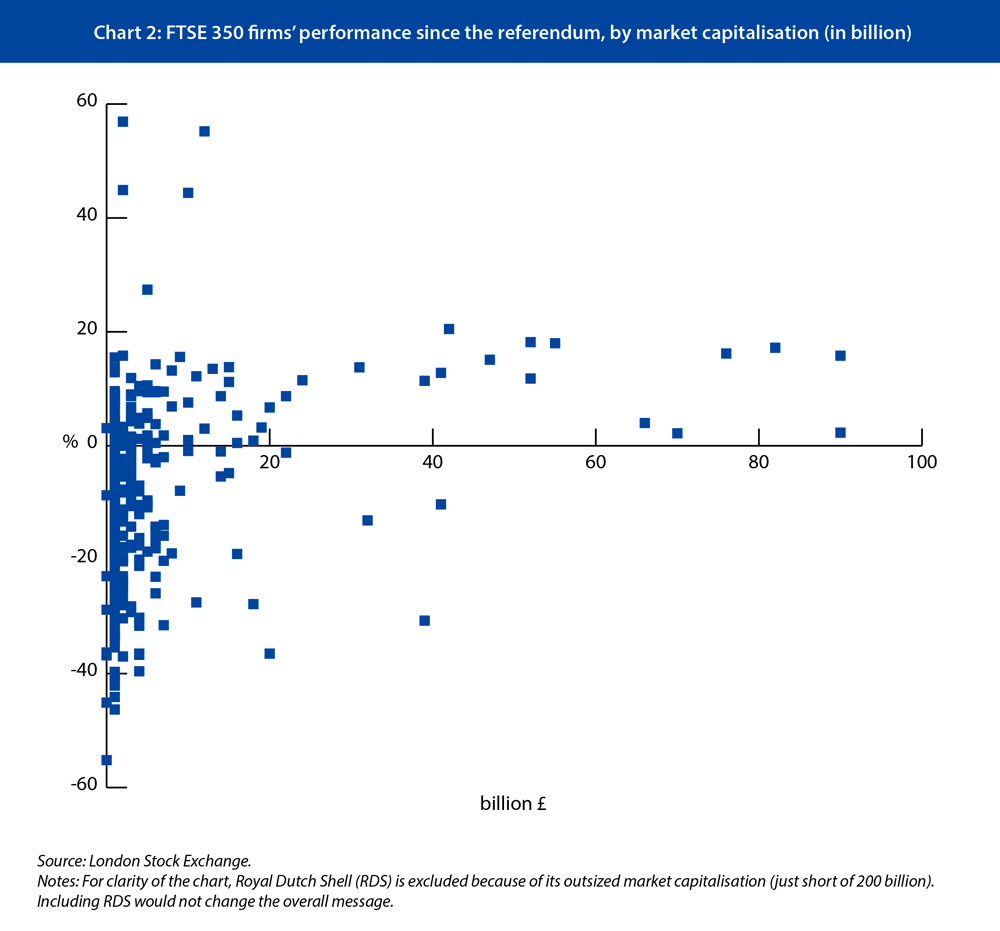

Who knew that the Leave side made things up to win the referendum? Size is one factor, but arguably not the most important (see Chart 2). While most companies that have lost value are indeed small (the dots on the left side of the chart), the correlation between size and post-referendum performance is not very strong, and the variation quite high.

So what explains the difference between the FTSE 100 and the FTSE 250?

What is important is the sector in which the company is active, and whether its revenue is earned mainly in the UK or abroad. Let’s have a closer look at the stock market to see which companies are the most affected (Chart 3).

Tobacco and beverages companies are up? Are people that depressed?

Maybe. But the sectors at the top of the table are those that make most of their money abroad in other currencies. With the weakening of the pound, these foreign revenues are now worth more. So these companies’ profits have had a boost.

FTSE 350 companies serving very British sources of growth have taken a #Brexit hammering

The bottom of the chart looks like a who’s-who of the most British types of economic activity: housing, consumption and banking.

That is a bit unfair to the British economy, but you are right in the sense that these companies depend on domestic demand: retailers on the consumer, real estate and construction firms on investment. And banks and insurers depend on the value of domestic assets, such as commercial real estate.

So large international businesses are doing fine, while domestically-oriented, investment-dependent businesses are doing badly. That points to a recession, doesn’t it?

