Should the EU tax imported CO2?

An EU carbon border tax would be tricky to design, costly to implement and sure to provoke legal challenges. But if done properly there are reasons to think it could succeed.

Climate change is central to the agenda of the new European Commission. Yet many member-states fear that action on climate change will undermine their economic competitiveness and lead to carbon-intensive economic activity moving from the EU to more accommodating jurisdictions.

One solution the Commission is considering is to tax imported CO2 – with proposed trade commissioner Phil Hogan tasked with designing and introducing a so-called carbon border tax. Such a tax would be levied on imported goods at a rate commensurate with the amount of CO2 emitted in their production.

A carbon border tax would allow the EU to pursue more ambitious climate change policies in the knowledge that domestic industry would not be unfairly undercut by foreign suppliers.

A carbon border tax would allow the EU to pursue more ambitious climate change policies in the knowledge that domestic industry would not be unfairly undercut by foreign suppliers. Designing a practical border carbon adjustment scheme (BCA) will prove challenging, as will ensuring that it is compliant with World Trade Organisation rules. But many of the associated concerns can be avoided through careful design and implementation – and, if a BCA succeeds in providing cover for far greater EU climate action then the political and economic costs will be ones worth paying.

Is there actually a problem?

The rationale behind a BCA is as follows:

Carbon ‘leakage’ (when climate action in one country leads polluting activity to shift to another) does not help the climate, as the global output of greenhouse gas remains the same, and it encourages free riding, reducing all countries’ incentive to take action. A BCA is one way to ensure that products produced abroad face the same climate change-related costs when sold on the domestic market as those produced at home.

