The UK can ride Trump out on trade

The UK will probably face less trade disruption under Donald Trump than some fear – but will have fewer opportunities to improve ties with the US than some hope. The UK’s priority should be deepening relations with the EU.

Trump’s second term ushers in a new period of uncertainty for global trade, including for the UK. The debate about the consequences for the UK has so far focused on whether the UK must choose between the EU or lining up with the US to avoid tariffs. In fact, Keir Starmer is right: the UK will most likely not have to choose. For the UK, the most likely scenario is little disruption in US-UK trade relations, albeit with significant downside risks. The best strategy will be to actively engage with Trump and keep an eye out for possible mini-deals, but otherwise continue to prioritise deepening relations with the EU.

The UK won’t have to choose between the EU and the US – but it will have to prioritise EU relations.

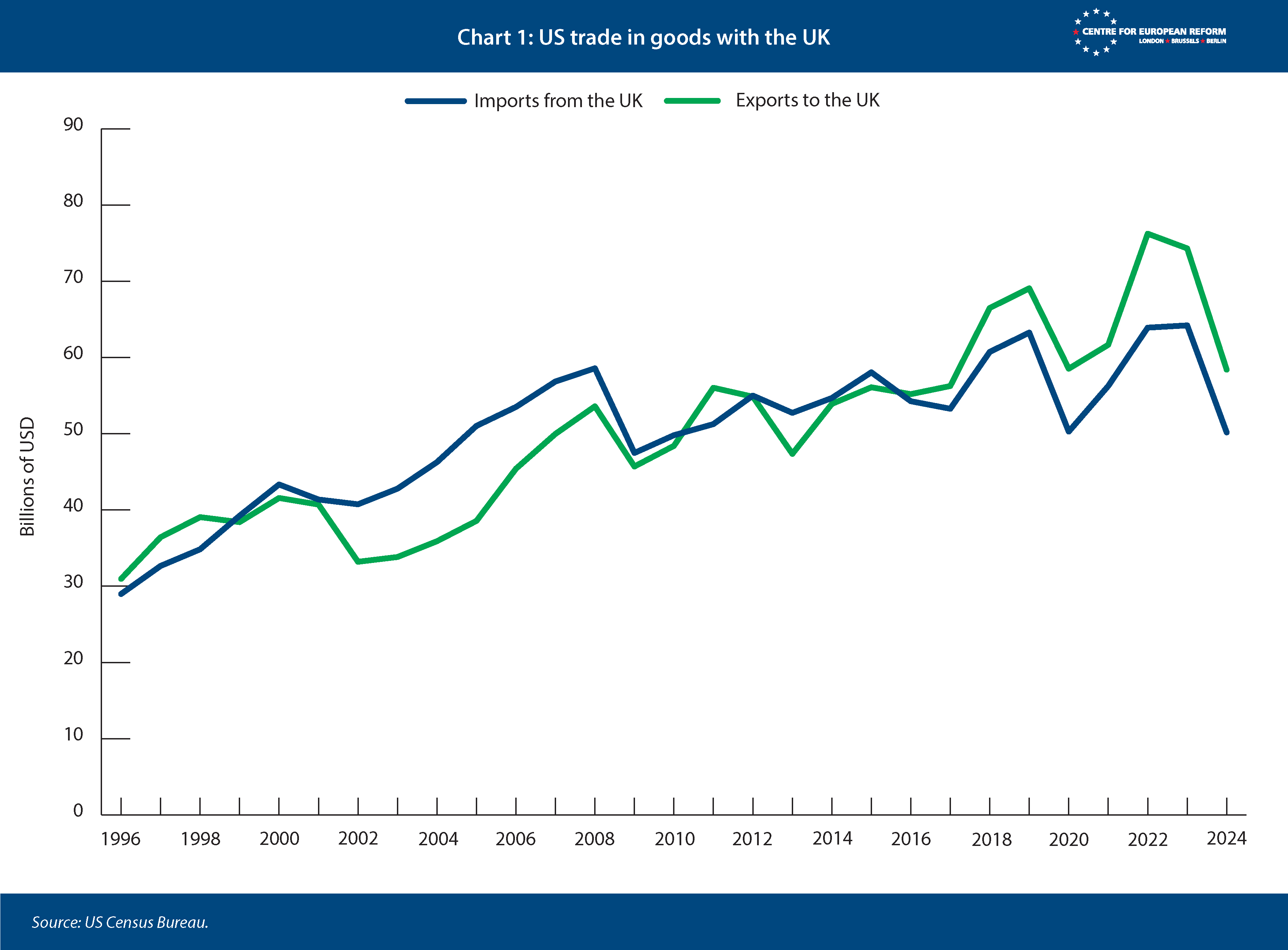

Trump’s most prominent trade policy is a 10-20 per cent tariff on all imports into the US. The UK should take this threat seriously: although a large portion of UK exports to the US are services, tariffs would still make a significant impact on UK exports. Estimates indicate that a 20 per cent tariff could reduce UK exports to the US by £22 billion, equivalent to 0.8 per cent of GDP. Nevertheless, there are good reasons to believe it will not be implemented: US consumers would face an immediate increase in costs, which could prove politically disruptive. Moreover, Trump has a track record of using the threat of tariffs as a bargaining chip to obtain concessions from trading partners. Past examples, like the deals Trump concluded with the European Commission under President Jean-Claude Juncker, or with Xi Jinping’s China, were built around commitments to purchase US goods. His nominees, including Scott Bessent for Treasury, Jamieson Greer for US Trade Representative and Howard Lutnick for Commerce Secretary all have records that indicate support for a similar strategy.

If he intends to use the threat of tariffs as negotiating leverage, then Trump will probably not apply across-the-board tariffs, but instead target them on particular countries based on their trade and diplomatic relations with the US, such as whether the US has a trade deficit with the country. But the US actually runs a trade surplus with the UK so it should be easy to demonstrate that trade relations with the US are already open and mutually beneficial, and the UK is unlikely to be a prime target for tariffs. Moreover, the UK remains a significant security partner for the US. Trump also has a track record of wanting to improve relations with the UK, not worsen them. In his first term, he opened negotiations for a UK-US free trade agreement, boasting that it could raise trade three or four times. Without being complacent, there are reasons for optimism that tariffs on UK trade can be avoided. Should that optimism extend to actually seeing closer economic ties?

