Why have Europe's energy prices spiked and what can the EU do about them?

Europeans’ skyrocketing energy bills are not primarily Russia’s fault, though it is capitalising on Europe’s vulnerability. The EU’s decarbonisation strategy provides the best long-term guarantee of stable energy prices.

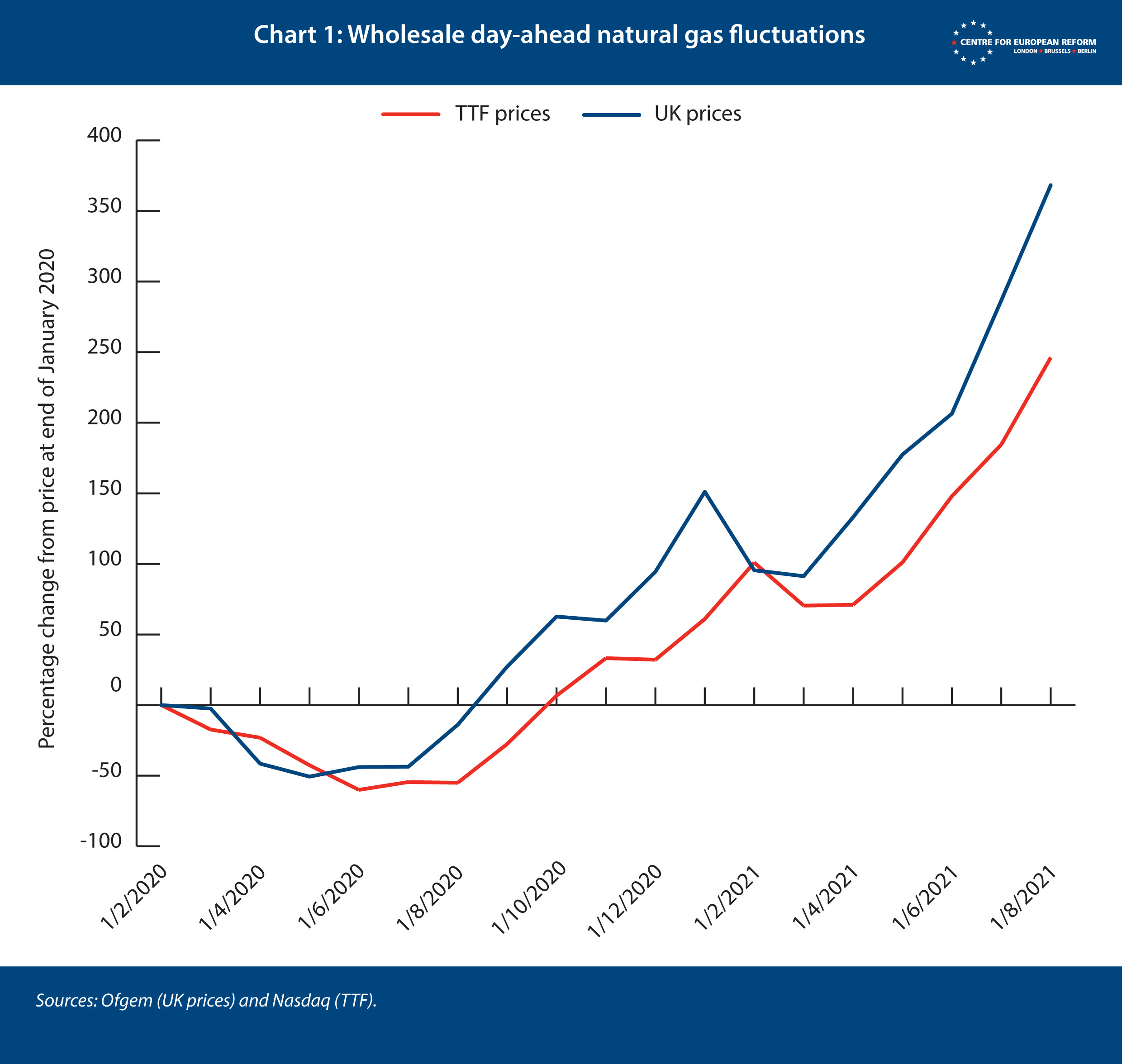

After a scorching summer, Europe may face a chilly winter, courtesy of spikes in energy prices. After hitting a low in June 2020, with lockdowns crushing demand for energy, the wholesale natural gas price in Europe had increased more than ten-fold by October 2021, reaching an all-time high. Asia is experiencing similar price hikes. Gas prices have, in turn, pushed electricity prices higher. Should Europeans blame global gas supply and demand fluctuations, sabre-rattling by Putin, or Europe’s ambitious climate action plan?

Much is due to an unfortunate combination of economic and environmental factors. Many countries are reopening after COVID-19 restrictions, which has increased global energy demand, and Europe and Asia are competing to buy gas. Maintenance work on gas infrastructure in Norway has limited Europe’s supplies. And a cold winter and spring followed by a hot summer meant more demand than usual for energy for heating and air-conditioning. Lack of wind in northern Europe over the summer led to higher demand for coal and gas to fill the shortfall in wind-powered electricity generation.

Russia – Europe’s largest provider of natural gas – has its own problems. A fire at a Russian processing plant in August cut gas production and exports to Europe. With winter approaching, the Russian government has prioritised meeting domestic demand and replenishing storage. It has fulfilled existing long-term contracts to supply European customers, but (unlike previous years) it has not increased supplies to Europe to meet uncontracted immediate demand for gas (known as the ‘spot market’). However, the International Energy Agency believes Russia could do more, because it still has capacity to boost gas exports to Europe by about 15 per cent.