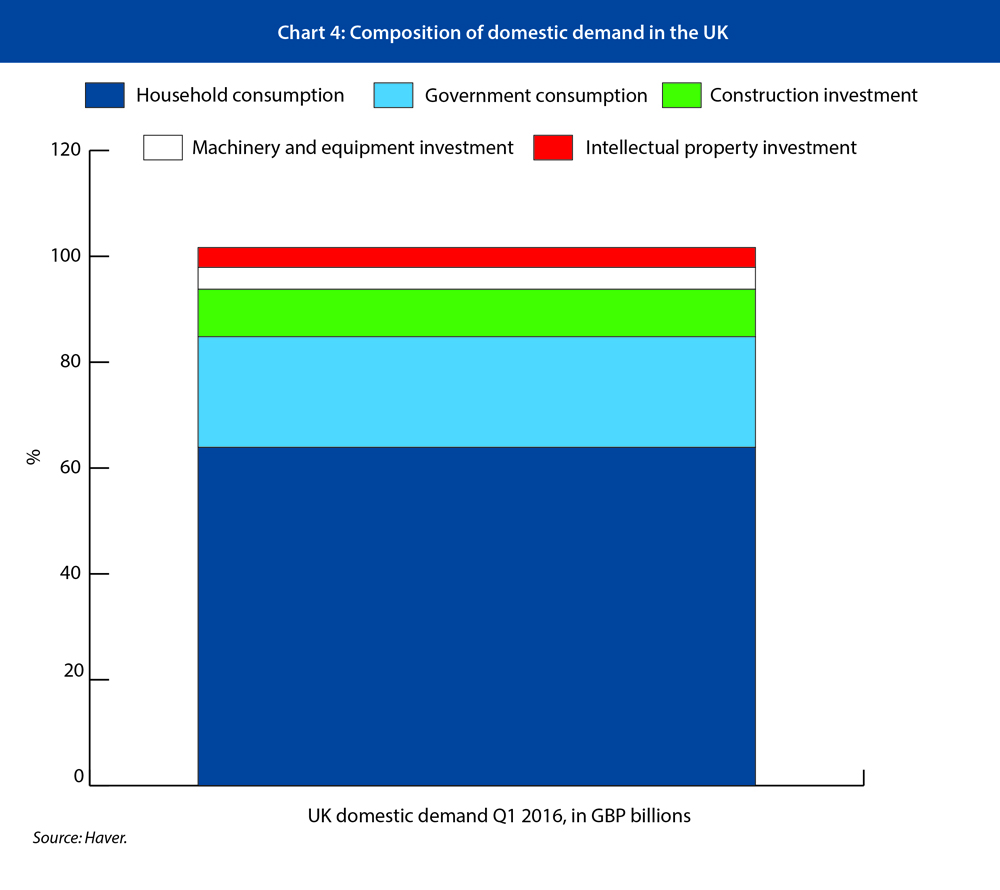

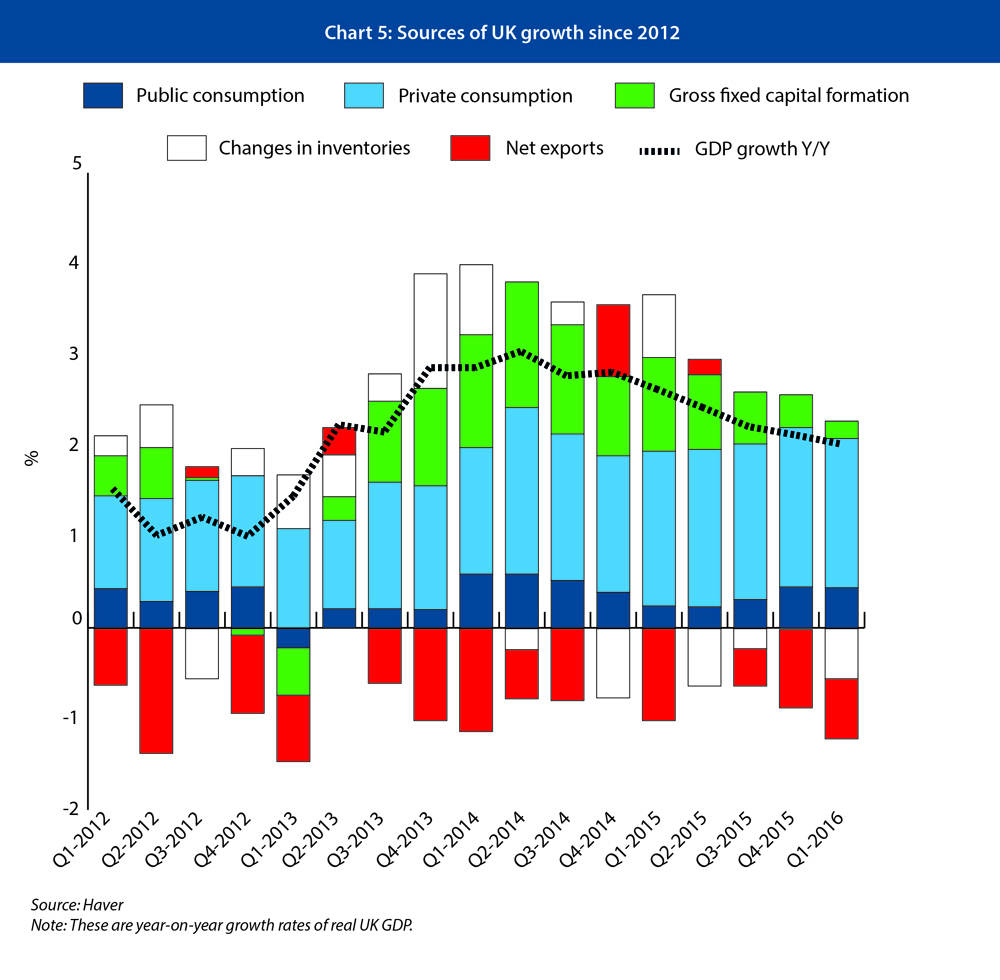

It does indeed. Private consumption makes up more than 60 per cent of UK domestic demand (see Chart 4). It has been the biggest source of growth since 2012, while investment has ground to a halt – probably in anticipation of the referendum (see Chart 5). Consumption was in part driven by the strong labour market and house price inflation, which made people feel wealthier. If people start to feel more uncertain about their job prospects or incomes, and if house prices stagnate or fall, consumption may well fall. That alone will be a major drag on the economy.

What about investment?

The stock market suggests that house builders and construction companies will feel the pain of Brexit most. Many real estate funds have already had to suspend withdrawals. This is very worrying – not only because construction investment accounts for 9 per cent of UK GDP, but because construction sector activity is also a leading indicator of severe recessions, as research has repeatedly shown. Then there is business investment, which is only 8 per cent of GDP but is highly responsive to uncertainty.

Hold on a second. Paul Krugman says that the argument about uncertainty having a negative impact on the economy is lazy thinking. He even complained that Remainer economists are lowering their intellectual standards by saying it. Is he right?

Krugman makes an important point. He agrees that Brexit increases uncertainty and damage to the supply-side of the British economy in the long run. But he argues that this is not enough to suggest that a recession is imminent: recessions are the result of falling demand, he writes, and not of the higher trade, investment and migration barriers that are likely to come along when Brexit actually happens. Krugman is right to say that “the arguments for big short-run damage from Brexit look quite weak” – if by ‘big’ he means a calamity like the post-2008 crash. The slowdown or recession will be far shallower than that. But his arguments about investment are misconceived.

