Can the EU hold back the great tech decoupling?

The US wants Europe to adopt stronger limits on high-tech goods trade with China. In response, the EU should insist the US stick with de-risking, not decoupling, and demand greater transatlantic economic co-operation.

US leaders frequently describe America’s rules on trade with China as imposing a “small yard with a high fence”. Rather than decoupling the US and Chinese economies, Washington says it is only interested in stopping exports to China for a limited number of sensitive goods. Washington is, however, steadily expanding the size of the yard – and the fence is increasingly entangling European firms including, most recently, German companies Zeiss and Trumpf. To protect its interests, the EU should adopt the recent recommendations of former Italian prime minister Enrico Letta to develop a single European approach to economic security – and pressure Washington to keep its yard small.

Take advanced computer chips, and the machinery to build them. Fearful of China’s potential uses of AI for advanced weaponry, Biden abandoned Washington’s previous doctrine of allowing China to develop its chip-making prowess as long as it stayed several generations behind the cutting edge. Now, the US wants to limit China’s chip-making development as far as possible.

Washington’s new strategy inevitably draws in its allies. The US leads the world in chip design and chip-making software tools. But enforcing export controls on these types of intangible assets is difficult. Countries such as Japan, Taiwan and the Netherlands have stronger roles in the physical parts of the chip-making supply chain, where exports are easier to monitor – and this is where the US has turned its attention. The US could choose to apply export controls to European firms in the chip supply chain, since these firms rely on US intellectual property: but the US fears that if it took such a unilateral approach, European chip-making firms might respond by eliminating US intellectual property and other inputs from their supply chains so they become immune to US sanctions. The co-operation of European governments is therefore essential. The US has already persuaded the Netherlands to control exports by Dutch firm ASML, which produces the world’s most advanced machines used to ‘print’ circuits onto wafers, preventing those machines being sent to China without a government-issued licence. In 2019, the Dutch imposed licensing requirements covering ASML’s most advanced machines. In 2023, the US persuaded the Dutch (and the Japanese) to extend those controls to a wider range of chip-making machines. Now, to the dismay of ASML and the Dutch government, the US wants to constrain ASML staff from providing some types of maintenance for machines already sold to Chinese customers – services which are crucial given how complex and sensitive the machines are.

Countries such as Japan, Taiwan and the Netherlands have strong roles in the physical parts of the chip-making supply chain, where exports are easier to monitor – and this is where the US has turned its attention.

Chinese retaliation against chip-related export controls has so far been limited – for example, Beijing has imposed export licensing requirements on rare earths used in electronics, particularly gallium and germanium. This has been a relatively mild response – suggesting that China is not keen to see further escalation, despite its role as the dominant supplier of many raw materials on which the West is dependent. Instead, knowing its reliance on Western chip-making technology is a vulnerability, China has been spending vast sums to develop its own chip-making supply chains. If China achieves self-sufficiency, its willingness to retaliate against export controls imposed by the US and its allies might increase significantly.

However, China has had mixed success in mastering cutting-edge chip-making, because it is incredibly complex not just in terms of technology but also logistically. Rather than expanding its empire by bringing as much of its supply chain in-house as possible, for example, ASML acts as an ‘orchestrator’ for approximately 5,000 direct suppliers, which often provide highly specialised parts developed specifically for ASML and for which the firm has no realistic alternative supplier. China cannot simply replace ASML’s machines with its own because it cannot rebuild the entire ASML supply chain at once. Instead, an intermediate step for Chinese chip machine producers like SMIC would be to buy inputs directly from ASML’s suppliers. This risk has drawn Washington’s attention further down the value chain, to important ASML suppliers like German manufacturing firms Zeiss and Trumpf, and to German firms like BASF whose chemicals are used in all types of chip-making, not just high-end production. Such export controls are unlikely to dent China’s ambition to indigenise the technology now that Beijing has seen it is vulnerable regardless, but they might slow it. There seem to be other reasons for the US’s rapid expansion of its ‘small yard’ approach, however. For example, in response to curbs on its ability to make high-end chips, China has (predictably) repurposed its production facilities to pump out high volumes of cheaper but less sophisticated chips. This risks a global oversupply of lower-end chips which could put many Western-aligned chip-makers out of business – and might explain why the US is now targeting supplies like chemicals which are used in both high-end and low-end chip-making. The line between protecting national security and economic interests is becoming increasingly blurred.