Under Trump 1.0, the British instinct was to take advantage of the special relationship, particularly when Boris Johnson was prime minister. At the heart of this strategy, was an attempt to negotiate a US-UK free trade agreement (FTA). Such an agreement would have potentially boosted UK GDP by 0.8 per cent, according to government estimates. Although this is a small fraction of the cost of Brexit, which the CER estimates as 5 per cent of GDP, it is still significant. However, one of Britain’s core defensive objectives was to preserve the high standard of food regulation, so-called sanitary and phytosanitary (SPS) standards, inherited from the EU. Feedback from public consultation was also overwhelmingly focused on this issue, along with pleas from business to maintain alignment with EU standards. But US objectives were diametrically opposed: Washington’s priority was to pry the UK away from EU standards and allow more access for US agricultural produce which did not meet those standards.

The UK’s trade surplus and close relation with the US makes it an unlikely priority target for Trump tariffs.

Even if the UK had been willing to abandon EU standards, Northern Ireland’s continued alignment with the EU and the political imperative to not have trade barriers in the Irish Sea would have proved an insurmountable obstacle. The Biden administration quickly shelved the negotiations over this issue and there has been no attempt to revive them since.

The chances for a fully-fledged US-UK FTA are therefore remote. Trump has in the past expressed openness to a trade deal with the UK and there is considerable support in Washington for the idea. However, the UK is still deeply enmeshed with the EU economy, its largest trade partner, which absorbs more than 40 per cent of UK exports and provides more than 50 per cent of its imports. The prospect of diverging from the EU would be even more difficult under a Labour government that has promised an SPS agreement with the EU and is charting out a pathway to greater alignment with EU regulation in general.

Although many on the Trump-aligned right in Washington support a trade agreement, any concrete proposals are impossible to square with the realities of the Windsor protocol for Northern Ireland, British regulatory preferences or the policy direction set out by the Starmer government. The conservative Heritage Foundation, for instance, has proposed that the UK join the free trade agreement that the US has with Mexico and Canada because it is a ready-made agreement with “little need for negotiation”, which means that the UK would have no input at all and accept being pulled into the North American regulatory sphere.

