How to build and fund a better EU green industrial policy

- The EU was an early mover in climate action, relying on regulation and carbon pricing to prompt decarbonisation investments. As a result, the bloc leads in all kinds of machinery for clean electrification and had been expanding its presence in global exports of hybrid and electric vehicles.

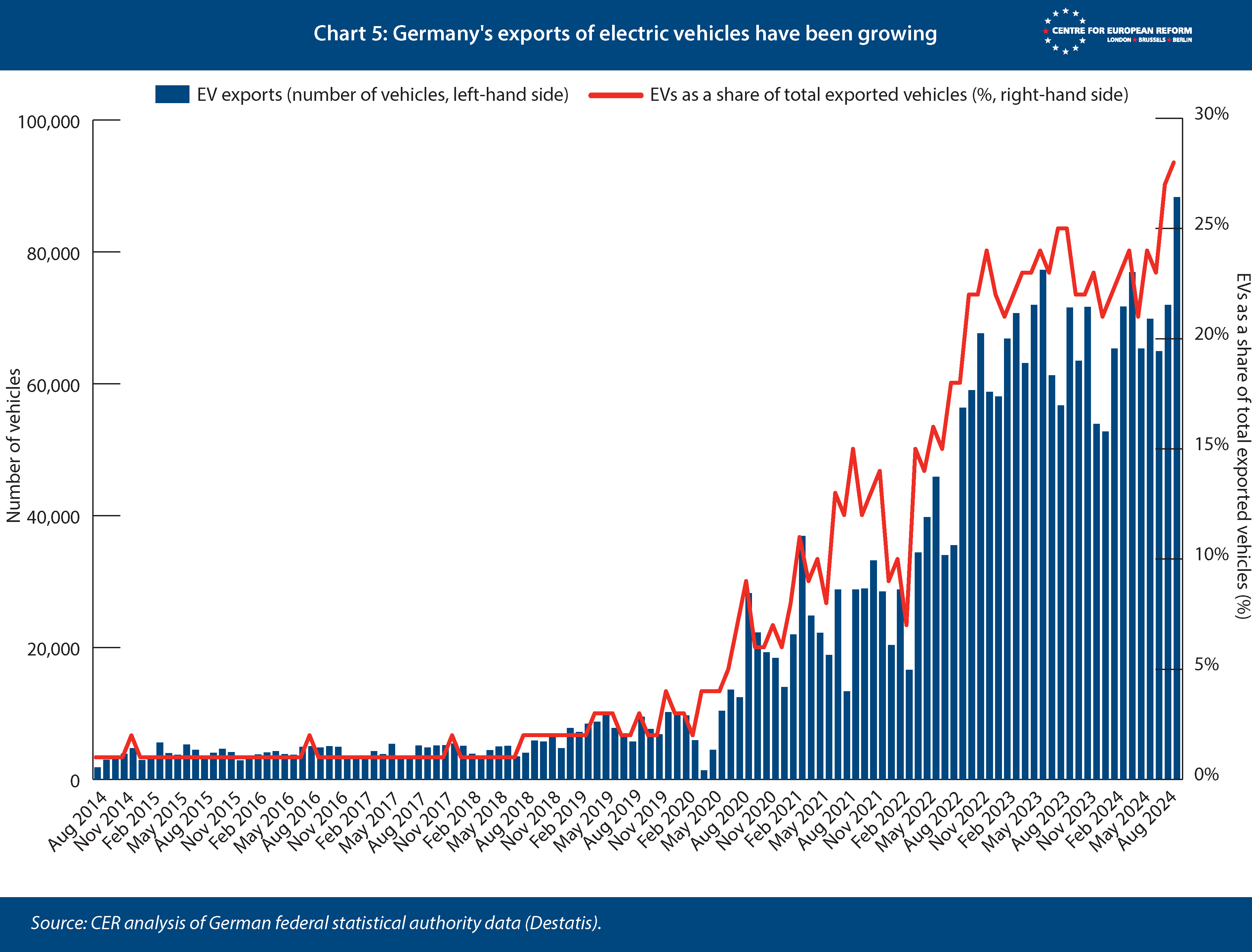

- The EU’s clean tech industry is a rare growing sector for a continent starved of economic dynamism, expanding at twice the rate of EU GDP growth from 2010 to 2021. Germany already exports clean tech products worth 4 per cent of its GDP. Electric vehicles now make up a quarter of its car exports – a rare bright spot for an industry battling an existential crisis.

- But the EU’s clean tech advantages may wither from several major geopolitical challenges that businesses cannot overcome autonomously:

- High European energy prices threaten to choke off the future of basic goods industries that supply numerous downstream manufacturers.

- China, suffering from weak domestic demand, is investing in its manufacturing capacity and rapidly expanding clean tech exports while squeezing imports. This is siphoning demand away from EU producers both at home and globally.

- The Trump administration’s looming tariffs, rollback of the Inflation Reduction Act subsidies and halt on wind park construction will deal a big blow to Germany’s growing exports of electric vehicles and to the EU’s top-tier but struggling wind turbine producers.

- The EU needs to shape and fund a common green industrial policy to ensure its promising clean tech industry survives. The EU has historically left industrial policy largely to national governments but has indirectly shaped policies through its state aid rules and the pandemic recovery fund. But the EU’s existing policies are not fit for today’s challenges:

- The EU’s funding programmes are largely horizontal or generic in nature, while there is a need for policies that steer demand into specific sectors where the EU can gain or retain a competitive position on the global market.

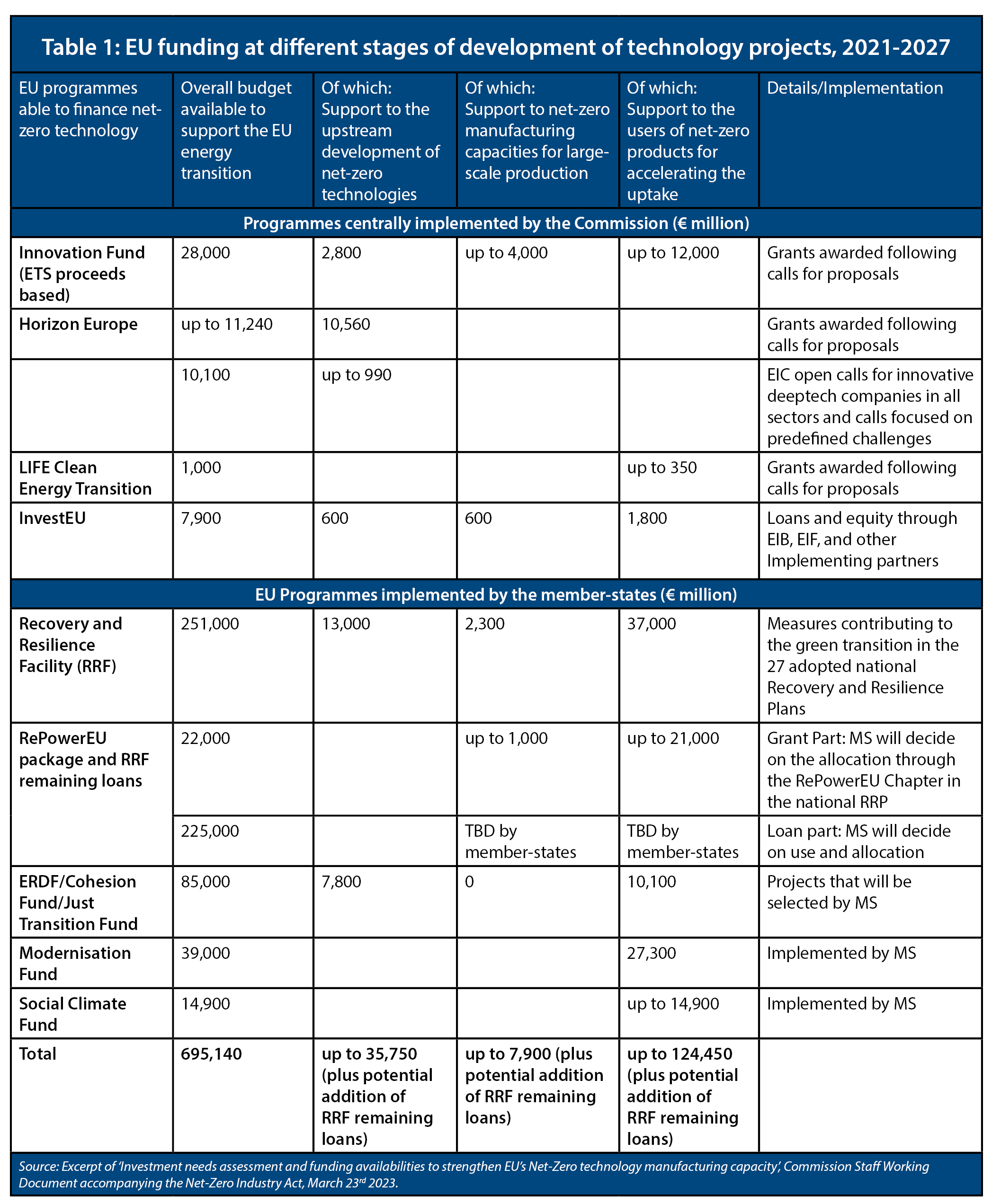

- EU programmes are also largely geared towards the early stages of tech development – notably, support of R&D – or to final deployment and user uptake. There is a dearth of support for the manufacturing stage.

- The bulk of 2022-2023 national state aid was focused on bailing out incumbents in energy-intensive sectors, not investing in nascent clean tech sectors.

- The magnitude of EU funds is very far from the estimated investments required to meet net-zero emissions targets.

- The EU should follow these principles to shape its new sector-specific clean tech industrial policies:

- Selectivity: industrial policy will require public money while tariffs may drive up prices for consumers in the short run: this only makes sense in sectors whose competitiveness can be realistically defended or restored. The EU’s industrial support should consider industries’ strategic value, cost and production structure in addition to patenting and export competitiveness.

- Firm-neutrality: to mitigate risks of favouritism and regulatory capture, the EU should deploy sector-wide interventions that apply equally across clean tech firms – like tariffs, consumer subsidies, R&D spending and infrastructure funding.