European governments care much more about this line than the US. Like the Netherlands before it, Germany now seems reluctant to yield to the ever-escalating US requests, both because it wants to protect its firms, which make large sales in China and would be directly impacted by restrictions, and to avoid the broader risks of Chinese retaliation. For Zeiss and Trumpf, for example, China is an important market and production hub (see Table 1 below), and Germany still exports more to China as a share of its GDP than any other EU country – even though China is increasingly competing against Germany’s key industries.

Berlin and The Hague should think carefully and strategically about how to respond to US requests for more export controls. US restrictions appear to be continuously expanding in scope as the US thinks through the full consequences of its new strategy. Hindering China’s rise is about the only thing Republicans and Democrats can agree on in Washington – and US pressure on EU member-states is impossible to ignore given its role as Europe’s security guarantor. That means the current round of negotiations is unlikely to be the last.

The EU should seek to protect its own interests in several ways.

First, the EU should recognise that dependency on China and Taiwan for chips is a more immediate problem for the US than for Europe. Given its smaller chip-making industry, Europe should not be too worried about China’s low-cost, high-volume chip production driving down profit margins for Western chip-makers. US consumer electronics firms like Apple and Google need access to the most advanced chips which are currently only made in east Asia, and therefore are at risk of disruption if China invaded Taiwan. In contrast, direct European demand for chips is mostly for automobiles and industrial machinery, which can use lower-end chips produced in many other parts of the world. In the short term, cheap Chinese low-end chips could therefore prove to be a boon for EU manufacturers. Agreeing to further expansion of export controls may therefore not be in the interests of the EU as a whole in the short term.

Second, rather than fret about dependencies, the EU should adopt a more positive form of de-risking. It could do so by ensuring that the EU remains an indispensable supplier of some goods for both the US and China – even if, as seems inevitable, the total value of EU exports to China decreases over time as China becomes more self-sufficient. To achieve this, Europe should defend, maintain and expand areas in which it still has the global lead, like production of chip-making tools. This will allow it to continue to ensure Western-aligned countries have a technological lead over China without giving up on sales to China completely, which could lower firms’ profitability and constrain their ability to invest in research and development.

Some of these efforts should be directed defensively at protecting European intellectual property: China’s success in replicating Western technology has relied heavily on industrial espionage. But the EU should also spend money to keep European leaders at the technological frontier, as Japan has done to support its chip-making champions. Dutch authorities have just pledged to spend €2.5 billion on infrastructure and skills development in response to the company’s threats to invest in France instead of the Netherlands. While subsidies to compete for investment within the EU are not ideal, the public investments could nevertheless be justified if they help ASML speed up the pace of innovation in chip-making tools, in turn making it harder for China to keep up. But keeping ahead of Beijing over the long term will require sustained and targeted financial support.

Boosting the EU’s technological leadership will help strengthen the bloc’s leverage, which is essential for the third leg of the strategy: setting up a ‘club’ of like-minded and allied countries based on a well-defined ‘small yard’. The first ASML deal was a missed opportunity to build such a club: it could have ensured that, in return for European co-operation, the US would guarantee European access to chip technology from the US, along with Japan, Taiwan and South Korea, each of which is home to firms that dominate certain parts of the value chain.

The EU and the US recently announced a Minerals Security Partnership Forum with 15 members, aiming to boost sustainable critical minerals investment and promote fair competition between members. And economists like Alan Beattie and Brad Setser have offered proposals for a ‘subsidy club’ whereby the EU and the US would agree that their industrial subsidies would be available to firms from, and activities in, all countries which meet a minimum set of standards. A similar club focused on chip supply chains would have several major advantages for both the EU and the US and their allies in Asia:

- It could better co-ordinate the chip subsidies the club’s members are doling out, making them more efficient and reducing risks of overproduction.

