Surviving Trump 2.0: What does the US election mean for Europe's economy?

- The EU-US economic relationship is the world’s largest – the value of traded goods and services is more than €1 trillion per year, and each is the other’s largest partner in both trade and investment. The EU has over time become increasingly dependent on the US to soak up its exports and mitigate the effect of austerity and stagnant European consumption. The bipartisan shift in the US towards protectionism and reindustrialisation therefore poses a huge challenge for the European economy.

- Kamala Harris’s selection as the Democratic candidate for President came as a relief to European leaders, since she may be more inclined than Donald Trump to take European interests into account. While Harris would not see the US trade deficit with the EU as a critical priority, Trump sees it as a similar problem to the US trade deficit with China. However, the race remains tight. Moreover, whether the US president is Harris or Trump will not fundamentally change the economic dilemmas facing EU leaders.

- Trump and Harris would both be tough on China. If the US applies more tariffs on China, that risks a larger volume of Chinese exports being dumped in Europe instead. In turn, that could force the EU to follow the US in increasing tariffs, raising the risks of an all-out trade war with China. The US may also directly increase pressure on the EU to reduce economic ties with Beijing.

- The EU is therefore likely to face, at best, a continuation of the status quo with both pressure from Washington and rising trade tension with Beijing. At worst, however, the EU may face significant new tariffs on its exports to the US – while at the same time being pulled by the US into a trade and technology war with China.

- Whoever wins, the EU should take the offensive and seek to not only defend existing trade ties, but boost transatlantic co-operation. To do so, the EU should:

- First, continue dialogue and close some of the regulatory gap between the EU and the US, for example through the EU-US Trade and Technology Council (TTC). Better aligned regulations would encourage more European firms to adopt US technologies, like cloud computing and AI, to help boost the EU’s stagnating productivity.

- Second, remain pragmatic. The EU should ensure that disputes which have political force in the US but are not macroeconomically significant – such as disputes around steel and aluminium – are contained and do not harm the broader relationship.

- Third, tackle the question of China. The EU should work productively with the US on issues of common concern when it comes to Chinese policy, such as intellectual property protection, industrial subsidies and macroeconomic imbalances, and develop a more unified economic security strategy.

- Fourth, tackle the most significant risks associated with a second Trump presidency, such as the threat of across-the-board tariffs on EU exports. The EU should adopt pragmatic solutions, and try to ensure any deals to avoid tariffs include realistic commitments on both sides to drop barriers to trade.

- Fifth, secure co-operation with other US allies to help ensure their collective interests are better taken into account in US policy-making. A strong coalition could help resist some of Trump’s most dangerous ideas, and persuade either Trump or Harris that respecting international law and open trade – at least with their allies – is not naïve but pragmatic.

- Sixth, focus on reducing vulnerability to both US and Chinese coercion, so the EU can continue to push for open trade – even when this runs against Washington’s preferences. Using trade policy to boost diversification – for example, by securing new trade deals with Mercosur and India – along with boosting domestic demand is the most viable way to reduce the EU’s foreign dependencies.

For Europe, the stakes are high in the US elections in November. The EU-US economic relationship is the world’s largest – the value of traded goods and services is more than €1 trillion per year, and each is the other’s largest partner in both trade and investment. The EU has over time become increasingly dependent on the US to soak up its exports. The US has long been the global consumer of last resort, absorbing production from both East Asia and Northern Europe.