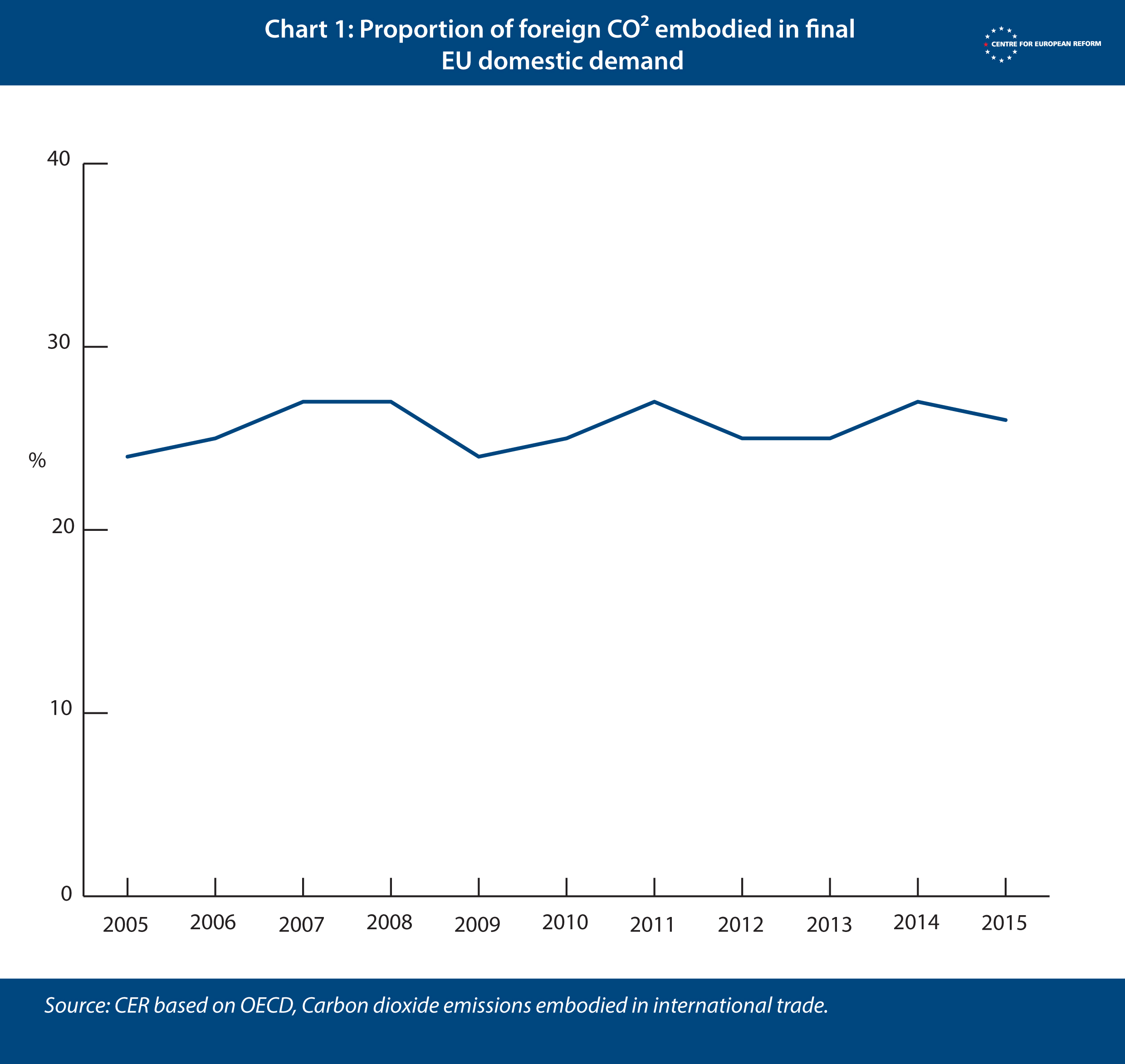

Theoretically the rationale for a BCA holds firm. Countries seeking to combat climate change should not be punished by economic activity moving to places where curbs are less stringent. But it rests on an assumption that requires testing: that the pursuit of ambitious climate policies leads to a relocation of economic activity. In the context of the EU, the evidence of such relocation is far from overwhelming. The OECD finds that the proportion of foreign CO2 embodied in final EU domestic demand has remained relatively constant, at around 25 per cent, in recent years (Chart 1) despite new EU measures such as the Emissions Trading Scheme (ETS) and Renewable Energy Directive coming into force during the observed period.

While there is not a big problem now, tougher European action to address climate change may lead to one in the future. Two estimates highlighted by the Commission illustrate how difficult it is to forecast the economic consequences of carbon leakage (Table 1).

The first estimate finds that EU GDP in 2050 would be relatively bigger (or at least the losses would be smaller) if it were to act unilaterally instead of taking part in a global effort. That estimate is based on the assumption that the global economy incurs costs from action against climate change. The second finds that unilateral action would leave EU GDP 0.7 per cent smaller than if ambitious action were taken globally. This estimate assumes that fresh EU spending on transitioning from a high to low carbon economy would act as an economic stimulus. The estimates do suggest, however, that the aggregate economic impact of ambitious European action on climate change, whether done unilaterally or as a collective, is likely to be small.

Beneath the headline GDP impact, there are sectoral concerns (Table 2). Politically sensitive European sectors such as the fossil-fuel industry, steel and other metals, and chemicals are expected to perform worse in a world in which the EU acts unilaterally than one in which action is taken globally. This means that some member-states where problems are felt more acutely will continue to obstruct EU action on climate change. And in climate politics, as with all politics, perception is sometimes more important than reality; so long as member-states believe carbon leakage is an issue to address, some will continue to obstruct action on climate change.

How could an EU border adjustable carbon tax work?

The idea of a BCA is not new. In the US, for example, lawmakers have tabled several proposals to introduce a carbon tax. So far, though, no country in the world has an operational BCA.

A simple BCA works as follows: Country A applies a domestic carbon tax on producers of, for example, €20 per tonne of CO2 emitted. In order to ensure that domestically produced goods are not placed at a disadvantage vis-à-vis imported goods, Country A levies an equivalent tax on products imported from countries that do not adopt equivalently stringent measures. Additionally, exports from Country A are eligible for a carbon rebate in order to ensure no loss of global competiveness vis-à-vis competitors based in more lenient jurisdictions.

An EU-wide measure would by necessity be more complicated than this. The EU does not have the necessary competences to impose an EU-wide domestic carbon tax. Instead internal discussions have focused on the idea of levying a tax on imports equivalent to the costs borne by domestic industries as a result of needing to buy carbon permits under the European ETS (at the time of writing ETS carbon permits trade at around €25 per tonne of CO2).

Under an ETS-linked BCA, importers would be required to pay a border carbon tax equivalent to the cost of acquiring the carbon permits necessary, for the average domestic company to produce the same product. This system would have to take into account that a number of permits are currently given to companies for free. The BCA would apply to imports originating in countries lacking an equivalent domestic carbon pricing mechanism. However, if a non-EU company is able to demonstrate that its production methods are less carbon intensive than the average EU producer then it will be eligible for a reduced carbon border import tax rate, or no tax at all, regardless of its location.

But implementing an EU BCA will not be easy. First, the EU will need to ensure that its carbon tax complies with WTO rules.