Russia’s decision not to raise supply to meet the spike in demand has contributed to higher prices, although the impact is difficult to quantify. European spot gas prices have increased rapidly since June, when it became clear Russia would not increase supply as expected: but those prices had already more than doubled between January and June, so arguably this was just the continuation of a pre-existing trend. Furthermore, when Gazprom indicated on October 28th that it would begin refilling European storage facilities, prices on the largest EU gas trading hub, the TTF, decreased by only 6 per cent – far less than prices have risen over 2021. Finally, Chart 1 also suggests that Russian supply constraints are not the most important contributor to gas price increases. It shows that UK gas prices have increased far more than prices on the TTF. Yet the UK imports only 5 per cent of its gas from Russia, far less than the EU does.

Russian president Vladimir Putin certainly has a number of motives for wanting to limit gas supplies to Europe in the short term, and for wanting the EU to believe Russia can significantly influence prices.

Russian president Vladimir Putin certainly has a number of motives for wanting to limit gas supplies to Europe in the short term.

First, he wants to ensure that Germany approves Gazprom’s use of the just-finished Nord Stream 2 pipeline quickly. This will allow Russia, if it wishes, to turn off the gas supply to Ukraine (with which it has been in a low-intensity war since 2014). Hitherto up to 40 per cent of Russian gas exports to Europe have transited through Ukraine; when Kyiv signed a new five-year transit agreement with Moscow in 2019, it expected to receive about $3 billion per year in fees. Taken together, Nord Stream 2 and the Turkstream pipeline from Russia to Turkey under the Black Sea have enough capacity to replace the Ukrainian pipeline system, without affecting the supply for other European countries. Gazprom would save the transit fees, while Ukraine would lose out financially, and would be more vulnerable to Russian threats to cut off its gas supply completely.

Second, Putin wants to persuade Europe that its problems result from giving the market a bigger role in determining gas prices. In particular, he wants a reversal of reforms that have forced Gazprom to offer most of its gas at market prices, and a return to long-term fixed-price contracts for European customers. These types of contracts disincentivise investments in energy efficiency, diversification and the transition to cleaner energy sources. Gazprom is also currently challenging a 2019 EU law, designed to force the company to give competitors access to Nord Stream 2. The Kremlin would prefer Gazprom to retain exclusive access to the pipeline, shutting out Russian competitors, such as Novatek.