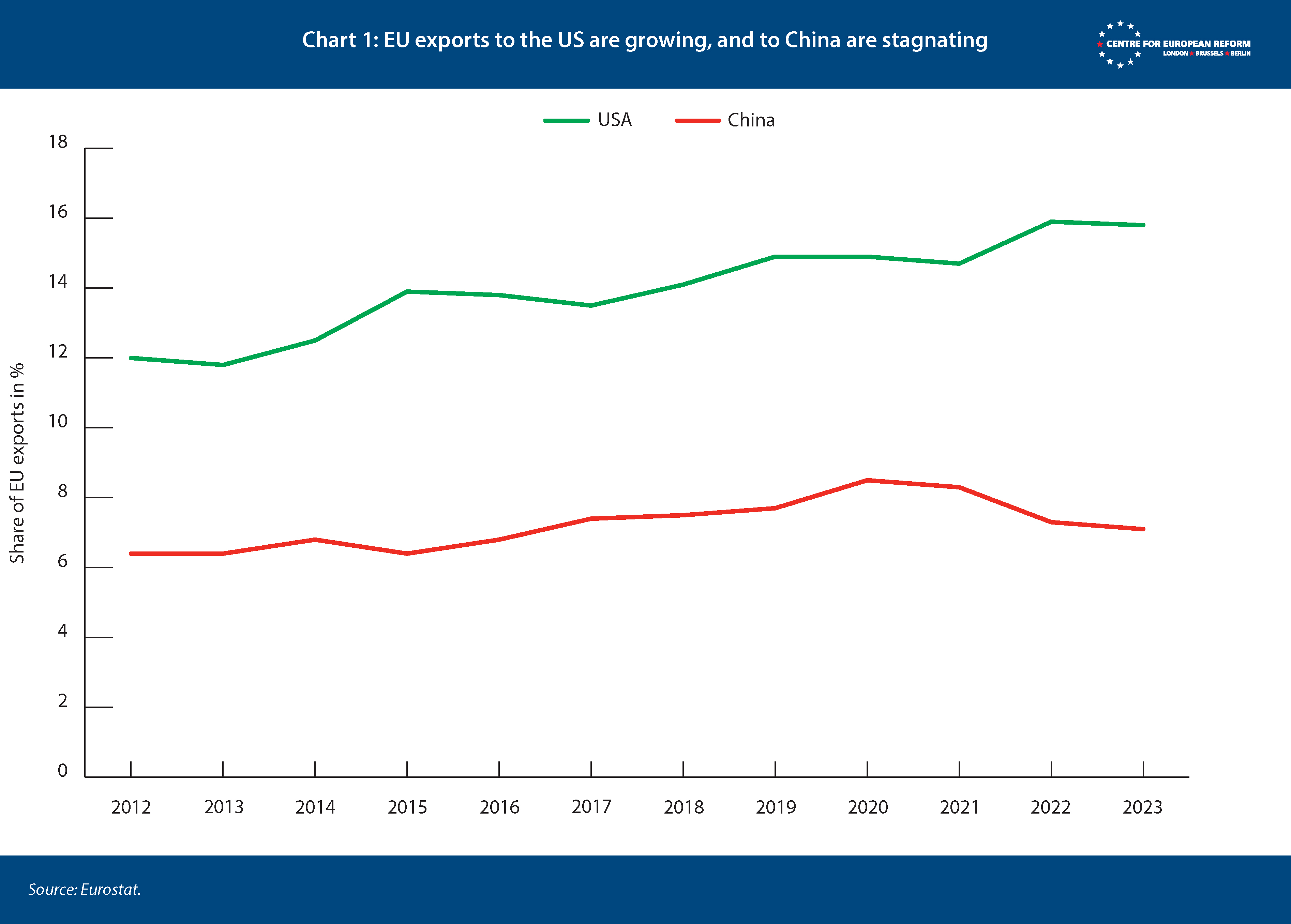

This role has become even more important to Europe for two reasons. First, China’s technological advancement, its repression of domestic demand, and local content requirements in its subsidy programs have caused Chinese imports of European products to stagnate. Second, the US has – with bipartisan support – started to reduce its trade with China, leaving an opening for European products. The US now absorbs 16 per cent of Euro area exports, up from 12 per cent in 2012 (Chart 1). A similar trend can be observed for services: the US absorbed 22 per cent of EU services exports in 2023, up from 18 per cent in 2014.

US economic policy therefore matters enormously for European economic growth. Rather than seeing economic growth as a competition – as Donald Trump seems likely to do if he returns to the White House – Brussels should recognise that strong US economic performance in the last decade helped mitigate the effects of austerity and stagnant consumption in Europe.

Until recently, Donald Trump’s re-election to the US presidency had seemed a foregone conclusion. Besides the security risks from a waning US commitment to Ukraine and NATO, for the EU, the economic consequences of a second Trump presidency would be enormous. Many of Trump’s stated policies would directly harm European economic interests, upset the global economic order on which the EU relies, and undermine European objectives in areas like climate change. Goldman Sachs estimates Trump’s policies could slice 1 per cent off Europe’s GDP.1

For the EU, President Joe Biden’s decision not to run for a second term therefore seemed like a lifeline. Kamala Harris has achieved quick successes at securing the Democratic nomination, boosting fundraising for the Democrats, and taking a narrow lead in most national polls.

Kamala Harris has achieved quick successes at securing the Democratic nomination but the EU must not become complacent.

It is too early for the EU to become complacent, however. First, the race in the crucial handful of swing states that will determine the election is still finely balanced. Second, even if Harris does win, her policies and views on economic and foreign policy are largely unknown. Third, while Harris would likely be more interested than Trump in transatlantic dialogue, both candidates have economic priorities which will put Europe in an awkward position – including getting tougher on China, and boosting US jobs in sectors sensitive to Europe, such as vehicle production. Neither Republicans nor Democrats have been overly interested in European economic interests when they conflict with their domestic political priorities.