Carbon taxation is an untested area of WTO law, and opinions differ as to its legality. Jennifer Hillman, a former WTO appellate body judge, argues that to design a BCA that fully complies with the law, it should be non-discriminatory. This means that it should treat all products originating from its trading partners, as well as its own and like-foreign products, in the same way. Hillman says that “the key is to structure any accompanying border measures as a straightforward extension to the domestic climate policy to imports”. The EU will argue that while a BCA would not be a direct extension of its domestic ETS, GATT Article II.2 (a) allows for a WTO member to levy an additional tax on imports so long as it is equivalent to the cost imposed on domestic industry by an internal tax or similar.

Regardless, if the EU does go ahead with implementing a border adjustable carbon tax it should expect to be challenged at the WTO. This process will take a long time. In order to give itself the best chance of winning, the EU will need to ensure that its processes for assessing third-country equivalence are transparent and open. For that, it should make its criteria as objective as possible and put in place a straight-forward mechanism so that third countries can seek advice and appeal the EU’s decision to consider them to be less climate friendly. Additionally, the EU should also make it as easy as possible for companies to seek relief based on proof of actual greenhouse gas emissions.

To minimise the risk of a legal challenge, the EU could initially apply the BCA only to a small number of emission-heavy industrial sectors, as it has with the ETS, and make it subject to regular review. The EU would need to decide how and when to account for emissions associated with transport, and how best to tackle the issue of agricultural emissions, acknowledging that it would prove controversial with countries like Brazil and would need to be justifiable vis-à-vis domestic producers, whose emissions are largely untaxed.

There is then the issue of complexity. Calculating the embedded carbon within a given product, with inputs potentially originating from many different countries and regulatory jurisdictions, is not easy and it would probably be expensive. Importers might find that the cost of demonstrating that their product has lower embedded carbon than the EU average, and therefore deserves a reduced rate, is higher than the default carbon levy.

The EU should take on board much of the financial and administrative burden, particularly for small and medium-sized companies.

The EU should take on board much of the financial and administrative burden, particularly for small and medium-sized companies. This could involve the Commission funding the creation and continued support of third-party certification bodies able to provide an objective assessment of a company’s CO2 emissions. Some of this money would be recouped from BCA tax revenues. But raising money should not be the objective: the aim is to allow Europe to become more ambitious on tackling climate change without risking economic damage – and to help other countries shift towards low-carbon production instead of undercutting European environmental standards.

There would also need to be origin-based criteria that determine exactly how much work needs to be carried out on a product in a given territory for it to qualify as originating from that jurisdiction. This could be determined using the pre-existing method for determining non-preferential rules of origin which all EU importers already have to follow.

An EU BCA would have other costs. Consumer prices could rise. To compensate, the EU could reduce its aggregate ‘most favoured nation’ tariff that is levied on all imports from countries with which there is not a preferential trade agreement in place. Car tariffs could be reduced from 10 to 5 per cent, for example. Such an across the board tariff reduction would also serve to assuage third countries that new border carbon taxes are not undercover EU protectionism.

Finally, the EU would have to address the question of fairness. While all signatories to the Paris Agreement on climate change have agreed to take action to reduce emissions, developing countries have been given extra leeway because they have historically contributed far less to global emissions than industrialised countries. Any border adjustable carbon tax should take this into account. Countries currently covered by the EU’s ‘everything but arms’ scheme, which gives tariff and quota-free access to the EU market to least developed countries, could be exempted, for example.

Perhaps the most difficult question to answer is what impact an EU BCA would have on an already fractious multilateral trading regime. With tariffs already on the rise, a BCA that is seen as backdoor European protectionism would sour relations further. It could also provoke escalation from the US and make it harder for the EU to secure free trade agreements with some partners. For example, if extended to cover agriculture, ratification of the EU’s agreement with the Mercosur trade bloc, and in particular Brazil, could become impossible. As well as the US, a BCA might provoke China if it is deemed to unfairly single out Chinese products – and the process of determining whether Chinese domestic measures on climate are equivalent to the EU’s could create diplomatic tensions.

If the EU is to both meet its own targets and effectively contribute to keeping global temperature rises to below 1.5°C, it needs to be much more ambitious. A well-designed BCA could open political space within the EU for increased climate action. An effective BCA could also encourage action beyond the EU’s borders as it would motivate third countries to match the EU’s climate ambition if they want to be exempt from border carbon taxes. There are legal, practical and political hurdles standing in the way of a successful EU BCA. But that should not stop the EU from trying.

Sam Lowe is a senior research fellow at the Centre for European Reform.

Add new comment