Russia’s opposition to the EU’s energy strategy is unsurprising. EU initiatives have made Europe less susceptible to market manipulation by Gazprom than it used to be. For example, the European Commission extracted commitments from Gazprom to improve competition in eastern Europe, and the Polish competition authority has fined Gazprom €6.5 billion for abusing its market position. Europe has also been developing alternative sources of gas supply over the last 20 years, with gas pipelines from Norway, Libya, Algeria and – with the recent launch of part of the Southern Gas Corridor – Azerbaijan. Many EU member-states can import liquefied natural gas (LNG) by ship from a range of countries. Investments in pipelines and gas trading hubs have led to a more integrated market, allowing gas to flow to where demand is greatest, and enabling more EU member-states to buy gas at market prices. These reforms probably help explain why the EU has experienced less price fluctuation than the UK, which has been less integrated with continental Europe, has very little domestic storage capacity, and has less diversified sources of supply.

Despite EU market reforms, Russian gas exports to the EU continue to increase.

Why is Europe still reliant on Russian gas?

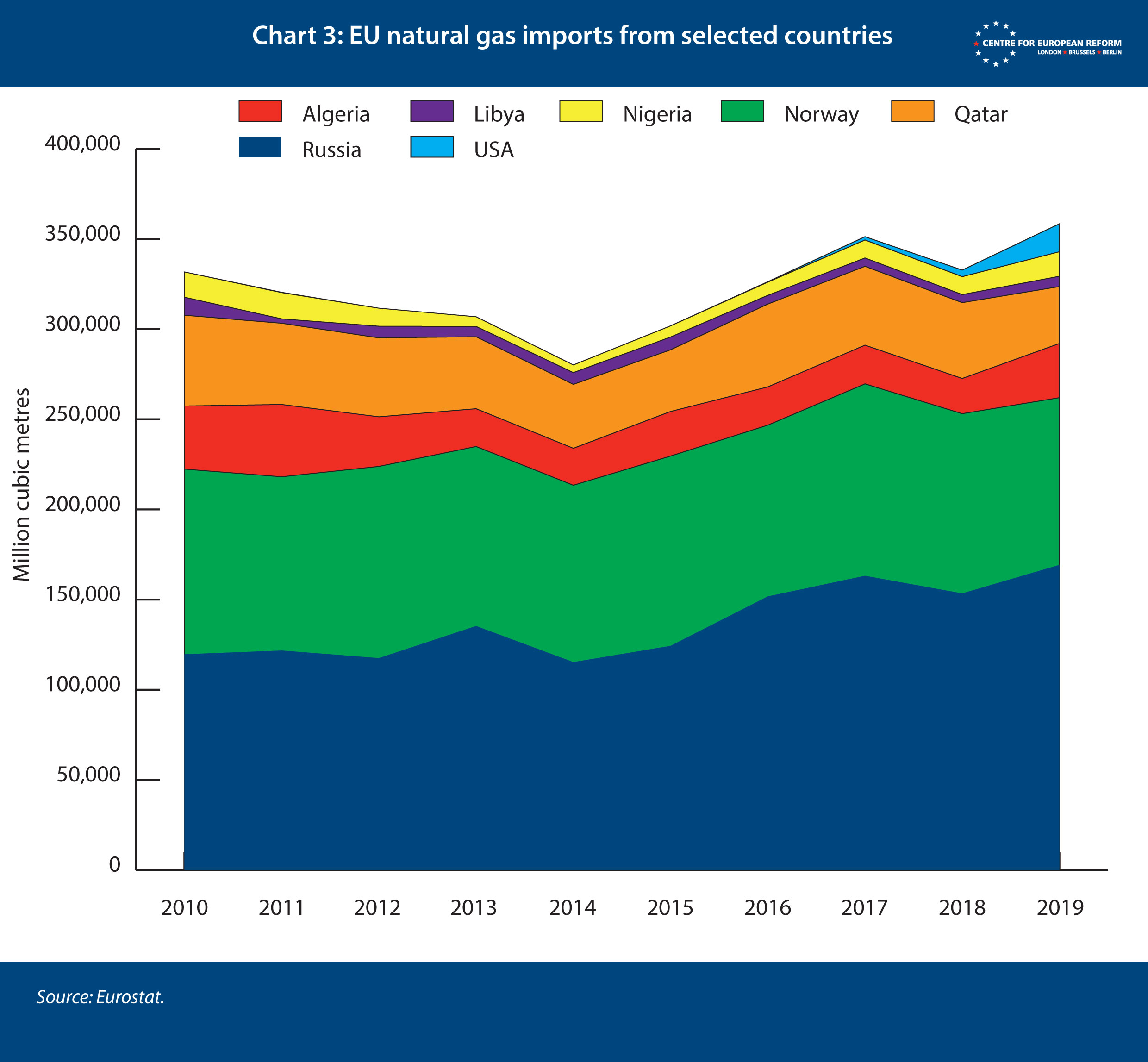

The EU’s initiatives have created a more efficient, cheaper, and more secure market. Yet, despite this, Russian gas exports to the EU continue to increase and – as this year has shown – prices can still be volatile. Various factors contribute to this paradox:

- Gas has become more important in Europe’s overall energy mix due to stricter climate and energy policies. The EU Emissions Trading Scheme (ETS) sets a price for carbon emissions from power generation and large-scale industry, to incentivise investment in low-carbon alternatives. It is progressively pushing coal out of the EU’s energy mix. Many EU member-states are also abandoning nuclear power. But renewables cannot yet fully replace coal and nuclear. Wind and solar energy are intermittent by nature; in the absence of adequate storage capacity and grid interconnections, they need back-up so that supply and demand always match. Gas does this job, and is less carbon-intensive than coal, which makes Europe stubbornly reliant on it, as Chart 2 shows. Putin is keen to maintain that dependency, and to make European citizens think that Europe’s current problems are a result of trying to move away from fossil fuels.

- Europe’s own gas production is in long-term decline, also illustrated in Chart 2. The Netherlands plans shortly to cease production at the EU’s largest facility, in Groningen, to limit seismic risk. Other EU member-states are also cutting production, in part because greenhouse gas emissions abatement goals make new gas investments unattractive.