The European Commission has set up a team of officials to consider how the EU will be impacted by either a Harris or a second Trump presidency. The team should not only be focused on protecting existing trade relations with the US, but also on boosting transatlantic co-operation. Tackling Europe’s economic priorities – such as boosting growth, delivering the green transition and improving economic security – will require trade and close co-operation with the US. Similarly, the US objectives of constraining China and reshoring manufacturing jobs will be much easier to achieve if America co-operates with Europe – which could help give European and US firms access to a larger market outside of China, enabling them to achieve larger economies of scale, more scope for specialisation, and the ability to benefit from each other’s inputs and supply chains.

At the same time, Europe must be realistic. There is no chance of reviving a grand EU-US trade agreement like the Transatlantic Trade and Investment Partnership (TTIP) negotiations that collapsed in 2016. Even the more modest EU-US Trade and Technology Council (TTC) launched under the Biden administration to promote transatlantic co-operation has had limited impact.2

We therefore propose the following priorities for Brussels to strengthen transatlantic relations in both a Trump and a Harris scenario:

- Continue dialogue to help avoid economic disputes with the US before they arise, and constructively engage with the US on issues of joint concern, such as China. Co-operation could lead to permanent solutions to ongoing political issues like subsidies for Airbus and Boeing and closer regulatory alignment on technology could boost take-up of innovation in Europe, helping to boost its flagging productivity.

- Acknowledge that domestic political imperatives mean that some tension is inevitable.

- Develop a plan for dealing with negative US policies under both Trump and Harris, including by boosting unity among European member-states so the EU can stand up for itself when necessary.

US-EU trade relations

The most alarming risk to the EU-US economic relationship comes from Trump’s trade policy. Trump proposes to impose tariffs of 10 to 20 per cent on all imports from anywhere in the world. It is unclear how seriously Europe should take this threat. On the one hand, in his first term Trump became fixated on US trade deficits, including with the EU, which does not bode well for transatlantic relations under a new Trump administration.

In other contexts, however, Trump has indicated that this is meant merely as a negotiating tactic. Furthermore, it is unclear whether the threat is credible. Many economists point out that the tariffs would likely lead to a stronger dollar – contradicting Trump’s stated desire to weaken the greenback, and proving counterproductive if the rationale is to reduce US imports.3 Tariffs also seem unlikely to boost US production, given the country already is near-full employment. Tariffs to exclude foreign suppliers also reduce domestic competition, which in turn will lower pressure for US firms to increase their productivity. Trump also cares greatly about the health of the US stock market – and many investors will oppose the idea of greater trade barriers. His policies are also likely to stoke inflation by raising the prices of foreign inputs, which could make him unpopular: high inflation seems to have been an important reason for Biden’s lack of popular approval.

From Trump’s point of view, the US trade deficit with the EU is a similar, albeit smaller, version of the US trade deficit with China.

Whether or not Trump actually imposes across-the-board tariffs, Harris and Trump’s trade priorities are very different from an EU perspective. A Harris administration would undoubtedly still put diplomatic pressure on the EU’s large trade surplus countries, especially Germany, to increase their domestic demand to bring down trade imbalances. But it is unlikely to see the US trade deficit with the EU as a major problem, much less a critical priority. From Trump’s point of view, however, the US trade deficit with the EU is economically speaking a similar, albeit smaller, version of the US trade deficit with China.

There is little doubt that Europe would more easily benefit from US growth under a Harris administration. Even though the Biden administration maintained the protectionist policies of the previous Trump administration and even strengthened some of them through reinforced “Buy American” mandates, he also sought to reduce conflict with the EU. For example, his administration applied the Inflation Reduction Act – a law which provides massive subsidies for electric vehicles which in most cases must be built in the US – in ways that enabled many European-made electric vehicles to qualify for subsidies. Biden also found temporary solutions to the long-running dispute about granting subsidies to aircraft manufacturers Boeing and Airbus and the steel and aluminium issue.4 Tariffs on steel and aluminium were initially imposed by Trump, ostensibly on national security grounds, which caused the EU and others to retaliate. Biden ultimately decided to temporarily dilute the issue by allowing substantial quotas of imports.

With a Harris administration, the EU can continue to play the card of being a reliable and democratic trade partner and can focus on developing ways to boost trade and investment further. For example, unlike Trump, a Harris administration would also seek to keep the US aligned with the EU on the fight against climate change, possibly further stoking US demand for EU-built cleantech products. If Trump wins, the EU needs to be prepared to divert Trump’s attention from the US trade and goods deficit with the EU and ensure that – if tariffs on all imports to the US are implemented – the EU is exempt, for example by offering enhanced co-operation on China.

The EU-US-China triangle

There is bipartisan consensus in Washington on the need to contain China. As the US increasingly sees China as a strategic and military threat, Washington has sought to limit China’s technological development in areas like semiconductor technology and artificial intelligence. Under Obama, the US largely tried to sway China to adjust its economic policies via diplomatic pressure. But frustrations with the lack of results mean a reversal to the diplomatic approach is unlikely. Trump aggressively imposed tariffs on Chinese goods and these tariffs were kept in place under Biden. But Biden moved from a policy of keeping Beijing a few generations of technology behind to trying to constrain China’s tech development as far as possible. In large part, the US has pursued these aims by imposing controls on exports of sensitive items to China and trying to persuade its allies to impose similar controls.