Investment growth ground to a halt before the #Brexit vote. And it’s likely to get worse

That’s quite a thing to say about a Nobel prize-winning trade economist. Aren’t you biased Europhile upstarts?

We are certainly pro-European upstarts, but let’s stick to the economics of this. We would argue that there are two ways in which Brexit matters in the short term. The first is that higher barriers with the EU in the future will have a short-term investment impact, even in the absence of uncertainty: if investors knew with certainty that trade barriers would be higher in the future, they would reduce investment now. It is not dissimilar from the discussion about ‘secular stagnation’: the expectation of lower growth in the future leads to less investment today.

Can’t the Bank of England react to such a dearth of investment by lowering interest rates?

It is not clear whether interest rates can fall far enough to boost economic activity to compensate. UK rates are already at very low levels. The governor of the central bank has already hinted at further monetary easing, and its financial policy committee (FPC) has lowered the amount of banks’ own funds that they must put into investments (the so called countercyclical capital buffer). But the question is how effective those measures will be. Krugman is usually the first person to point out that monetary policy has its limits: he has championed the argument that when rates near zero, monetary policy becomes impaired.

Why should they not be effective?

This is where uncertainty comes in, and leads us to the second way in which Brexit will hit the UK economy in the short term, despite the fact that Britain has not yet left the EU. Uncertainty does not mean that bad things will certainly happen, just that it is more uncertain whether good or bad things will happen. In a period of higher uncertainty, companies may well wait for the dust to settle before making decisions that they cannot reverse easily. They may also be averse to taking risks – which could be more relevant for small companies, which have been shown to be more cautious whenever uncertainty increases.