- Liberalisation, in particular greater numbers of gas transporters and retailers across Europe, has led to greater competition and downward pressure on wholesale gas prices. This benefits Russia, which can supply the most gas at the lowest cost, and as Chart 3 shows, provides a growing share of Europe’s gas imports – currently more than 40 per cent.

Europe’s strategy to mitigate its vulnerability to Russia withholding supply has been less effective than usual this year:

- Europe has significant gas storage facilities, which can mitigate the impact of supply or price shocks. But these facilities were only 47.5 per cent full at the end of June 2021: the lowest level at that time of year for more than a decade.

- There is higher demand for shipped LNG: China and India need LNG to fuel their economic recovery, and are willing to pay more than Europe.

- Some domestic regulatory regimes have struggled to cope with price shocks. Companies which supply gas to retail consumers and businesses can hedge against price fluctuations: they can do so by purchasing gas over a period of months or years before it is needed. But in countries such as the UK and Germany, many small, poorly-capitalised retailers exist, and some may rely on spot prices rather than long-term hedging. Governments and regulators did not force them to hedge when prices were low, because that might have increased consumer energy bills in the short term and many suppliers would not have had the necessary financial resources. But these retailers are now failing, unable to afford more expensive gas on the spot market.

This confluence of short-term factors – not any fundamental problem with the EU’s energy strategy – has made Europe especially vulnerable to Gazprom’s decision not to increase supply.

Price shocks in gas markets have been spilling over into electricity markets, which will in turn feed into price rises across the economy. Even though natural gas only accounts for about 20 per cent of the EU’s energy mix for generating electricity, it sets the electricity price. This is because the energy mix is determined by periodic energy market auctions, in which electricity producers bid to contribute to the power grid. These bids are accepted in price order from lowest to highest until demand is met; the price of the last bid (the ‘marginal producer’) becomes the price for all producers. At present, the marginal producer is natural gas. Because of the rise in gas prices, electricity prices in some European wholesale markets have increased by 200 per cent in the last year.