A more specific long-standing American concern is China’s impact on US industry. Chinese lack of consumption and industrial subsidies have led to what senior members of the Biden administration frequently refer to as an “overcapacity” with production being “untethered from global demand”.5 US administrations have also frequently accused China of manipulating the renminbi to boost exports. The Biden administration sees this as contributing to the decimation of US industry and a loss of American jobs. Biden kept most of the tariffs which Trump imposed on Chinese imports in his first term – and even added new tariffs on certain products. Harris is unlikely to take a different approach.

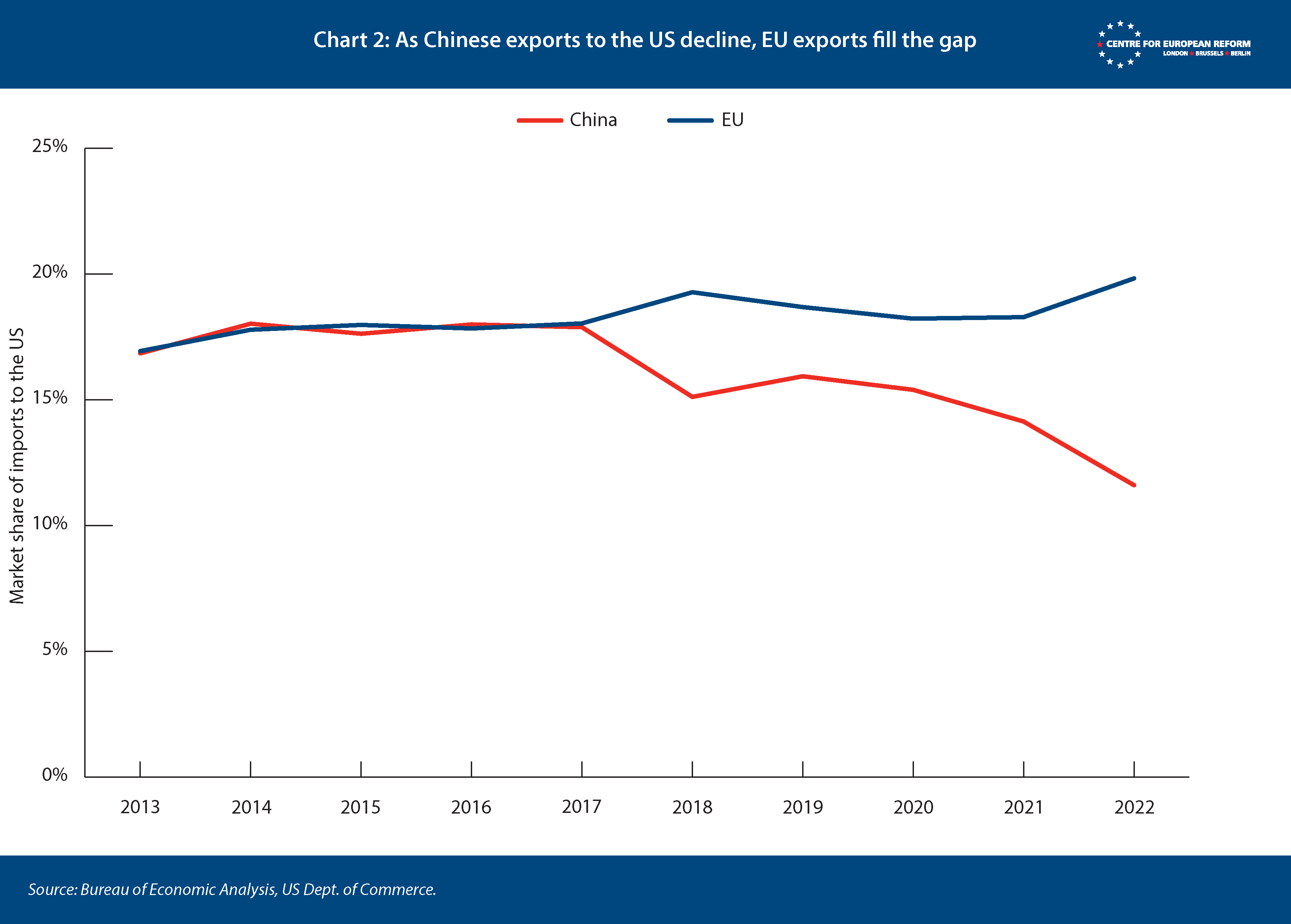

This turn in US trade policy has a two-pronged impact on the EU economy. First, as a major exporter, Europe stands to benefit from the shift in US trade away from China. China’s share of US imports has declined sharply in recent years. Although part of this is Chinese manufacturers shifting production abroad or channelling trade through third countries, the EU’s market share of US imports has risen substantially over the last decade. The dependency therefore is mutual: exports to the US help European growth, and the EU is a reliable and trusted source of imports to satiate the appetite of the consumer-driven US economy.