It still sounds like a demand problem that could be addressed with policy to manage demand: monetary policy, for example.

The problem is that looser monetary policy is less effective when companies are uncertain about the future. In other words, if companies want to wait until the future prospects of their investments are clearer, lowering interest rates will not nudge them to invest, or hire more people, for that matter.

So investment in people, as it were, is also affected?

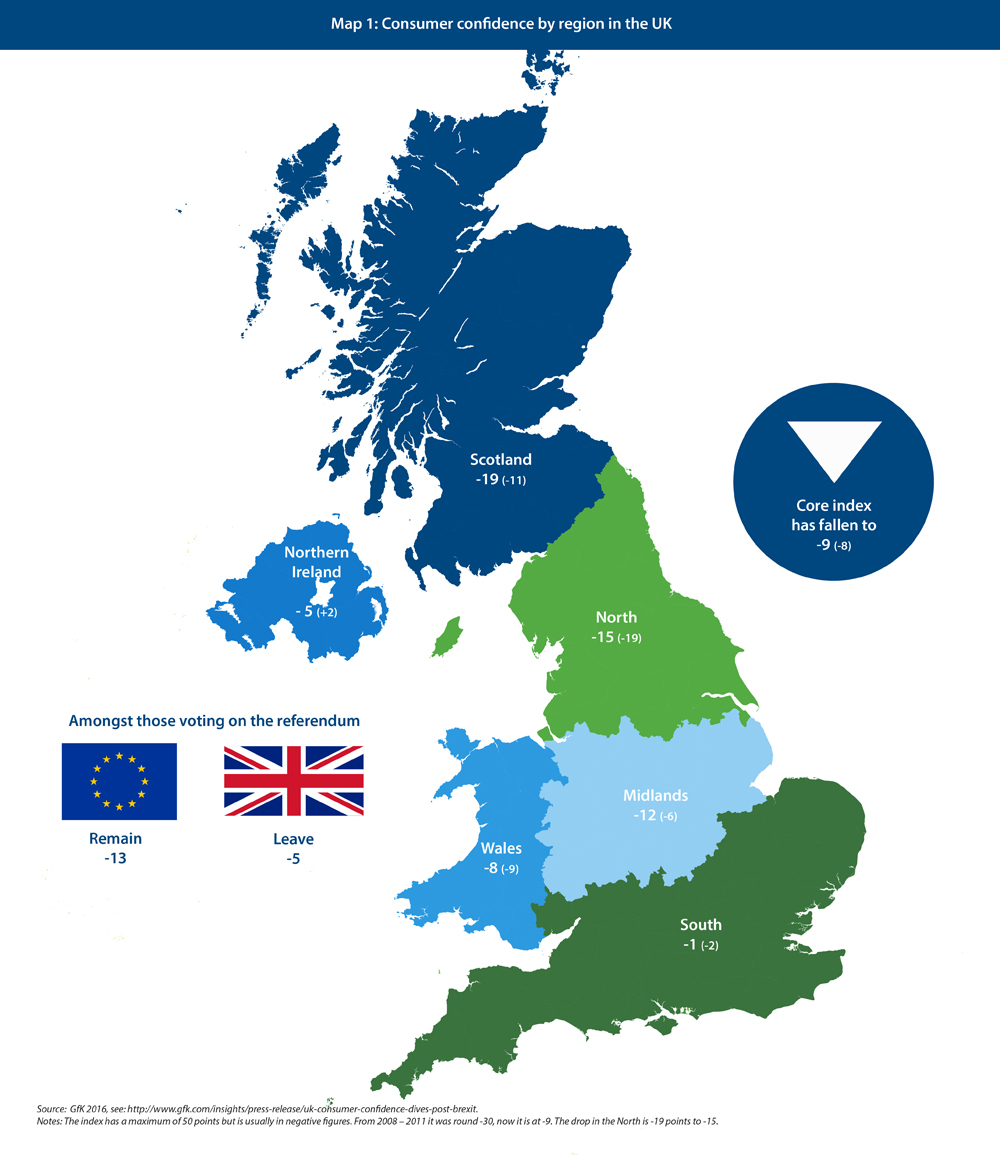

Absolutely. Companies cannot easily reverse a decision to take on more workers, so they may hold off doing so until it is clear what kind of deal the UK is able to broker with the EU. That affects employment, wages, and through these channels, consumption. Consumer confidence has already fallen: a recent survey found the sharpest drop in 21 years (see Map 1). The fall is strongest in the North of England, a region that has most to lose from an EU exit, as we have argued before. Scotland faces additional political uncertainty over its future in both the EU and the UK. Consumers earning between £25,000 and £50,000 showed the biggest drop in confidence. If this translates into lower spending, it will hurt the British economy considerably.