- Market structures: Creating larger firms to capture economies of scale is less risky in manufacturing than in services, given the more complete single market for goods allows EU firms to compete fairly against each other.

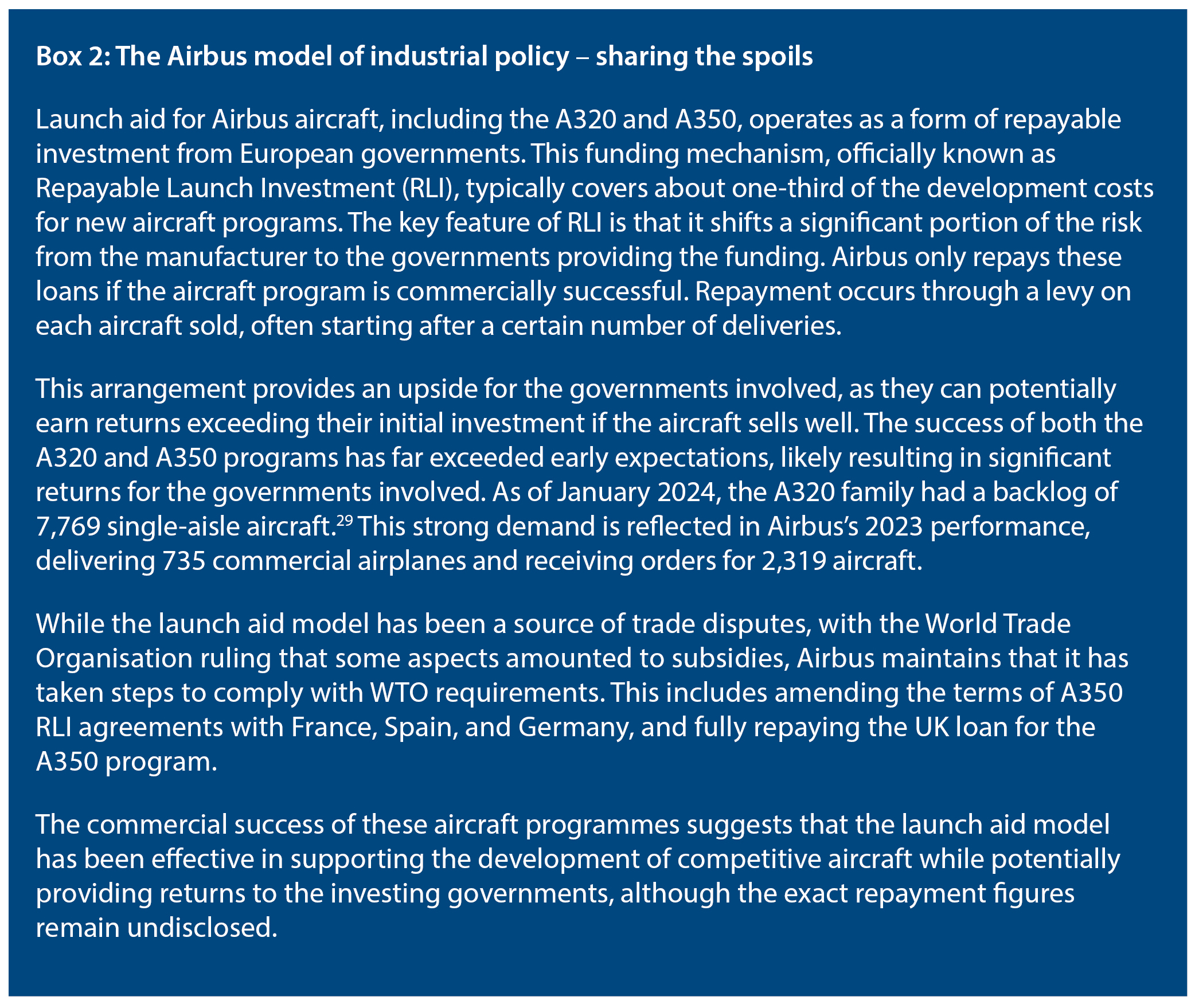

- Recoups: When firm-specific support is unavoidable, member-states should insist on profit-sharing, following the model used with Airbus – where governments derisk the design of new aircraft but recoup a share of profits from successful projects.

- Steering European demand to European clean tech production is essential. Europe should not let China’s subsidised competition exploit incentives given to European consumers:

- The Commission’s recent Competitiveness Compass rightly proposes that public procurement should follow a buy-European approach.

- By embedding environmental, labour, and national security conditions into subsidy schemes, EU countries can boost local production, stay open to products produced by allies, and counter China’s subsidies. The Commission should only approve subsidy schemes that include such criteria to ensure coherence across the EU single market.

- A common EU-level fund for strategic investments could further help alleviate the risk of subsidy races between member-states.

- The EU can become a clean tech manufacturing powerhouse – especially as the US rolls back green subsidies and cedes ground to China. Brussels can do so more cheaply than Washington by leveraging carbon pricing and regulation, and targeting support more carefully than America’s broad subsidies. But substantial financial commitments are needed to ensure Europe’s clean tech industry survives a stormy phase.

As the EU aims for net-zero carbon emissions by 2050, the next frontier for decarbonisation is in energy-intensive industries. This ties the EU’s climate ambitions to the need to preserve its industrial competitiveness. At the same time, both the US, with the Inflation Reduction Act (IRA), and China, with its endless state support, have been funding green industries, from renewables to electric vehicles (EVs). While the Trump administration is now rolling back the IRA, European leaders have realised that the world’s two largest economies have long employed subsidies as their main industrial policy tool – an approach that differs significantly from the EU’s focus on carbon pricing and regulation.

Furthermore, industrial policy in the EU has so far been a predominantly national affair – with the risk of it becoming the prerogative of few fiscally capable countries home to large, well-established industries. At the same time, Europe moved faster than the US on climate policy. This has meant that markets for clean technologies, and associated production have emerged earlier and on a larger scale in Europe. The EU has real strengths in some of the technologies that are key for the energy transition, from wind turbines to electrolysers – for brevity, we refer to these transition-related technologies throughout the paper as ‘clean tech’.

The geopolitical context is changing in ways that the EU should be quick to exploit. While large parts of the IRA support schemes have already reached the economy, Donald Trump will undo as much of the IRA as he can, removing subsidies that greatly boosted investments in clean technologies in the US during Joe Biden’s mandate. Trump is also reversing some of the few federal regulations that encouraged decarbonisation, such as the mandate for electric vehicles. The EU should seize the occasion and focus on strengthening its industrial base and building the foundation for stronger clean tech manufacturing.

While European industry is leading in many clean tech sectors, there are challenges that business alone cannot overcome.

On the other hand, however, the EU is exposed to the second China shock. China is shrinking its imports while directing investment into expanding domestic production in the automotive, machine-building and clean tech sectors – chief among them, electric vehicles. China’s internal demand remains too weak to absorb the resulting production. As a result, China’s exports have surged, its trade surplus has now ballooned to $1 trillion and its export-based growth is cutting into both the European market and the EU’s global export markets. Further, Europe’s reliance on imported fossil fuels keeps its energy prices stubbornly higher than those of the US, creating added costs for European energy-intensive industries.

So while European industry is leading in a range of clean tech sectors, there are challenges that business alone cannot overcome. The report by former Italian prime-minister Mario Draghi has made it clear that the EU needs a strategy for its industrial policy to maintain primacy in its strongest manufacturing sectors, and to build leadership in the clean tech sectors that will be crucial in a decarbonised economy. But a fragmented approach focused on individual member-states is a dead end: the IMF recently showed that state aid from EU member-states has tripled over the past decade, increasing from 0.5 per cent of GDP in 2012 to around 1.5 per cent in 2022.1 However, overreliance on state aid can create an uneven playing field within the bloc, weakening both the single market and creating political tensions.

Addressing this requires a new set of tools to allow for an EU-wide industrial policy, and a change in mindset in terms of both the type and amounts of funding devoted to this objective. So far, EU-level tools favouring clean innovation were predominantly horizontal in nature, meaning generic rather than sector-specific: this is driven by the EU’s will to stay technology-neutral, allowing market players to identify appropriate technologies instead of picking them itself. But the technology neutrality mantra may need to be revised: in a context where other powers are heavily subsidising key sectors to conquer market share, the EU may need to consider targeted support for strategic sectors, as suggested in the Draghi report. Clearly, not acting could be highly risky, but acting is not risk-free either. When authorities engage in industrial policy in a given sector, or give support to a single firm, they risk wasting money on firms that do not need funds or that turn out to be unviable.

An effective industrial policy requires an adequate pot of cash. In her political priorities, Ursula von der Leyen has promised a new European Competitiveness Fund to invest in strategic technologies to be manufactured in the EU, “from AI to space, clean tech to biotech” by leveraging and de-risking private investment.2 This paper considers the policy tools and funds – both horizontal and sector-specific – the EU already has to support its clean tech industry, the gaps in this area, and the additional instruments that are necessary to address them.