Second, given Europe’s open economy, which is much more trade-intensive than America’s, there is a significant risk of Europe becoming collateral damage in US-China economic rivalry. That is especially true if the US pressures Europe to go further in decoupling from China.

Unlike the US, the EU has not significantly reduced its trade links with China, particularly for imports. This partly reflects an internal conflict in the EU about how to tackle China. Some member-states see China as a strategic and commercial threat and want stronger action. The EU has around 30 million manufacturing jobs, so it now has far more to lose from China’s overcapacities and surging exports than the US does.6 The US has only around 13 million manufacturing jobs, and many are located in less exposed sectors like meat processing.7 Many of the larger EU members are also worried about national security and China’s domination of strategic industries, and recognise the need for tighter controls on investment and sensitive trade.

But they also understand that China is both an essential supplier to many European industries, that some European firms have made significant foreign investments in China which are vulnerable to any Chinese retaliation, and that the country remains a high-growth market. Moreover, cheap Chinese goods contribute to lower prices at a time when concerns about purchasing power run deep across Europe. On balance, these European countries are not averse to a stricter approach to China – France, for example, pushed hard for tariffs on Chinese electric vehicles – but still wish to ensure disputes with China are contained. As suggested in the Draghi report, the EU will have to be selective in its approach to China.8 There are sectors, like solar panels, where low-cost Chinese supply is essential to secure reliable and low-cost energy that Europe needs to fight high energy prices and for the green transition and where it is very unlikely tariffs could make European manufacturing competitive.

Writ large, Europe’s current approach – of piggybacking off the US without significantly reducing trade with China itself – has risks. Whoever the winner of the US election is, it is unclear whether Europe’s can continue to benefit from US growth without reducing trade with China itself.

Biden seemed – at least at times – to recognise that the US benefits greatly from increased trade with China.9 Parts of his administration therefore called for a “small yard with a high fence”: strict restrictions on trade in sectors of concern, but with most US-China trade unaffected. However, there have been significant differences within the Biden administration about how small the yard should be – and the yard has certainly been increasing over time.10

If Harris follows Biden in expanding tariffs to China, that risks a larger volume of Chinese exports being dumped in Europe instead. Trump has been even clearer about his willingness to escalate a trade war with China in order not just to reduce dependence on China but to eliminate the US-China bilateral trade deficit. He wants to impose a blanket 60 per cent tariff on Chinese imports, and the Republican party platform calls for phasing out imports of essential goods and blocking Chinese investment in the US. Such a course of action would put even more Chinese import pressure on European markets.

The EU has not fully emulated the US approach to China to limit the risk of escalation.

In turn, that could force the EU to follow the US in increasing tariffs, raising the risks of an all-out trade war with China. So far, the EU has tried to avoid adopting policies which fully emulate the US approach. For example, the EU’s proposed tariffs on electric vehicles are not nearly as high as those in the US. The EU wants to preserve the international trade order and the World Trade Organisation (WTO), under which countries cannot unilaterally increase tariffs without good cause. This helps limit the risk of escalation: Chinese threats of retaliation in relation to new European tariffs on electric vehicles have been relatively mild. The consequence, however, is that Europe has only bought breathing space for its car manufacturers without fully stemming the tide of Chinese electric vehicles.

The US might also directly increase pressure on Europe to decouple from China. While the Biden administration has followed Trump by pressuring European countries to remove Chinese equipment from 5G networks, it has tolerated countries like Germany taking a slow and piecemeal approach. Biden also pressured Europe to adopt similar export controls to the US in sensitive sectors such as semiconductors. However, his administration has made an effort to secure agreement rather than rely extensively on secondary sanctions, which directly prohibit European companies that rely on US inputs from doing business with China. In some cases, Biden has even backed off when European countries strenuously objected to requests that Europe tighten its export controls. Harris might well be less accommodating and might be happier to threaten to use secondary sanctions to coerce Europe into adopting the same policies on China. There is little sign Trump would care about European sensitivities and he might be even more willing to impose secondary sanctions. However, Trump has sometimes taken surprising positions despite his anti-China views: for example, he opposed the forced divestiture of TikTok in the US from its Chinese owner, despite broad bipartisan consensus for the law.