What about fiscal policy, the other demand-side policy lever?

It is unclear how far the next British prime minister, Theresa May, will be willing to go to fight off recession by boosting public spending. It is true that politicians are pragmatic on fiscal policy when it serves their purposes. But the recession is likely to hit tax revenues severely, as consumption and real estate are heavily taxed sectors of the economy, by way of VAT and stamp duty. The Conservatives would need to make a spectacular policy U-turn if they wanted to create a big enough fiscal stimulus to counteract the decline in investment and consumption. And their plans to cut corporate taxes could well backfire: the stimulative effect of such tax cuts in the short run is weak, as with monetary policy. Companies will be unlikely to invest their extra earnings while they face uncertainty. And the more the UK plans to become a tax haven, the tougher the EU will be as a negotiating partner – the remaining states have no interest in rewarding the UK for attracting investors by undercutting tax rates elsewhere in Europe.

Regions outside the south have seen the biggest falls in consumer confidence since #EUref

What about a rebound in investment? Krugman said that nobody seems to make the argument that once the dust has settled and we know what the future relationship between the EU and the UK will look like, firms will invest.

If Britain stays in the European Economic Area (EEA), investment should bounce back as firms give postponed investments the go-ahead. Those who have attempted to model the short-run impact of Brexit all find that a bounce-back would happen – Krugman seems to read the wrong papers. If the UK is outside the EEA, we might also see investment rebound from domestic businesses currently under pressure from imports from the EU. They might see new opportunities in the domestic market, as EU imports become more expensive. But the negotiation between the EU and the UK will be a lengthy affair, so the effects of uncertainty will persist for several years.

I can wait.

But many companies will not. We must not forget that Brexit is mostly a problem for the UK. Irish EU membership, for example, is not in doubt, so companies can easily invest there and be sure of continued access to the Single Market. This will have a scarring effect on the UK economy. Once investment decisions have been made and money has been sunk into new operations, there will be little reason for firms to reverse their decisions even if the UK succeeds in striking a good deal with the EU.

That is true. But why are you so certain that the negotiations will be long and difficult, and that trade barriers are likely to rise? The Tory leadership is confident that a good deal can and will be made.

There are two sides to this negotiation: the EU and the UK. And in both, domestic politics preclude a quick and easy deal. In Britain, May has reiterated that leaving the EU will end free movement of labour. Labour MPs are also saying in private that they would not be able to vote for a deal that excludes controls on EU migration. The problem is that the EU will only offer the UK membership of the single market if it signs up to free movement.

Because the EU is stubborn.

Not really. The EU’s single market only really works, economically and politically, as a package deal. As trade economist Richard Baldwin said at a recent CER event, every country hates bits of the single market, which is why unpicking it is impossible. Richer countries with more advanced economies do not want poorer countries to be able to restrict imports of goods and services; poorer countries will not compromise on the freedom of their compatriots to work elsewhere. Moreover, the kind of restrictions that the UK seems to want would require treaty change. But treaty change is impossible for countries like France and the Netherlands, which would have to hold referendums on those amendments – which would almost certainly be lost.

But surely the EU is also out to punish Britain for its defection.

It is clearly in the EU’s interest to be inflexible. The EU wants the UK to understand the trade-off between single market access and free movement, and to come to a decision about what is more important to Britain. If people elsewhere in Europe see mounting economic problems in Britain, they might be less likely to support anti-EU parties, for example in France.

So will this be a new Lehman moment, or rather a long period of low growth?

The Lehman comparison is flawed. Brexit is not a major shock to a country with an overly leveraged banking system, which then runs into fire-sales of assets, liquidity problems and insolvency. Instead, exiting the EU is a shock to the economic growth potential of the UK. The path towards an agreement with the EU is strewn with obstacles, and the UK economy will face slower growth for years to come. Markets still seem to be too complacent in thinking that the problems can be resolved easily, that Brexit will not really happen, or that the EU will compromise its principles to reach an agreement that satisfies British demands. The politics both in Britain and the EU suggest otherwise.

Christian Odendahl is chief economist and John Springford is a senior research fellow at the Centre for European Reform.

Comments

Democracy does not mean people give up and accept-they go on and campaign.

As the eurosceptics have done for the last 30 years.

Add new comment