The strengths and weaknesses of Europe’s green industry

Europe’s clean tech industry is both powerful and promising. According to estimates of the European Environment Agency, the EU’s environmental goods and services (EGS) sector has been growing faster than the EU economy between 2010 and 2021, at an average growth rate of 2.9 per cent annually, while EU GDP increased by only 1.2 per cent per year. This sector made up a sizeable 2.5 per cent of EU GDP in 2021.3

While the Union is behind China in the production of key products such as batteries, solar photovoltaic (PV) panels, and to an extent also electric vehicles (EVs), in many areas is at the technological frontier. This is visible in IMF data on low carbon technology goods (LCT), which are defined as technologies that generate lower greenhouse gas emissions over their lifecycles compared to conventional alternatives.4 The IMF includes in this category more than 200 goods ranging far beyond EVs and solar panels, including items such as heat pumps, electrolysers, all kinds of turbines, as well as everyday technologies like insulation and thermostats, and tracks their global trade.5

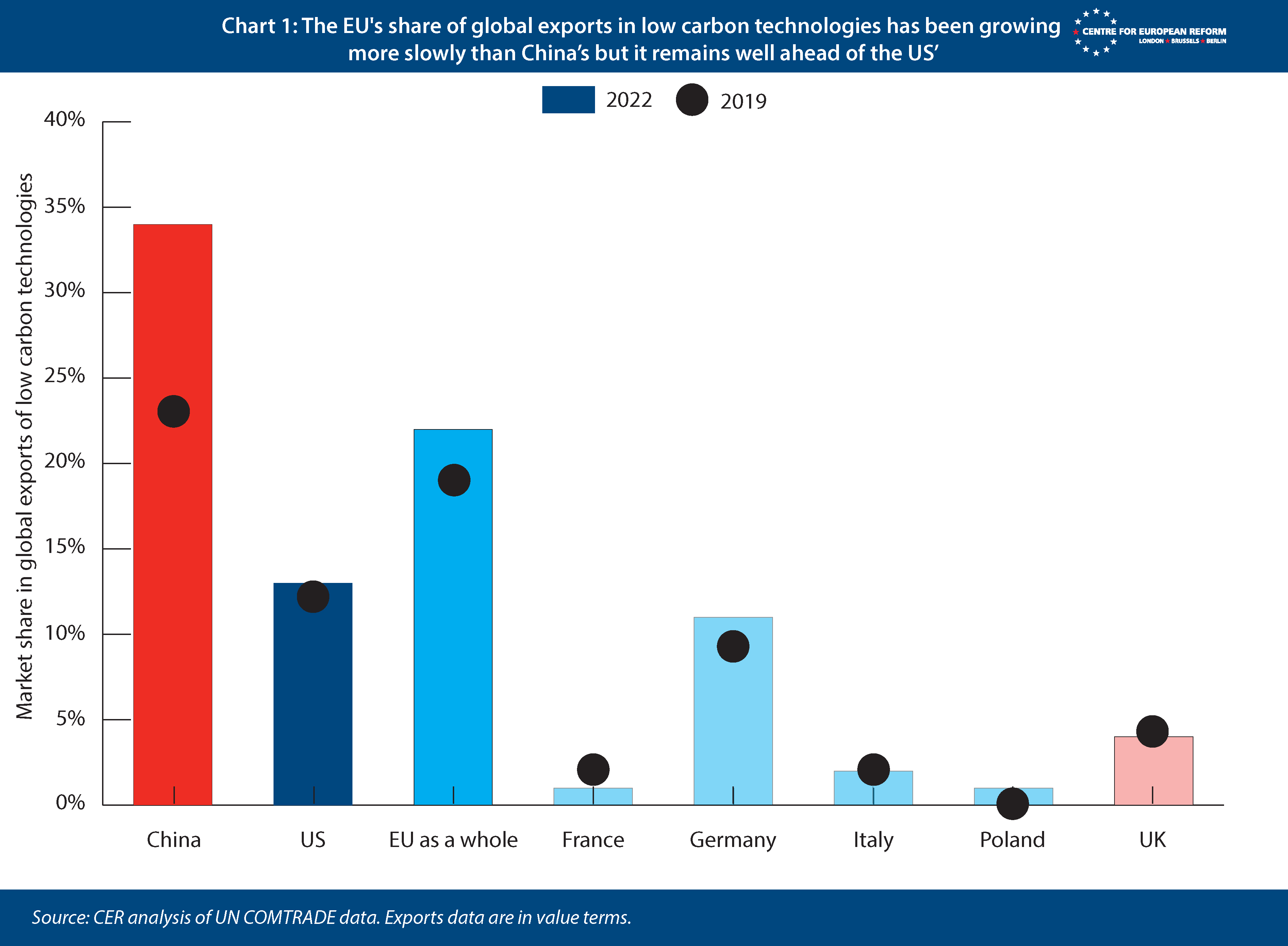

The EU has the second largest share of global export markets in LCT products (see Chart 1). Germany, the largest EU economy, boasts the most significant production hub for such technologies in the G7: its exports of LCTs already make up 4 per cent of German GDP. In absolute terms, Germany exports around €180 billion in clean technologies – the second highest volume in the world after China.

Some of the European economy’s most powerful sectors are based on the production of highly specialised, crafted and designed products. This includes luxury fashion, airplanes (think LVMH and Airbus) and chiptool maker ASML – all of which produce their goods with unique design or technology in relatively small amounts. A similar dynamic can be observed in clean tech: the EU dominates in categories of highly specialised machines such as wind turbines and hydro-electric energy generation kits (see Chart 2).

The EU is also a global leader in the number of patents issued for clean tech. Despite a relative decline in its overall patenting activity, the bloc maintains a significant share of innovation in clean technologies. As of 2020, the EU accounted for approximately 23 per cent of global green transition-related patent applications – down from 30 per cent in 2010.6 According to the EIB, back in 2020, the European Union filed 50 per cent more patents in green technologies than the United States and 76 per cent more patents integrating both green and digital technologies.7

However, there are two major challenges to the EU’s green industrial ambitions that businesses cannot overcome autonomously and that require co-ordinated policy action.

High energy prices threaten to choke off base industries that supply downstream manufacturers.

The first challenge is that of high energy prices which threaten to choke off base industries that supply downstream manufacturers. The energy crisis triggered by Russia’s full-scale invasion of Ukraine has significantly impacted the EU’s energy-intensive industries. Production in sectors such as paper, chemicals, non-metallic mineral products, and basic metals has declined steeply: output in each of these industries was 10 per cent lower by the end of Q3 2023 compared to early 2021.8 This decline coincided with an unprecedented spike in energy prices, with EU electricity prices averaging 230 €/MWh in 2022, a staggering 121 per cent increase from 2021.9

The situation presents a dilemma for EU policy-makers. On one hand, the decline in energy-intensive industrial activity can further reduce emissions, beyond the 30 per cent emissions drop from these industries experienced between 1990 and 2018. On the other hand, maintaining the competitiveness of these industries is crucial for the EU’s economic resilience and strategic autonomy.

But there is a stark difference between curbing emissions without shrinking output, thanks to decarbonisation, and doing so because of an economic slump that shrinks output.

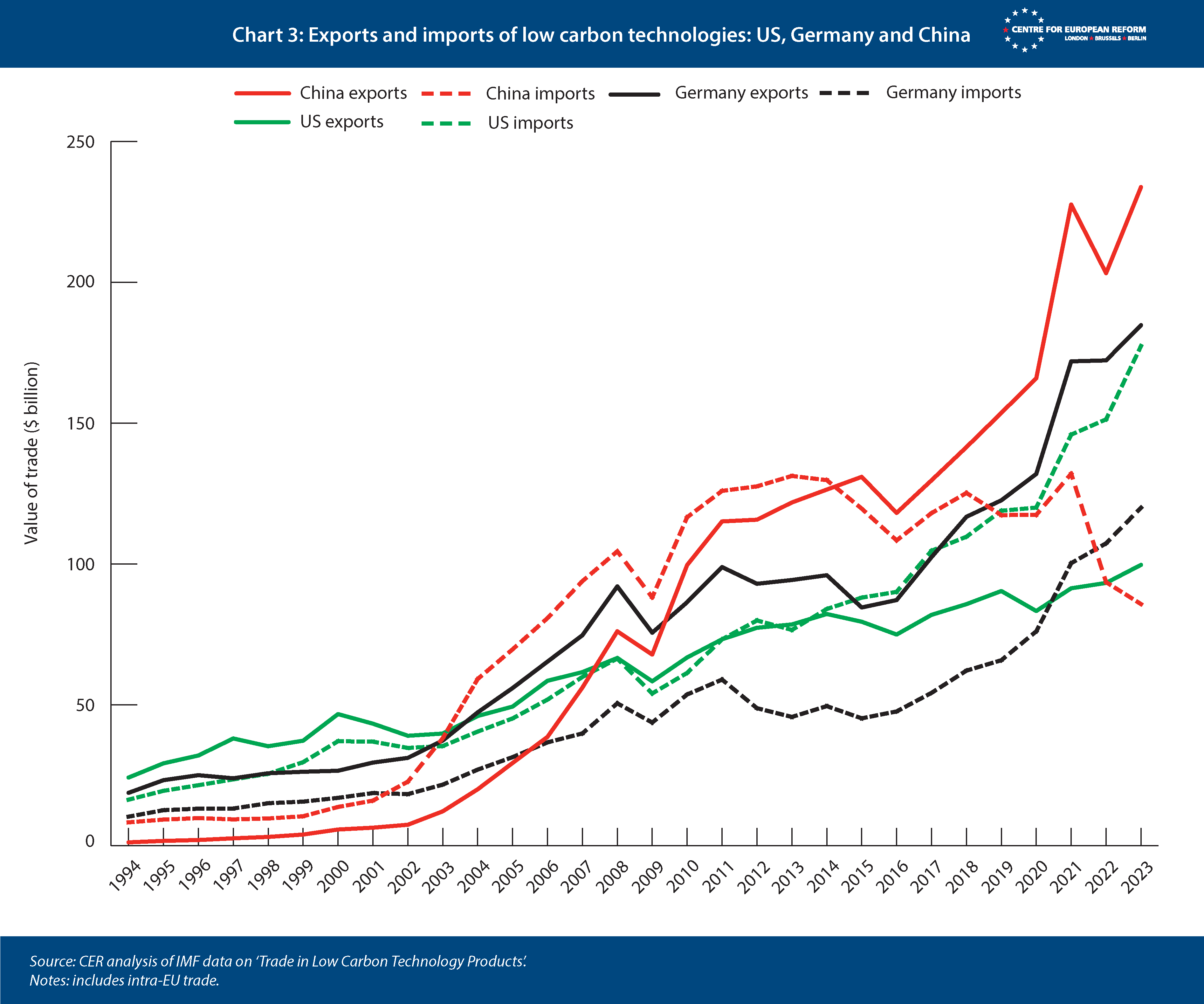

The second challenge is the ‘China shock’ that is currently reverberating across global goods markets. Trade in clean tech is growing rapidly across the world and between the major blocs. But there is one key exception: China is reducing its imports of low-carbon tech, even as its exports are surging (see Chart 3). This pattern is visible in clean tech trade, and in other sectors at the heart of the European economy like the automotive, machine-building and civil aviation industries.