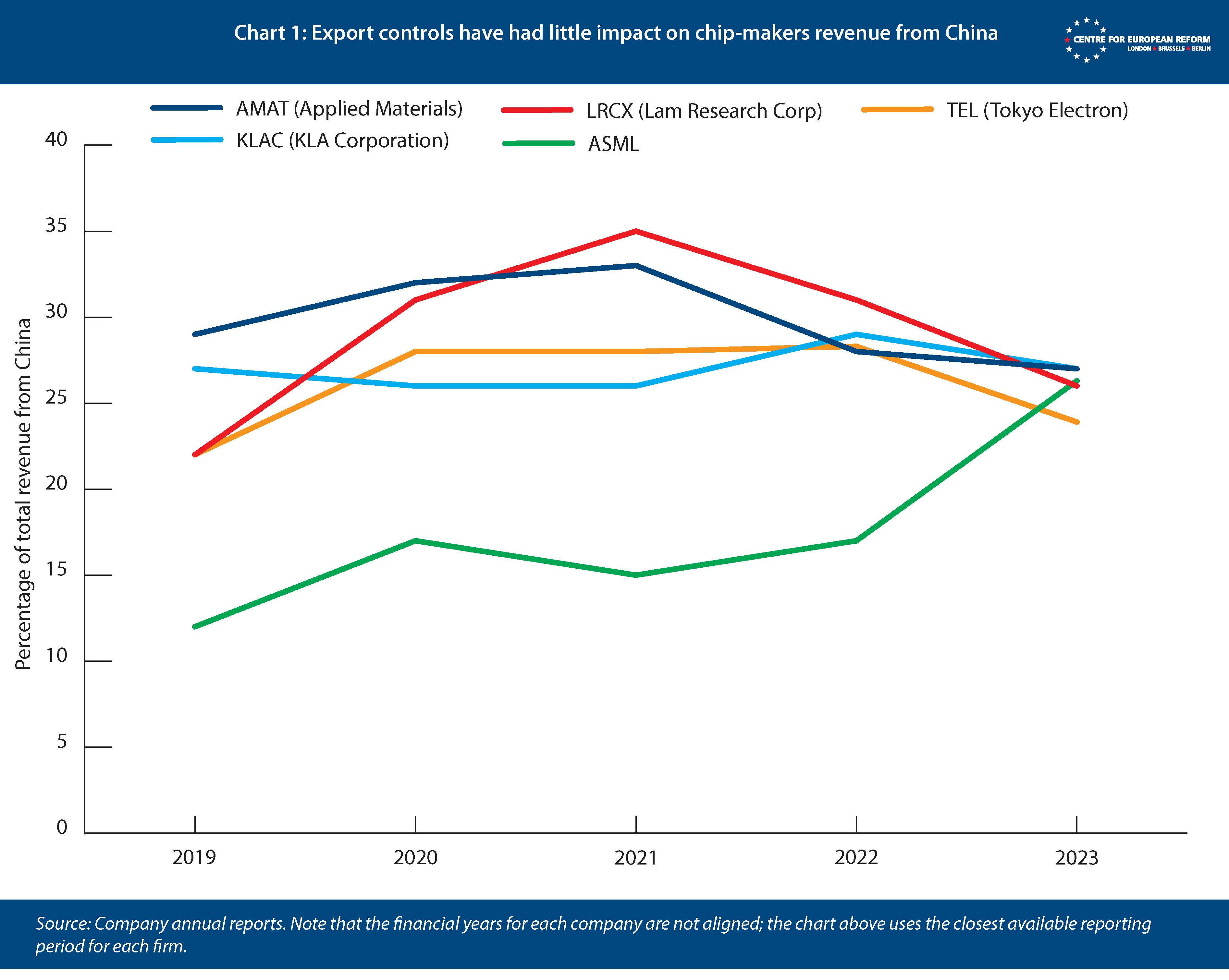

- It could increase transparency about how export controls are being applied between members of the bloc, to ensure some members are not using the controls to gain economic advantages over others. For example, ASML has previously been blocked from exporting certain machines to China while the US appears to have granted numerous licences for its companies to export competing machines. Nevertheless, as Chart 1 below shows, export controls have so far not obviously hindered chip-making equipment producers’ sales to China – ASML has even managed to increase its proportion of revenue from China, and its main limitation on sales to China is production constraints rather than regulatory requirements.

- It could ensure mutual commitments to provide access to each other’s technologies and inputs even in times of disruption – boosting the resilience of supply chains. The club could also help to make mutually agreed export restrictions more effective, for example by sharing intelligence about when third parties buy kit and later resell it to China (or Russia).

Fourth, as recommended by Enrico Letta in his recent report on the single market, EU members must allow more decisions about ‘economic security’ and industrial policy to be made at an EU level. That would ensure the EU identifies its interests as a bloc and defines a clear strategy; it could give businesses more certainty and consistency about the rules across member-states, boosting investment and deepening the single market; and it would reduce the ability of China or the US to lean on individual member-states. The EU acting together as a whole can match the US and China in a way that member states cannot. However, the EU’s recent economic security strategy failed to rise to the challenge, largely accepting member-state competences in areas like export controls and foreign investment screening and relying on voluntary mechanisms which have failed in the past. Bringing other European countries to the table might carry the risk that they care more about transatlantic relations than maintaining the EU’s strengths in the chip supply chain. But chip-making firms are vital for Europe’s strategic autonomy. ASML’s supply chains for example run deep and wide across Europe: the whole continent has a stake in its success, and without a well-defined fence, other industries could quickly get drawn in. At a minimum, the European Commission and Germany should join trilateral discussions between the US, Japan and the Netherlands on export controls.