Why Europe’s green agenda is the solution, not the problem

Following the approval of stricter EU climate goals for 2030 and 2050, the EU’s carbon price under the ETS increased from about €30 per tonne at the start of 2021 to over €60 now. While this is a substantial increase, the European Commission estimates that, since early 2021, the impact of wholesale gas price increases on electricity prices is nine times greater. The current jump in energy prices is largely due to the increased cost of fossil fuels that Europe continues to depend on, not carbon prices or intermittent renewables.

Even with less wind than usual in northern Europe, renewables reached 42 per cent of the EU energy mix between April and June and 36 per cent between July and September, as opposed to 32 and 35 per cent respectively for fossil fuels. With more renewable generating capacity and technologies to address renewable energy’s intermittency, gas would lose its place in the electricity market, lowering energy prices and reducing Europe’s dependency on energy imports. Transitioning to a mostly renewables-based electricity market will, however, require additional investments in electricity storage. A recent scenario analysis estimates that around 100 GW of electricity storage will be needed by 2030 to meet Europe’s current climate action goals. For comparison, in 2019, Germany installed 0.5 GW of storage capacity. Meeting Europe’s goals will also require more grid interconnections between different European regions – to allow energy to be traded between regions with different weather profiles.

What should governments and the EU do?

In the short term, Europe can do little to resolve the crisis. In the toolbox published on October 13th, the Commission suggested straightforward measures that EU member-states could use to help poorer consumers – such as income support, temporary bill deferrals and energy tax cuts, and protection against disconnection from the grid. These measures are sensible, provided they are designed not to reduce consumers’ incentives to limit their energy consumption. Member-states should also take the chance to boost public and private investment in energy efficiency.

The factors contributing to higher prices will remain, however. Continued economic growth in Asia will drive competition for gas supplies and Europe’s green energy agenda is probably making investment in new gas production for Europe unattractive. So long as Europe is reliant on gas, and Gazprom remains Europe’s largest provider, Russia will still be able to capitalise on price spikes – no matter how diversified Europe’s other supply sources are – even if it is not the primary cause of those spikes. But Russia’s recent actions – and its attempt to exaggerate the role it can play in mitigating the crisis – indicate that Europe’s energy strategy is on the right track: Russia is desperate to delay Europe’s green transition and extract as much profit as possible in the meantime.

To improve resilience, the Spanish government and others have suggested that the EU should replicate the joint procurement efforts pioneered with COVID-19 vaccines, and collectively purchase gas to create common stored reserves. The Commission is cautious, and has only proposed that voluntary joint procurement of gas for storage could be “explored”. Joint gas storage facilities could be beneficial for those countries that have few reserves of their own. However, even if negotiating as a bloc, and even with a more diverse set of potential suppliers, the EU would still need to buy a substantial share of its gas from Russia to keep prices down. As its actions show, Russia can tolerate a temporary loss of revenue better than Europe can tolerate a gas shortage. An alternative approach would be for EU member-states to require European retailers to hedge against price fluctuations, by buying ahead instead of relying solely on spot prices, mitigating the impact of any future crisis.

Member-states should not pull the brake on green policies, for fear of additional impacts on consumer energy prices. Instead, they should redouble their efforts to ensure that these policies result in a just energy transition.

In the long run, a faster green transition offers the best insurance against the next crisis. Member-states should not pull the brake on green policies proposed in the recently-tabled Fit for 55 package, for fear of additional impacts on consumer energy prices. Instead, they should redouble their efforts to ensure that these policies result in a just energy transition – ensuring costs are fairly shared between all consumers and across countries. And in the end, the best way to avoid the impact of high gas prices is not to rely on gas.

Ian Bond is director of foreign policy, Elisabetta Cornago and Zach Meyers are research fellows at the Centre for European Reform.

Add new comment