But while industrial policy can explain China’s sectoral successes, it cannot, on its own, explain such a massive trade surplus. The culprit is China’s renewed macroeconomic imbalances.10 After the global financial crisis, China’s property sector disguised the country’s extremely low consumption rate by absorbing the resulting excess savings. But since its property bubble burst in 2021, China has doubled down on investment in priority manufacturing sectors, despite a lack of internal demand for much of its output. If domestic consumption is flat and production capacity is rising, exports are the only means to achieve growth.

Chinese manufacturing exports and the associated trade surplus surged over the last four years, with the latter reaching a staggering 10 per cent of GDP.11 China’s exports in volume terms are growing at over 12 per cent per year, wildly outpacing global trade growth. In the meantime, eurozone exports are languishing, and German exports of capital and durable goods are declining. China’s increasing technical sophistication, political commitment to subsidising advanced manufacturing, and reliance on global demand to compensate for weak internal consumption pose a clear challenge to all large, advanced economies – including the EU.

Unlike their Chinese state-backed competitors, EU firms are bound by the logic of capitalism to deliver returns, not just pour out products. Without profits to fuel new investment, they risk falling behind in the technological race. This in turn may suppress European green patenting, which would negatively affect the energy transition.

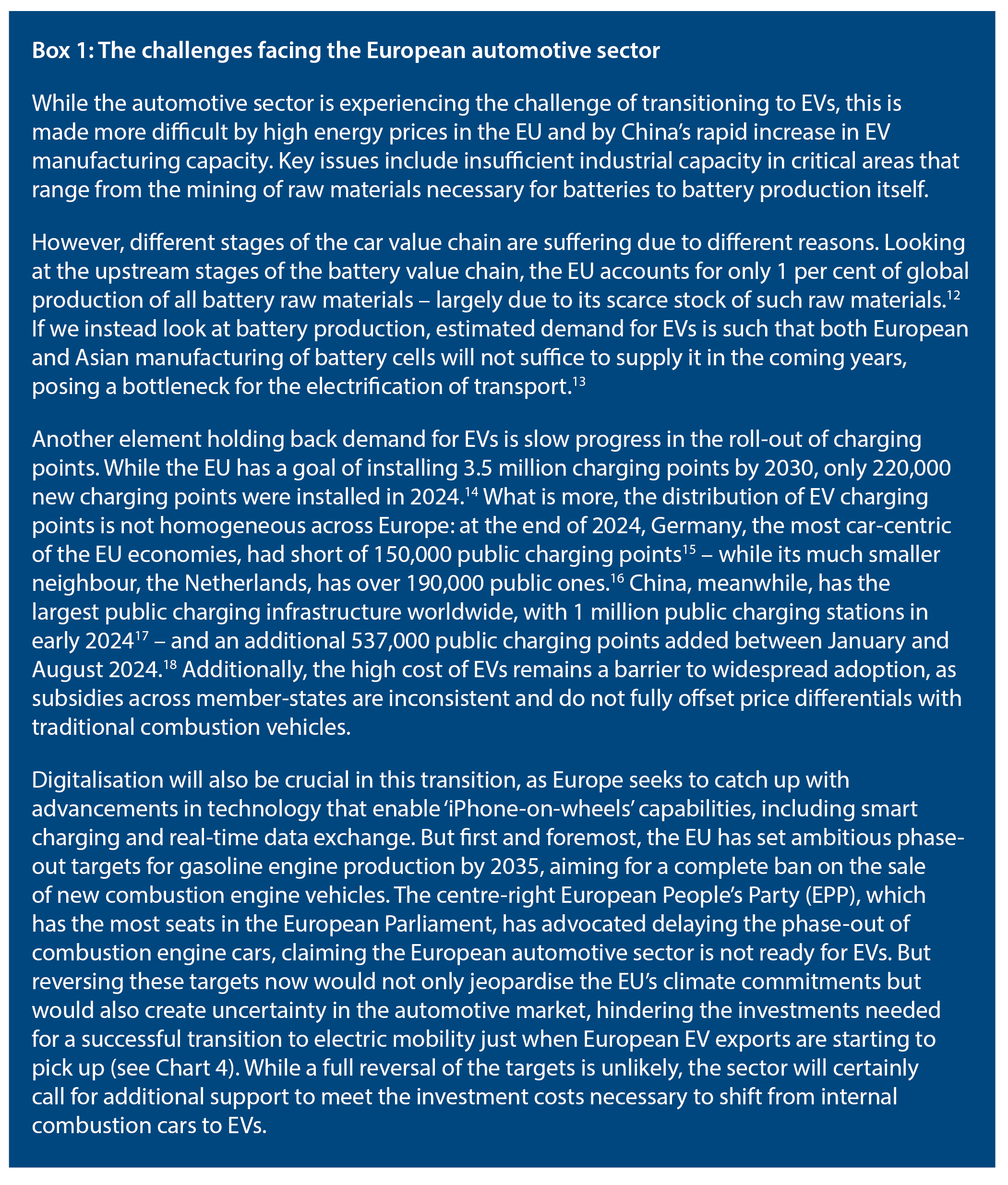

Maintaining the EU’s competitiveness in the face of high energy prices and of China’s export-driven strategy will require a strategic response and continued innovation in the European clean tech sector. Both of these challenges are evident in a sector that is key to the European economy, and that presents some unique challenges: automotive (see Box 1).

Green industrial policy in the EU: Programmes, funds and failures

The EU has not dabbled much in industrial policy so far, as this was the remit of national governments. However, through the design of its state aid rules, the EU has effectively contributed to shaping national industrial policy. For example, in 2022 the Commission agreed to loosen state aid rules to shield industry (largely energy-intensive sectors) and consumers from the energy price shock. This points to a key risk: the tendency of state aid is often to protect incumbents, as opposed to taking a forward-looking approach to support the development of the nascent industries of the future.

The tendency of state aid is often to protect incumbents, instead of supporting promising nascent industries.

The consequence of supporting incumbents is that, so far, industrial policy has been tilted in favour of energy-intensive industry, with weak incentives for it to become more efficient and eliminate its dependence on imported fossil fuels. What is more, in the entire EU, governments typically spent an overall €57-62 billion (2023 prices) in fossil fuel subsidies per year between 2015 and 2021. According to the European Environment Agency, fossil fuel subsidies doubled to over €100 billion during the 2022-2023 energy crisis.19

When former US President Joe Biden launched his signature Inflation Reduction Act infrastructure and climate bill in 2022, the EU started to see the urgency of building a collective approach to green industrial support. The IRA caused panic in European capitals, as EU leaders and industries assumed European manufacturing would crumble and relocate to the US to gobble up generous tax credits. This was a largely misplaced fear as US investment in clean tech did not suddenly make European investments unviable.

In fact, the US trade balance in low-carbon technology deteriorated after the IRA’s passing, suggesting that the US was actually importing more from the EU.20 The EU also managed to convince the White House and the US treasury to let European automotive producers benefit from IRA subsidies if they exported vehicles to the US for lease. Since then, around two-thirds of EU carmakers’ exports to the US have been vehicles for lease – a much higher percentage than before.21 But this scheme could soon reach an end if Trump repeals the IRA, as his administration has already started doing, or simply reinterprets the rules to exclude EU-leased vehicles.

While the EU may have worried too much about the IRA, it was not fretting enough about China’s state support, which allowed many of its industries to capture significant market share on global markets – including the European market. Today, this is the case for a range of technologies, from solar panels to EVs. And ultimately, the EU has been complacent about some of its key structural weaknesses which cause competitive disadvantages for its industry – chief among them the dependence on imported fossil fuels that causes its high energy prices.

The EU has been complacent about some of its key structural weaknesses, such as its dependence on imported fossil fuels.

The EU needs to develop a joint approach to industrial policy to avoid the threat to the single market posed by assertive policies in the US (where trade protectionism may replace the IRA as a threat to EU industry) and China (where the bubble of industrial overcapacity does not yet show signs of bursting).

In 2023, the EU attempted to create such a framework for EU green industrial policy by adopting the Net Zero Industry Act (NZIA). The NZIA identified a series of ‘net-zero technologies’, from solar photovoltaic to battery technologies, as well as heat pumps, geothermal, electrolysers and carbon capture and storage (CCS) technologies.The regulation set an overall target for the EU’s domestic capacity in net-zero technologies to meet at least 40 per cent of European demand in these goods by 2030.

But the NZIA has two main weaknesses. First, it imposes a (perhaps wishful) blanket target of 40 per cent deployment across very diverse industries. Second, it was not accompanied by additional programmes, nor did it refinance existing programmes with additional funds to meet such deployment goals. For these reasons, it has so far remained a target-setting exercise, with its most concrete innovation being an attempt to accelerate permit procedures associated with deploying net-zero technologies.

To move from empty target-setting to an effective green industrial policy, the EU needs to critically assess the existing programmes that contribute to it, and if necessary, upgrade them. Effective industrial policy requires targeted efforts to support the emergence of markets for new technologies, and to provide direct financial aid to industry to support its decarbonisation investments.

So what are these existing programmes, and what is the magnitude of funds currently supporting green industrial investments? Table 1, excerpted from Commission documentation accompanying the NZIA, summarises the available EU programmes and associated funds that can support net-zero technologies across different stages of their development. To this list we can also add the following:

- Important Projects of Common European Interest (IPCEIs), which allow EU member-states to deploy state aid for projects that can benefit from important EU-level economies of scale, mainly at the R&D stage but also for first industrial deployment. Approved IPCEIs so far have included transition-relevant industries such as batteries and hydrogen.

- The EU Hydrogen Bank, which aims to support the creation of a hydrogen value chain in Europe by facilitating the matching of demand and supply, and through targeted investment support that is allocated via auctions (similarly to what happens under the Innovation Fund).

There are three main shortcomings in these programmes for green industrial policy. First, taken together, the existing programmes are largely horizontal or generic in nature, applying to multiple sectors, with the exception of the Hydrogen Bank. Conversely, the Draghi report recommends shaping sector-specific industrial policy that recognises that industries have differing potential, and supports them with specialised approaches. Second, as evidenced from the figures in Table 1, such programmes are largely geared towards the early stages of tech development – notably, support of R&D – or to final deployment and user uptake, leaving a dearth of support for the manufacturing stage. Third, the magnitude of EU funds is very far from the estimated investment needed to meet net-zero targets, as highlighted by the Draghi report.