Of course, if tariffs succeed at convincing China to change its economic model, that would mitigate the dilemma for Europe. This would require China to boost domestic consumption, reduce household savings, increase salaries and increase imports. But there has been little sign so far of Chinese leaders being willing to reconsider its propensity for overproduction.11 Under either president, increasing US coercion or secondary sanctions would instead negatively affect Europe economically – by potentially forcing European firms to halt operations in China, reducing European firms’ exports to China and convincing European governments to stop Chinese investments in Europe. The latter would be particularly damaging given that, in response to China taking the technological lead in sectors like electric vehicles, many European countries are now trying to actively encourage Chinese investment in Europe.

Stronger export controls similarly pose risks to the prospects of some of the EU’s technological leaders like Netherlands-based semiconductor company ASML, which export to China and see it as a large potential growth market. In Europe, export controls currently are implemented at the member-state level, and US pressure has specifically targeted the Netherlands (though increasingly other EU countries too). Europe has also taken a ‘middle road’ approach on this issue: European governments have often accepted US pressure and aligned with Washington in part, while pushing back on some of its demands. It would help to move as many decisions as possible to the European level to reduce Washington’s ability to pressure member states individually. But the political obstacles for such a move are high. Member-states are reticent to give up national control, and they will need to unanimously agree to vest such powers in Brussels instead.

A central difference between the US and EU approach to China is that the EU is adamant about staying within WTO law to uphold the multilateral trade system. The US, on the other hand, has de facto exempted itself from WTO regulations and seems increasingly keen on developing a ‘NATO for trade’: a club of like-minded countries that would exclude China and other actors deemed hostile. While Europe will not easily abandon the WTO, the EU will have to find more flexible ways to square maintaining WTO adherence with good relations with the US. Politically sensitive issues like EU-US trade in steel and aluminium have not been definitively resolved yet.

The EU and US could progress discussions by focusing instead on areas that are less strictly regulated by WTO law such as regulatory policy and aligning restrictions on China that can be plausibly motivated by national security. To the extent the US wants a regulatory NATO, there could be transatlantic agreements on issues like regulation of AI, or the design of subsidies in sectors like electric vehicles. Such a subsidy scheme could be non-discriminatory but still exclude China from decision-making and perhaps even market access if China is unable or unwilling to comply.

A positive agenda for EU and US trade and regulatory co-operation

Whoever wins, the EU should take the offensive and seek to not only defend existing trade ties, but boost transatlantic co-operation. There are compelling reasons for Europe to pursue closer engagement, in order to help tackle Europe’s economic priorities – such as boosting growth, delivering the green transition and improving economic security.

Focusing on converging US-EU tech regulation would be a wise economic policy move for Europe.

The best way Europe could continue to piggy-back off US economic strength, and its bipartisan policy of de-risking from China, is to further boost transatlantic trade and investment. However, there is no chance of securing a comprehensive trade agreement between the EU and the US. Previous attempts at comprehensive economic co-operation – such as the 1995 New Transatlantic Agenda and 2007 Transatlantic Economic Council – delivered only modest results. In 2013, the Obama administration tried to secure a more comprehensive deal, the Trans-Atlantic Trade and Investment Partnership (TTIP). However, these talks dissolved into debates over politically explosive issues like the potential for US chlorinated chicken to enter the EU single market. Trump showed no interest in reviving the TTIP talks, and since then the US opposition to new free trade agreements has hardened. Biden instead adopted a more modest forum, the Trade and Technology Council (TTC). Even the TTC has been criticised for achieving little by way of concrete reductions in trade barriers – instead focusing primarily on discussing regulation of technology.12

Focusing on converging US-EU tech regulation would be a wise economic policy move for Europe. EU economic growth has been stymied by Europe’s low productivity growth. With an aging population and growing hostility to immigration, greater use of technology to boost productivity will be essential. Given the US strength in the ICT sector, that will invariably require Europe to increase its imports of US technology services like cloud computing.

However, European firms’ willingness to use these types of technologies has been stymied by uncertainty about whether and how they can meet EU standards in areas like data protection, since the US has left the digital sector largely unregulated (though that began to change under Biden). Furthermore, US law enforcement and intelligence gathering practices have sometimes been inconsistent with fundamental rights under EU law. This misalignment has undoubtedly been a significant barrier to greater digitalisation in Europe.