If the idea of a US-UK trade agreement is impractical, what then would US-UK trade relations look like under Trump? The UK should prioritise avoiding any disruption to trade by engaging early on with Trump, even before his inauguration. It should highlight the US trade surplus with the UK, the security relationship, and the historically close UK-US ties. The UK should also prepare a list of ‘concessions’ that could be presented as wins for Trump. This need not be limited to trade: it could also involve commitments on raising military spending, deepening ties with the US defence industry, increasing energy imports or even increasing co-operation with respect to third countries, such as China. These should be kept as bargaining chips to be used in any kind of tit-for-tat deal with the Trump administration, if the need arises to avoid tariffs.

In a more positive scenario, the UK would not need to use these bargaining chips to avoid general tariffs, and could instead use them in potential mini-deals to improve trade relations. These deals would fall well short of the benefits of a comprehensive traditional FTAs but could instead focus on modest improvements in trade relations. This could mean regulatory co-operation, resolving trade disputes or even a mini-deal like the one Japan concluded with the US under Trump’s first administration (which reduced tariffs on a limited list of agricultural products and certain industrial goods). The UK should aim to maintain the status quo, while seizing small wins if the opportunity arises.

Beyond the threat of general tariffs, there will also be specific issues that arise during Trump’s term of office. Since the UK is an important manufacturing hub for Airbus, it's party to the long-standing Boeing-Airbus dispute, for instance, which had caused retaliatory tariffs from both sides of the Atlantic over subsidies to their respective aircraft manufacturers. These tariffs have now been suspended until 2026, but the underlying conflict has not been solved. The UK is also setting up its own Carbon Border Adjustment Mechanism (CBAM) that would tax imports when the exporting country, like the US, does not have a carbon price. Although the affected volume of trade is modest, this will nevertheless likely cause friction with the Trump administration. The UK is aligned with the EU in both these cases, either directly or indirectly, and should seek a united front and joint solutions when negotiating with the US. The prospects for solving the Boeing-Airbus dispute or at least extending the suspension of tariffs should be relatively good, given the weakness of Boeing. CBAM could be a far tougher nut to crack, as the need for WTO compliance makes it difficult to make exceptions for the US.

There is also a risk that the UK will become caught up in a US-China trade war. The UK has generally sought to maintain good trade relations with China, and an attachment to open trade. The Starmer government has made a point of trying to seek a warmer relationship with Beijing. Because the UK’s strength is in services instead of manufacturing, it is also less exposed to the negative consequences of China’s increases in manufacturing exports. There are two ways the UK can nevertheless be pushed into creating higher trade barriers with China. One is direct pressure from the US. A good example of this occurred during Trump’s first administration: the UK, after resisting US pressure, eventually agreed to force telecoms operators to remove certain Chinese vendors from 5G and fibre networks, at significant cost. A new Trump administration might pressure allies to exclude even more Chinese products. For instance, the US is now introducing domestic restrictions on Chinese connectivity-related components and software in cars, just as Chinese electric vehicle producers have established a commercial presence in the UK. It is easy to imagine a 5G-like scenario for connected cars.

The UK wants to maintain trade links with China – but it may be forced into restrictions due to US pressure.

The other way in which the UK may be pushed into enacting trade barriers against China is indirect. If the US imposes a 60 per cent tariff on all Chinese goods entering the US, China will have a lot of excess products looking for a market. This would have benefits for the rest of the world, in the form of reduced inflation and cheaper consumer goods. However, it would also increase competitive pressure on UK producers, which could lead the UK to introduce tariffs as a safeguard mechanism. At the same time, other trade partners – most notably the EU – are also increasingly taking a harder line on trade ties with China. Brussels has imposed new duties on Chinese electric vehicles and introduced tools such as the Foreign Subsidies Regulation, which is aimed at ensuring a level playing field when subsidised Chinese companies invest in Europe.

Despite the noise surrounding Trump, the UK should focus on its already existing trade agenda. Geographically and economically Britain is in Europe – the European Union is its largest trading partner and the UK trades more than twice as much with the EU as with the US. There is a long list of areas where the UK would benefit from closer ties with the EU and where closer ties can realistically be achieved: a possible SPS agreement, electricity trading, improved short-term mobility for workers, and carbon emissions trade, for example. Meanwhile, the US remains the UK’s closest security partner and an important trading partner, but it is now a politically volatile country without a plausible pathway to significant trade concessions and improved market access. The UK’s priority should be to have constructive and flexible engagement with the US in order to maintain the status quo and opportunistically grab any minor concessions that may be on offer.

Aslak Berg is a research fellow at the Centre for European Reform.

Add new comment