This January, the European Commission launched its Competitiveness Compass. It includes a joint plan for decarbonisation and competitiveness, and the Clean Industrial Deal, which aims to “channel investment in infrastructure and industry, in particular for energy intensive sectors.”22 The Compass is right in steering EU demand toward EU production and makes a useful proposal to pursue buy-European public procurement rules – which China cannot litigate against because the country refused to sign the WTO’s Government Procurement Agreement. However, the Compass also falls into the trap of vague rhetoric – the Commission will need to make several of its elements more concrete, as Draghi did, to forge a real industrial policy. Moreover, it proposes to create a new, ill-defined co-ordination instrument that prioritises process over substance. Given that the EU already has the tools it needs, it should instead agree on which sectors to support and consider ways to complement or utilise the existing generic programmes and funds to meet sector-specific needs. We provide recommendations on this in the next section.

Good practices for sector-specific industrial policy

The Draghi report suggests that the EU tailor its approach to each industry’s unique characteristics, prospects, and strategic value. It conceptualises tools for industrial policy into the following typology:23

1. Accept the necessity of large-scale imports in sectors where the EU has lost its competitive edge, such as solar panels, to limit costs to European taxpayers and consumers.

2. Use trade and industrial policies to protect against unfair competition in industries crucial to EU employment, such as the automotive sector. In these sectors, foreign direct investment (FDI), even from China, could help preserve employment without necessarily compromising security interests.

3. Ensure EU ownership of both knowledge and production capabilities in security-sensitive sectors, such as dual-use permanent magnets used in wind turbines and radar systems, by imposing, for example, local content requirements on national security grounds.

4. Put in place temporary trade protections for emerging industries where the EU holds an innovative advantage to shield EU innovation from China’s overcapacity and protectionist policies.

The EU should tailor its industrial policy to each industry’s unique characteristics, prospects, and strategic value.

This typology represents a step change in EU policy dogmas, as they may challenge WTO rules. They indicate a possible move towards a more assertive use of trade and state aid in service of preserving and developing EU industrial strength. But the EU should be able to thread the needle and find a balance between these objectives and doing its part to protect the global trade order and the viability of the WTO. China’s pervasive use of subsidies, and the Commission’s increasing documentation and understanding of them, provide ample space to impose tariffs within the rules of the WTO. The recently instated tariffs on Chinese EVs, which were designed to abide by WTO procedures while protecting EU interests, exemplify this approach.

To avoid handouts to firms and maximise impact, EU green industrial policy should follow a couple of core principles.

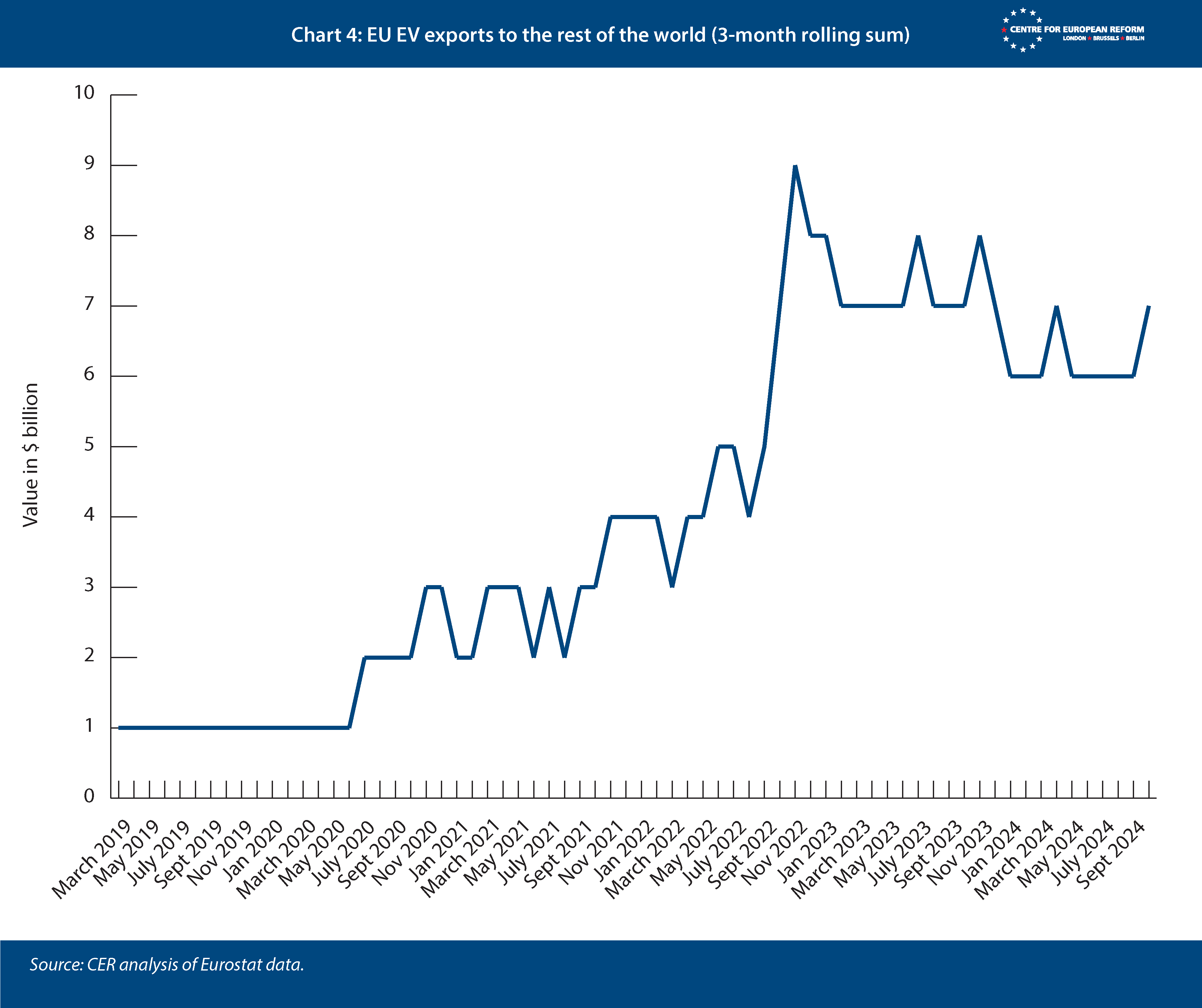

First, it should be selective. Measures like tariffs, buy-European subsidies and competition policies represent transfers from consumers to producers and vice versa. Deploying such instruments to support producers only makes sense if a sector’s competitiveness can be realistically defended or restored – considering the industry’s cost structure, market share, emerging export competitiveness and production patterns. Consider the stark contrast between solar photovoltaics and cars. In 2023, the solar PV sector in Europe employed a total of 826,000 workers: 87 per cent of these jobs are in installation.24 Supporting domestic production would mean imposing higher PV prices on consumers, which would come at the expense of installation, hurting a larger share of employment than it would help. But in the automotive sector, the employment stakes are much higher, as the EU car industry employs over 13 million people. At the same time, unlike the PV sector, the automotive sector is also showing some promise: it is a net exporter of electric vehicles, with Germany emerging as the second-largest global producer worldwide (see Chart 5). These different landscapes call for tailored strategies.

Second, to mitigate risks of favouritism and regulatory capture, the EU should prioritise firm-neutral instruments. This means focusing on broad-based interventions that apply equally across firms – like increasing R&D spending, developing infrastructure and implementing tariffs. The Dutch Beethoven plan, which created the conditions for the growth of ASML’s cluster, exemplifies this approach. It involves a €2.5 billion investment combined from the national and local government to retain ASML and strengthen the Brainport Eindhoven region.25 The funding focuses on improving local infrastructure, housing and expanding the Eindhoven University of Technology to address talent shortages, while also allocating €800 million for education and research across other regions in the Netherlands. Similarly, supporting European demand through consumer incentives – such as electric vehicle buying schemes – can boost industrial ecosystems without picking specific corporate winners.

Third, the EU’s strategic approach must also consider both how complete its own internal market is and global competitive dynamics. Creating larger European firms to capture economies of scale is less risky in manufacturing than in services. The single market for goods is more complete and industrial firms face fewer barriers in exporting to other member-states than services providers. This means that EU firms from other corners of the single market can compete fairly. In sectors where relatively mature European markets face global oligopolies, supporting the creation of champions to avoid strategic dependencies and to compete with US and Chinese firms can be advantageous.26 For example, in the EU wind turbine sector, there may be growing consolidation pressure over time as the sector is reeling from higher funding costs from interest rate increases, high inputs costs and surging Chinese exports. Now there will be a drop in US demand as the Trump administration rolls back on wind projects.27 European consolidation may over time be the only way in which a few large players survive. This is not a foregone conclusion, but EU policy-makers should take these dynamics into consideration. But in fragmented markets, as in the case of cross-border service provision that are hampered by member-states‘ regulatory barriers, consolidating interventions risk creating ‘sharks in small ponds’: oversized players without genuine European competition.28