This four-step strategy has a good chance of surviving a second Trump presidency. While Trump’s rhetoric against China during his first presidency was tough, he was also unpredictable and inconsistent. There would be no guarantee that any EU-US deal would be Trump-proof. But Trump would find it difficult to snub a club that included many Western-aligned countries with their own chokepoints in the chip-making supply chain – and he would face significant pressure from America’s tech leaders to abide by the deal. Furthermore, without an agreed approach, European chip-making firms might focus on eliminating US intellectual property from their own supply chains, making them immune to efforts by the US to unilaterally impose export controls on Europe.

Trump would find it difficult to snub a club that included many Western-aligned countries with their own chokepoints in the chip-making supply chain – and he would face significant pressure from America’s tech leaders to abide by the deal.

To make this four-step strategy possible, the EU needs more unity and a clear sense of its objectives. It should double down on retaining its leading position in some areas to remain an indispensable partner for other countries. For chips, this means supporting investment in the next generation of chip-making tools instead of only subsidising production, an activity in which the EU does not appear to have much comparative advantage. Europe should also use its leverage to ask the US and its allies to join it in ‘clubs’ to co-ordinate subsidies, technological access, and export restrictions. And the EU is often only as strong as its weakest link when it comes to standing up to Washington and Beijing: decision-making about economic security needs to be Europeanised. These pieces should be put in place now: with the EU-friendly Biden administration on the other side of the table they have a chance to succeed. A much more hostile Trump presidency might be only eight months away. For Europe, the clock is ticking.

Sander Tordoir is senior economist and Zach Meyers is assistant director at the Centre for European Reform.

The CER is working with four other think-tanks globally – the Center for Strategic and International Studies, Institut Montaigne, the Jacques Delor Centre and the Lowy Institute – on the topic of international co-operation and economic security. The network of think-tanks will produce research encompassing each of industrial, digital, green and trade policy. The project is kindly supported by Amazon.

Add new comment