The TTC has potential to help address this problem. It boosted personal relationships between EU and US leaders, which helped immensely in the parallel negotiations to improve the protection of Europeans’ personal data in the US – which ultimately led to the restoration of free data flows between the EU and the US.13 In the future, the TTC could help tackle remaining problems: for example, European firms using US cloud computing companies run into the risk that American law enforcement might obtain access to European data in ways that do not meet the standards set by European data protection laws. This issue has fuelled calls among some EU member-states to make US cloud computing companies ineligible to obtain certain cybersecurity accreditations.14

Regulation of emerging technology is also a more promising area of co-operation than regulation of other sectors. The EU and US have achieved mutual recognition in areas like aircraft safety certification and some financial services. However, these efforts were relatively painstaking to achieve. Co-operation might be easier in areas where both sides’ regulatory regimes are less well developed. The main barrier is that tech regulation has been almost entirely led by Brussels. The EU law-making institutions are shaping proposed laws without much taking US sensitivities into account. Conversely, the US has been unable to pass federal laws covering digital antitrust, data protection, artificial intelligence, or online safety even when doing so would boost transatlantic trade. However, the TTC has already helped bridge some of these differences. There has been relatively close engagement on the development of AI regulation, for example, even though in the US this has progressed through presidential executive orders rather than legislation. And the US Trade Representative no longer highlights many EU tech laws as being discriminatory trade barriers.15

There is some speculation that Harris is close to technology companies and may roll back Biden’s efforts to help bridge the gap between the EU’s rights-based approach to digital law-making and US techno-libertarianism. Such renewed regulatory divergences could harm European efforts to digitise, constraining European growth. But a second Trump presidency would clearly pose much greater risks. Republicans have toned down criticisms of the US tech giants, and Trump has signalled openness to ease immigration for tech talent. In turn, some large tech firms have sought to grow closer to Trump. Trump has promised to repeal the presidential executive orders regulating AI – the one area where the EU and US had seemed to achieve a degree of alignment. And many commentators believe a second Trump administration would take a laxer approach to tech mergers and anti-trust measures, contrary to efforts by US and EU leaders to boost digital competition.16

A European strategy to improving transatlantic economic relations

Whatever the outcome of the US election, America will be a difficult partner for the EU. The EU is likely to face, at best, a continuation of the status quo where the US is focused on domestic job creation and reducing its dependency on China, with European economic interests featuring as an afterthought. At worst, however, the EU may face significant new tariffs on its exports to the US – while at the same time being pulled by the US into a trade and technology war with China. How should the EU respond?

The EU should ensure small disputes are contained without harming the broader transatlantic relationship.

First, Brussels knows that the US is an indispensable partner, on whom the European economy and its military security depends. The EU must therefore do its best to maintain avenues for dialogue and co-operation which could boost transatlantic trade and investment. While the EU-US TTC may have failed to deliver headline-grabbing wins, it helped align EU and US approaches to AI regulation. The body could play an important future role in resolving ongoing data protection issues which make some European firms reluctant to use US tech services, limiting the EU’s productivity growth. While Harris will likely be willing to continue the TTC, its future under Trump is less certain. But the TTC’s rather low-key and technocratic nature, might prove to be an advantage – providing some scope for more transatlantic-minded members of a second Trump administration to continue with it under the radar in some form.

Second, the EU should acknowledge that bugbears in the relationship are inevitable and understandable since both sides have domestic political priorities. Even if they grab headlines, many of these disputes are not macroeconomically significant, such as disputes around steel and aluminium where US-EU is trade is limited. The EU should remain pragmatic and ensure these relatively small disputes are contained without harming the broader relationship.

Third, the EU needs to tackle the big China question which will arise under both Harris and Trump. Can the EU enjoy the benefits of the US reducing its economic ties with China – which has boosted EU exports to the US – without taking more meaningful steps to de-risk from China itself? Both Trump and Harris will undoubtedly pressure the EU to do more to de-risk, potentially by threatening the EU with much stronger sticks like secondary sanctions. The recent EU economic security strategy proposed incremental reforms while keeping control over issues like some export controls and investment screening in EU capitals. There is also a degree of incoherence in the strategy. For example, while some EU member-states want to promote inward Chinese investment in sectors like electric vehicles, the EU’s Foreign Subsidies Regulation (FSR) make that a risky proposition. Under the FSR, the Commission may force foreign firms to divest assets if it finds that these firms benefit from foreign subsidies which distort competition in the EU. A more unified approach would help the EU identify and defend its strategic interests, rather than having approaches to economic security be determined based on national interests. The EU can and should productively work with the US on issues of common concern when it comes to Chinese policy, such as intellectual property protection, industrial subsidies and macroeconomic imbalances.

Fourth, the EU needs a plan to tackle the most significant risks associated with a second Trump presidency, such as the threat of across-the-board tariffs on EU exports. Trump proved amenable to symbolic deals in his first administration and might prove willing to do so again. This co-operative approach may prove less risky than escalating the dispute, for example by deploying the EU’s Anti-coercion Instrument, which gives Brussels the ability to launch countermeasures against a coercive country, such as restrictions on trade and investment. The EU could reach an agreement to purchase more from the US along the lines of the deal Juncker reached with Trump in 2018 that gave Trump a symbolic victory without substantial concessions. Another model could be China’s 2020 agreement with the US to purchase $200 billion of additional US exports. It is unclear how such an agreement can be complied with, since the value of bilateral trade is not directly in the EU’s control. China bought none of the imports it promised in its 2020 deal.17 But the deal was enough to give Trump a positive headline. It could even have positive results for the EU and US if it was coupled with more politically realistic commitments on both sides to drop barriers to trade.