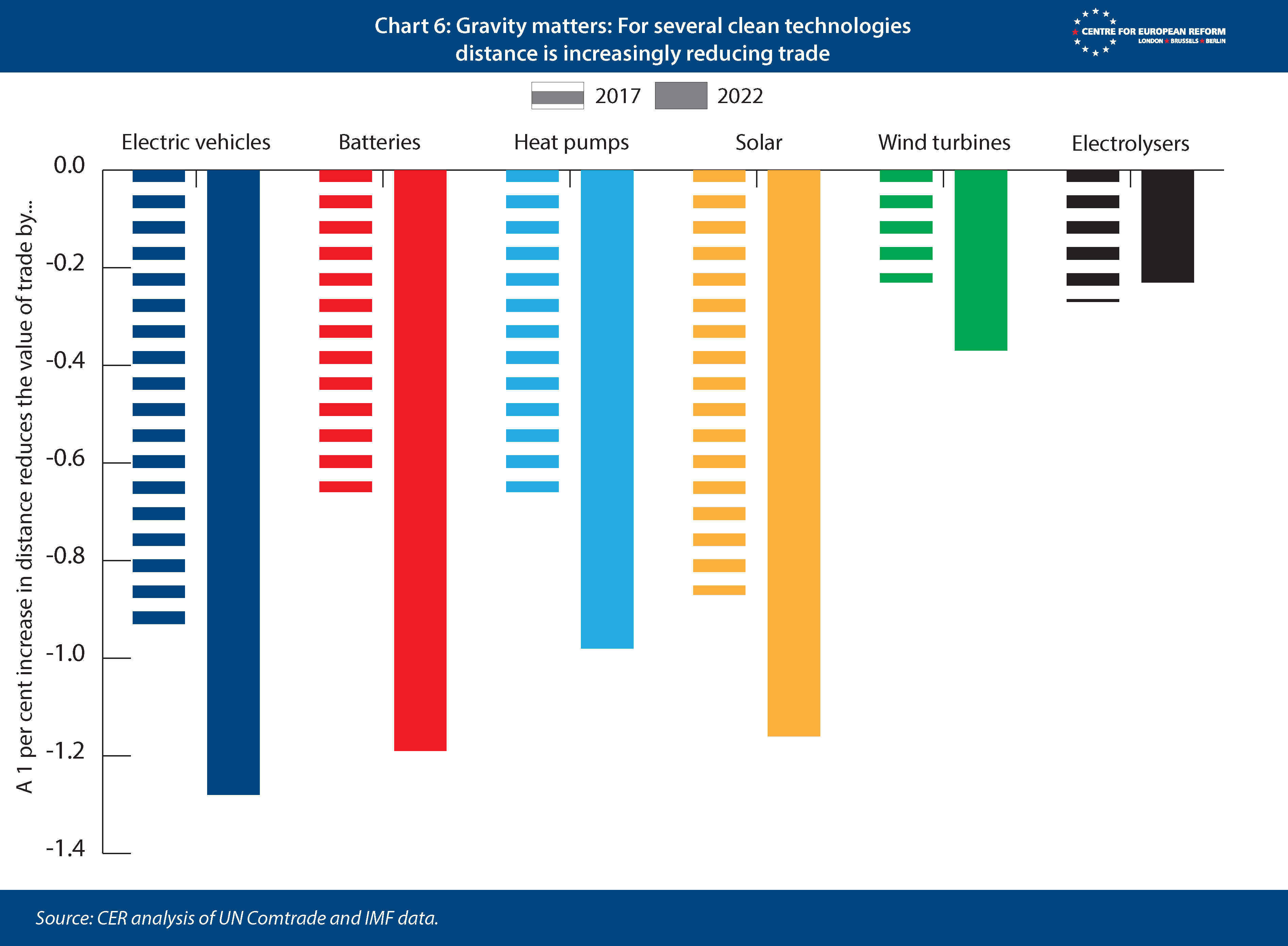

As technologies mature, their cost structure changes, with impacts on their entire value chain. For example, the negative impact of geographical distance on trade has notably increased from 2017 to 2022 across key categories of clean technologies – namely electric vehicles, batteries, heat pumps and solar panels and wind turbines (see Chart 6). This trend suggests that as technologies shift from novel to well-established, supply chains become shorter, prompting companies to expand production closer to their consumer bases in order to minimise shipping costs.

But large and expensive clean technologies seem to be an exception to this overall trend. Distance has a smaller impact on trade for wind turbines than it does for other green goods we analysed. One possible explanation for this is that transportation costs make up for a smaller share of costs, in relative terms, in more expensive pieces of kit. This suggests that Chinese manufacturers may become a threat to Europe’s wind industry, as China eats away at the EU’s export markets, and that they may increase exports to the EU itself. The minimal penalty to trading wind turbines across long distances means the EU could consider subsidising wind manufacturing to avoid becoming strategically dependent on China. One way to do so is by creating ample demand, for example by accelerating the construction of offshore wind turbines in the North Sea and mandating that the parts come from European and UK suppliers.

The Airbus model (see Box 2) offers some clues for strategic industrial support in capital-intensive technologies with extended development horizons such as new generations of wind turbines, electrolysers or other types of machinery. Airbus was created by merging legacy enterprises that could not bear the investment cost for new commercial airlines up front. The EU’s wind and electrolyser firms are barely protected by gravity, and as they get undercut by China and lose export markets, there may be a case for mergers down the line. The jury is still out on that. But the more immediate lesson from the Airbus experience lies in sharing both risks and rewards between the public and private sector. By providing initial government investment and recouping loans after market entry, this approach can be applied to emerging clean technologies.

The EU can help promote a virtuous cycle of production and investment for its promising clean tech industries if it is selective in the sectors it supports, uses firm-neutral instruments and leverages existing single market strengths. But there is a risk that China’s non-market competitors can tap into European demand-incentives to cut their costs – which is how Germany lost its early lead in solar PV manufacturing. Steering European demand to European production is therefore essential.

Steering European demand to EU-built clean tech products: Co-ordinating national policies

The existing EU regulatory framework provides a foundation for implementing ‘buy-European’ clauses for advanced downstream products like electric vehicles, heat pumps, electrolysers and wind turbines. By integrating environmental, labour standards and national security conditions into subsidy schemes, EU countries can promote local production while offsetting China’s subsidies.

Although the EU lacks a centralised budget for industrial policy, it can enact EU directives that encourage member-states to align their national subsidy programmes with these buy-European principles.

For instance, the NZIA mandates that authorities assess how renewable energy auctions for solar or wind projects promote sustainability, resilience, cybersecurity and responsible business practices. These criteria must cover at least 30 per cent of the annual auctioned volume in each EU country or 6 gigawatts, whichever is higher. A similar approach could be applied to clean tech subsidy schemes across member-states. Competition policy could be a key tool to enforce such criteria. The Commission could tie its approval of national subsidy programmes to conditions that favour EU production. For example, Brussels would only approve subsidies if they comply with social standards or exclude products associated with high emissions from coal-intensive production or long-distance transport.

France’s EV subsidy programme offers a model for the EU to follow. The scheme limits subsidies to low- and middle-income households and to ‘green’ vehicles, with eligibility determined by factors such as emissions from transport and whether production relied on coal or cleaner energy sources like those commonly used in Europe. This design has effectively excluded many Chinese-made EVs while favouring European vehicles that meet the criteria. If adopted EU-wide, similar subsidies could achieve effects comparable to Beijing’s local content requirements. Linking such schemes to environmental or national security conditions could also make them compliant with WTO rules. While the EU cannot prevent declining demand for European products in China or third markets dominated by Chinese goods, it can ensure that domestic European demand supports EU-based production.

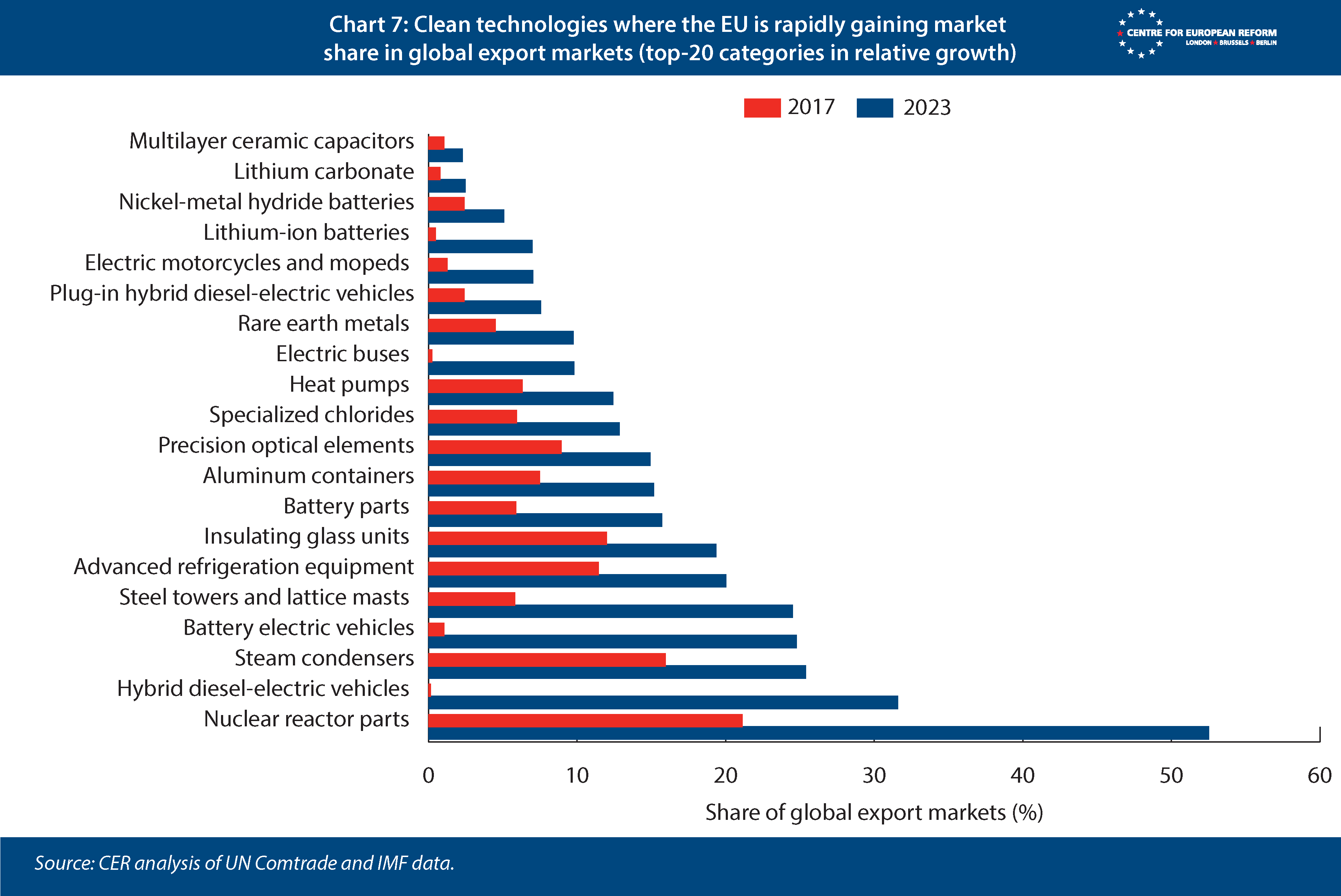

EU member-states should set subsidy criteria that are open to products imported from allies that do not discriminate against EU-based producers, such as Japan, South Korea, Australia and the United Kingdom. This would ensure that the EU continues to build out growing trade across a range of clean tech products (see Chart 7). Flanking environmental and carbon emissions criteria with criteria for high labour standards would be one way to do so. Security conditionality provides another. Batteries, for example, are a dual-use good that are important not only for electrification but also to produce military drones. Similarly, permanent magnets used in wind turbines are also a key input to radar systems for fighter jets. European demand-subsidies for batteries and permanent magnets should therefore be available only to producers from NATO countries. The Commission should be vigilant that the schemes retain such openness to key partners.

The EU’s product-specific regulations provide another tool to shield EU manufacturers from competition with China’s subsidised exports, which often benefit from lower environmental and labour standards. Instruments like the European Sustainable Product Regulation (ESPR) can restrict market access for non-European competitors that fail to meet strict sustainability criteria. Through delegated acts, the Commission could implement the ESPR by establishing product standards that combine minimum quotas for low-carbon components – such as green steel or efficient electrolysers – with emissions intensity thresholds. These thresholds, based on standardised estimates of a product’s carbon footprint (such as the industry average in a specific market), would prevent greenwashing and create a clear competitive advantage for EU producers, given Europe’s cleaner production processes.

For example, Chinese-made EV batteries, which often have higher embedded carbon emissions due to coal-intensive electricity grids, would struggle to meet such EU standards. This would naturally boost European manufacturers. Subsidy schemes and public procurement rules could then magnify these effects: tax breaks or grants could be linked to the use of components meeting EU standards, ensuring that financial support strengthens European supply chains rather than funding imports from China.

Such measures could also encourage EU member-states to embed mechanisms in their subsidy programmes that direct European demand toward European production. While some member-states have already scaled back consumer EV subsidies, any remaining or reinstated subsidies should be explicitly tied to buying European. These approaches would ensure a co-ordinated strategy across the EU to reinforce its industrial base while adhering to sustainability goals.

Buy-European policies would initially disadvantage countries like the US, which lacks a formal trade agreement with the EU. However, over time, there is potential to negotiate new agreements that grant allies and non-discriminatory trade partners access to European subsidies in exchange for reciprocal access to their subsidy schemes. As countries face challenges from China’s subsidies and unbalanced economic practices, common approaches to carbon tariffs and adjustments could enhance competitiveness while maintaining open trade principles.

The European funding challenge

The EU will also need some common pots of money for strategic projects. The EU’s approach to green industrial policy differs from the US strategy in several key aspects, potentially making it more cost-effective and targeted.

First, the EU’s strategy for industrial decarbonisation relies more heavily on carbon pricing mechanisms and regulation rather than direct subsidies. The EU Emissions Trading System (ETS) and the Carbon Border Adjustment Mechanism (CBAM) create market incentives for decarbonisation without requiring large government expenditures.30 This approach can help stabilise the green transition over the medium term by providing consistent price signals to industry.

The EU needs to commit substantial funds to its green industrial policy to remain competitive in clean tech markets.

Second, the EU’s recent approach to industrial policy is more sector-specific compared to the broad subsidies offered by the US Inflation Reduction Act. The Net Zero Industry Act and Critical Raw Materials Act target specific industries and supply chains crucial for the green transition. This targeted approach allows for more efficient allocation of resources and support to strategic sectors. These factors suggest that the EU’s green industrial policy could be less costly than the US approach. The IRA tax credits are demand-driven, but the total estimated fiscal cost is about 0.3-0.5 per cent of GDP annually.31

However, the EU will still need to allocate significant resources to support its green transition. This includes creating stable demand to offset potential losses from increased Chinese competition and providing firm-specific subsidies to mitigate risks in emerging green industries. Models like the Airbus one could support strategic investments while sharing risks between the public and private sectors. Overall, while the EU’s approach may be more cost-effective, it will still require substantial financial commitments to ensure the success of its green industrial policy and maintain competitiveness in the global clean technology market.

The EU’s current approach to industrial policy faces significant limitations, particularly in terms of funding and strategic focus. The Strategic Technologies for Europe Platform (STEP), a fund to support European industries in key technologies, is far too small and it largely redirects cohesion funds meant for the EU’s poorer regions. It also has fundamental design flaws. Industrial policy should prioritise allocating resources to the most promising supply chains rather than functioning primarily as a redistribution mechanism.

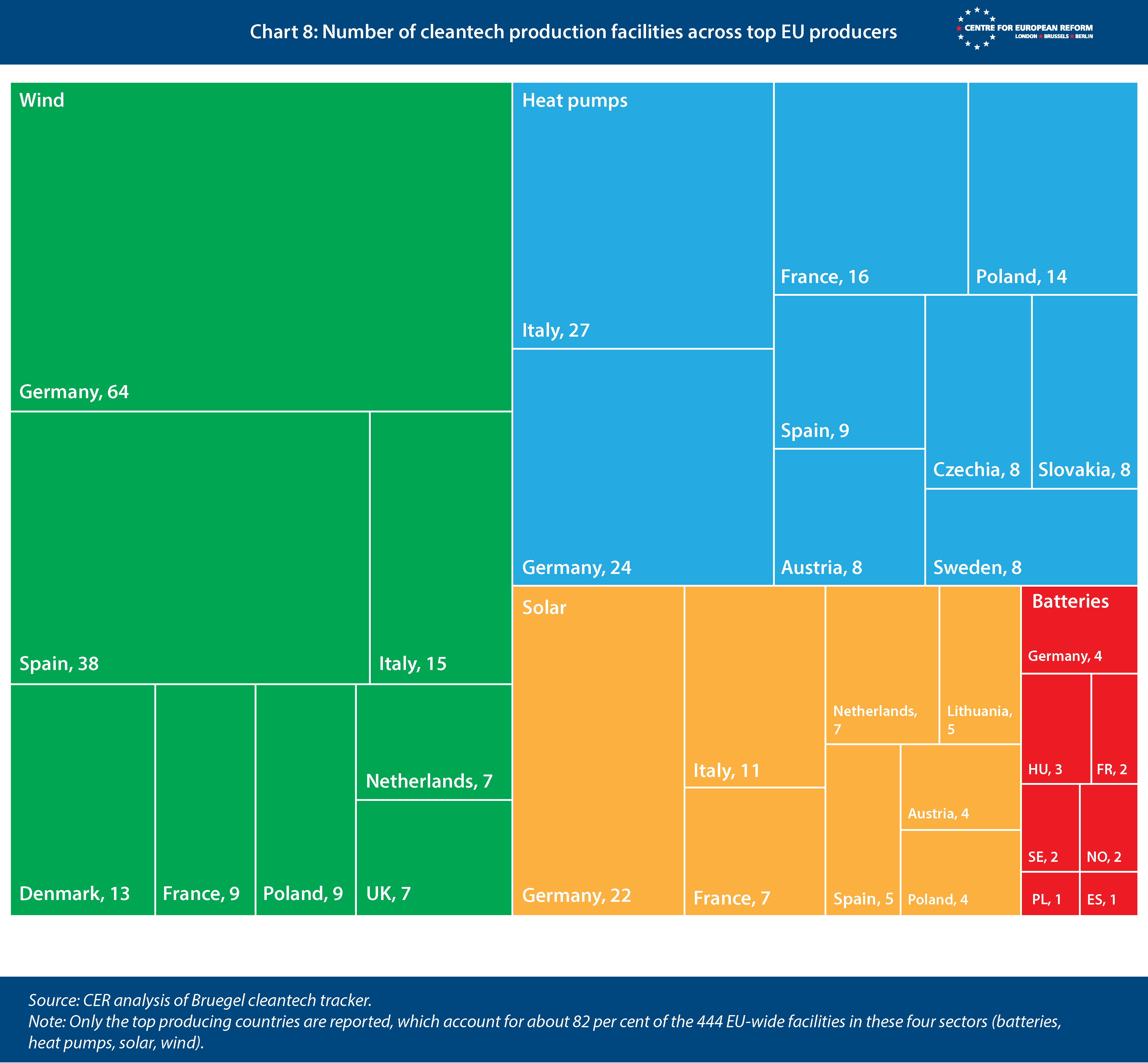

Most of the EU’s existing clean tech production capacity is in the ‘big four’ economies – France, Germany, Italy and Spain (see Chart 8). A common fund could unify EU industrial policy, alleviating intra-EU subsidy races through state aid efforts that distort the level playing field of the single market. It would also mitigate situations where countries like France and Germany end up bidding against one another to attract American or Taiwanese chip manufacturers to establish factories. However, the EU currently lacks the necessary financial resources: the €800 billion post-pandemic recovery fund has already been allocated, and the EU budget is under significant strain. Commission President Ursula von der Leyen has made repeated attempts to create a fund to support strategic industries across the EU, rebranding it from a ‘Sovereignty Fund’ to a ‘Competitiveness Fund’ in its latest version. Unfortunately, her initiatives have stalled due to member-states’ reluctance or inability to contribute additional funds or commit to new revenue streams – referred to as ‘own resources’ – for the Union.