Conclusion

To tackle the tough negotiations any future US president will demand, the EU will need to ensure it is in as strong a position as possible. The prospect of more tense transatlantic relations should encourage the EU to address the reasons why its economic size has been shrinking relative to the US economy. This will require the EU to maintain an active free trade agenda, even if that contradicts US preferences. But it will also require the EU to look at domestic sources for growth such as increasing consumption in countries like Germany where it is currently subdued; to enhance efficiency and help European firms build scale by deepening and broadening the single market; and to unlock more private investment for high-growth sectors.

The EU must reduce its vulnerabilities to both US and Chinese coercion, so it can push for more open trade.

To boost its leverage, the EU should also reach out and secure co-operation with third countries like the UK, Japan and Korea that, like the EU, are American allies. A united front could help ensure their interests are better taken into account in US policy-making. In particular, a strong coalition could help resist some of Trump’s most dangerous ideas, and persuade either Trump or Harris that respecting international law and open trade – at least with their allies – is not naïve but pragmatic.

There are many non-aligned countries that the West will need to attract if it wants to sideline China. These smaller countries desperately want to preserve the international trading order. Brussels should aim to convince the next US president that a more multilateral approach would be both less economically damaging for the US and its allies – but would also be a more effective way to contain the threats posed by China. This may require the EU to revisit its own trade policies, for example traceability requirements connected to sustainability and CBAM, which are now imposing more and more demands on trading partners rather than incentivising improved reciprocal market access. As the relative size of the European economy shrinks, the EU will increasingly lack the power to burden trade partners with too many social or ecological conditions and the cost to its own economy will grow.

Finally, the EU should focus on reducing its vulnerabilities to both US and Chinese coercion, so that it can continue to push for both open trade while protecting its strategic interests. In a few cases this may mean reducing dependencies and develop domestic production: for example, investing in renewables will help the EU reduce its dependency on foreign gas. In some cases, EU firms in areas that could be subject to US secondary sanctions should start at least planning for how to divest from US inputs. However, in most cases trying to fully decouple even limited supply chains from either the US or China would be expensive, complex, and take a very long time to achieve. Using trade policy to boost diversification – for example, by securing new trade deals with countries such as Mercosur and India – along with boosting domestic demand is a better approach.

2: Luca Bertuzzi, ‘Transatlantic tech summit postponed as platform loses steam’, Euractiv, November 30th 2023.

3: Erica York, ‘Tariff Tracker: Tracking the economic impact of the Trump-Biden tariffs’, Tax Foundation, June 26th 2024.

4: Uri Dadush, ‘What to make of the EU-US deal on steel and aluminium?’, Bruegel, November 4th 2021.

5: US Treasury, ‘Remarks by Under Secretary for International Affairs Jay Shambaugh on Chinese overcapacity and the global economy’, July 10th 2024.

6: Sander Tordoir, ‘Chinese exports threaten Europe even more than the US’, Politico, June 7th 2024.

7: Reserve Bank of St Louis economic data.

8: Mario Draghi, ‘The Future of EU Competitiveness’, September 2024.

9: Anshu Siripurapu and Noah Berman, ‘The contentious US-China trade relationship’, Council on Foreign Relations, May 14th 2024.

10: Sander Tordoir and Zach Meyers, ‘Can the EU hold back the great tech decoupling?’, CER insight, May 3rd 2024.

11: Zongyuan Zoe Liu, ‘China’s real economic crisis: Why Beijing won’t give up on a failing model’, Foreign Affairs, September/October 2024.

12: Frances Burwell and Andrea G. Rodríguez, ‘The US-EU Trade and Technology Council: Assessing the record on data and technology issues’, Atlantic Council, April 20th 2023.

13: White House, ‘United States and European Commission announce transatlantic data privacy framework’, March 25th 2022.

14: Zach Meyers, ‘Can the EU afford to drive out American cloud services?’, CER insight, March 2nd 2023.

15: USTR, ‘National trade estimate report on foreign trade barriers’, 2024.

16: This is not a foregone conclusion, however: JD Vance has been a surprising supporter of Lina Khan, chair of the Federal Trade Commission, who has led a series of antitrust actions against large tech firms.

17: Chad Brown, ‘China bought none of the extra $200 billion of US exports in Trump’s trade deal’, PIIE, July 19th 2022.

Aslak Berg is a research fellow and Zach Meyers is assistant director at the Centre for European Reform.

October 2024

This policy brief was written thanks to generous support from Amazon. The views are those of the authors alone.

View press release

Download full publication