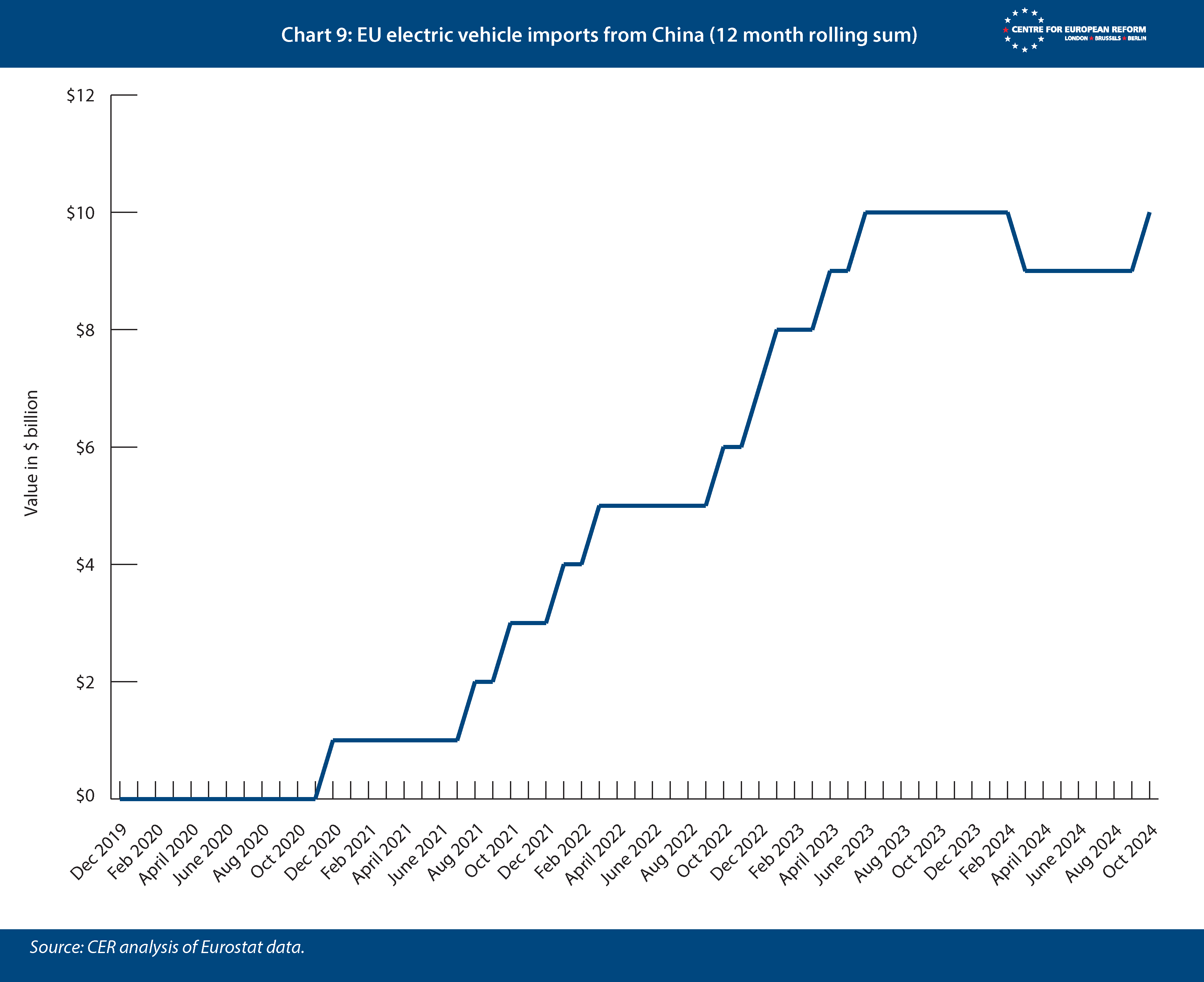

Finding additional revenue streams to support industrial policy requires political will and an innovative approach to public finances. But in some cases, reorganising existing revenues can help too. The EU budget is financed through customs revenue, member-state contributions based on value-added tax, and member-state payments determined by their relative gross national income (GNI). Typically, increased customs revenue leads to reduced GNI-based contributions from member-states. But instead, member-states could opt to channel extra tariff income from the EU’s new trade defence measures against China – stemming from shared trade concerns – toward the long-desired EU industrial policy fund. Tariffs on Chinese electric vehicles alone are expected to yield between €2-3 billion annually – a figure likely to increase as Europe’s imports of Chinese EVs continue to grow (see Chart 9). Contributions from member-states would not need to rise; rather, they would simply remain stable. Over time, this approach could generate a non-negligible revenue stream. While insufficient on its own, it could be put to good use by co-financing large-scale EU industrial initiatives, such as cross-border member-states projects or key Europe-wide strategic initiatives.

The scope of tariffed products is set to widen: this year, the EU plans to impose tariffs on Chinese titanium oxide and has initiated anti-subsidy investigations into Chinese imports of trains and wind turbines while expressing concerns about electrolysers. But tariff revenues will be volatile, so the EU should build up a reserve over time and disburse funds carefully so as not to overcommit resources. The fund could be established with an insurance clause designed to maintain a stable level of funding even if tariff revenues fall short of expectations. This mechanism would ensure that if revenues dip below a predetermined threshold, governments would be required to contribute additional funds to make up the difference. By providing this financial safety net, the fund could maintain its operational integrity and support strategic initiatives without being overly reliant on variable tariff income. Ultimately, some wider accompanying reforms may be required to make common industrial policy work, such as increasing tight mechanical spending limits of the EU budget.

Conclusion

The new von der Leyen Commission has made European competitiveness its priority, with the aim of preserving the EU’s industrial base in key legacy sectors, and building and strengthening clean tech sectors that are critical for the energy transition. With China and the US deploying significant public subsidies to support their nascent clean tech industries, the EU should no longer shy away from co-ordinating its industrial policy.

As recommended by the Draghi report, EU clean tech support should be sector-specific while remaining firm-neutral. Shaping a clean industrial policy that is fit for this era of urgent decarbonisation and increased trade protectionism will require a mix of pragmatic trade measures, public procurement rules encouraging the purchase of European products, and public subsidies with clear environmental, labour, and national security conditions.

A common EU-level fund for strategic investments – which Ursula von der Leyen has announced as the European Competitiveness Fund – could further help alleviate the risk of subsidy races between member-states. It will require finding new resource streams to rise to the challenges of industrial decarbonisation. This necessarily will raise the usual counterarguments from frugal countries. But unlike agricultural subsidies or regional transfers, European green industrial policy will create very different winners and losers: Germany would be among the winners, as is already the case when it comes to the EU’s Horizon research programme.32 Focusing the EU’s limited industrial policy funds on enhancing European competitiveness in key sectors such as clean tech will entail supporting value chains (and regions) with strong growth potential, many of which are concentrated in Germany. European green industrial policy will succeed both economically and politically if it focuses resources on the key industries for decarbonisation – even if some beneficiaries are located in member-states with higher GDP per capita.

2: Ursula von der Leyen, ‘Europe’s choice. Political guidelines for the next European Commission 2024−2029’, July 18th 2024.

3: European Environment Agency, ‘Gross value added of the environmental goods and services sector in Europe’, June 26th 2024.

4: IMF, ‘Trade in low carbon technology products’, 2024.

5: IMF, Climate Change Dashboard, Transition to a Low Carbon Economy Indicators.

6: In house legal, ‘Europe remains a global leader in innovation, ability to commercialise lagging’, policy and regulation, February 2024.

7: European Investment Bank, ‘EIB Investment Report 2020/2021: European Union is leading the way in green technology investment’, January 2021.

8: Eurostat, ‘Production in industry - monthly data’.

9: International Energy Agency (IEA) ,’Renewable energy market update’, June 1st 2023.

10: Sander Tordoir and Brad Setser, ‘How German industry can survive the second China shock’, CER policy brief, January 16th 2025.

11: Michael Weilandt and Brad Setser, ‘China’s record manufacturing surplus’, Council on Foreign Relations, March 10th 2024.

12: European Commission, ‘Critical materials for strategic technologies and sectors in the EU - a foresight study’, 2020. European Commission, ‘Study on the critical raw materials for the EU 2023 - final report’, March 16th 2023.

13: European Commission, ‘Critical materials for strategic technologies and sectors in the EU - a foresight study’, 2020.

14: European Commission, ‘European Battery Alliance’, Single Market Economy, December 2024.

15: Nationale Leitstelle Ladeinfrastruktur, ö-LIS report, December 2024.

16: Netherlands Enterprise Agency (RVO), Dashboard on charging infrastructure.

17: ICCT, ‘Charging up China’s transition to electric vehicles’, January 31st 2024.

18: Argus Media, ‘China’s EV charging infrastructure expands in August’, September 11th 2024.

19: European Environment Agency, ‘Fossil fuel subsidies in Europe’, January 29th 2025.

20: Sander Tordoir and Brad Setser, ‘How German industry can survive the second China shock’, CER policy brief, January 16th 2025.

21: Chad Bown, ‘How the United States solved South Korea’s problems with electric vehicle subsidies under the Inflation Reduction Act’, Peterson Institute for International Economics, July 26th 2023.

22: Ursula von der Leyen, ‘Europe’s choice. Political guidelines for the next European Commission 2024-2029’, July 18th 2024.

23: Sander Tordoir et al, ‘Draghi’s plan to rescue the European economy: Will EU leaders do whatever it takes?’, CER policy brief, September 17th 2024.

24: SolarPower Europe, ‘EU Solar Jobs Report 2024 – A solar workforce ready for stronger growth’, September 25th 2024.

25: Diederik Baazil, ‘Dutch invest €2.5 billion in Eindhoven to keep ASML at home’, Bloomberg, March 28th 2024.

26: John Springford and Sander Tordoir, ‘Europe can withstand American and Chinese subsidies for green tech’, CER policy brief, June 12th 2023.

27: Stine Jacobsen, ‘Trump’s halt on offshore wind power leases hits European companies’, Reuters, January 21st 2025.

28: Cristina Caffarra, ‘Joining competition policy with industrial and trade policy’, CEPR, November 8th 2024.

29: Airbus, ‘Orders and deliveries’, January 2024.

30: Elisabetta Cornago and Aslak Berg, ‘Learning from CBAM’s transitional phase: Early impacts on trade and climate efforts’, CER policy brief, December 3rd 2024.

31: Michele Della Vigna et al, ‘Carbonomics: The third American energy revolution’, Goldman Sachs, March 22nd 2023.

32: Lucas Guttenberg, Nils Redeker and Sander Tordoir, ‘Warum der Draghi Bericht eine Riesenchance für Deutschland ist’, Handelsblatt, September 17th 2024.

Sander Tordoir is chief economist and Elisabetta Cornago is a senior research fellow at the Centre for European Reform.

February 2025

View press release

Download full publication

Published with the support of the Heinrich-Böll-Stiftung European Union. The analysis and opinions expressed in this study reflect the views of the authors, and do not necessarily reflect the views of the Heinrich-Böll-Stiftung European Union.