Learning from CBAM's transitional phase: Early impacts on trade and climate efforts

- The EU applies a carbon price to its heavy industry through its Emissions Trading System (EU ETS). To prevent carbon leakage – the flight of carbon-intensive industry away from the EU and towards countries with looser environmental regulation – the EU so far has opted to largely exempt its heavy industry from the ETS carbon price.

- The introduction of the Carbon Border Adjustment Mechanism (CBAM) changes the EU’s strategy by applying carbon pricing both to domestic production and to foreign producers who sell in the EU, which allows it to level the playing field. CBAM applies to importers of a subset of goods from outside the EU: iron and steel, cement, aluminium, fertilisers, electricity and hydrogen.

- CBAM has already been imposing carbon accounting and reporting duties on these goods since October 2023. These are administratively burdensome, but one year after their introduction, CBAM has not had visible impacts on trade flows. Producers are absorbing these administrative costs, and they continue to trade with the EU. At the same time, CBAM has already encouraged other countries to implement their own carbon price systems or adjustment mechanisms.

- Starting in 2026, importers of CBAM goods will have to pay a carbon price aligned with the EU ETS one. This will push foreign producers to focus on limited exports of ‘cleaner’, lower-carbon products towards the EU, redirecting more carbon intensive ones elsewhere. Emissions would not decrease immediately and global markets of CBAM goods may split between low-carbon and high-carbon goods – at least until the former become more competitive globally. But in the longer term, there will be more momentum to decarbonise production of CBAM goods, leading to cleaner exports towards the EU and generally lower industrial emissions.

- CBAM is a climate policy tool with trade implications. This hybrid nature has irked many of the EU’s trade partners: their main criticism is that CBAM is discriminatory, privileging countries that choose carbon pricing over other decarbonisation policies. It also imposes a relatively heavier cost on producers with more carbon-intensive processes, which tend to be in developing countries. Some countries, including China and India, have threatened to file WTO complaints against CBAM, though the EU remains adamant that the policy is WTO-compliant.

- The countries most affected by CBAM will be those countries that export a high volume of carbon intensive goods to the EU and do not apply a domestic carbon price. Many are large economies, mostly in the high- or middle-income category: China, Russia, Türkiye, the UK, the US. These countries have the means to adapt to CBAM – implementing or strengthening their own carbon pricing system (like China, Türkiye and the UK), subsidising industrial decarbonisation (like the US has been doing with the Inflation Reduction Act) or merely absorbing the loss (in the case of Russia).

- However, there are also large economies that will be affected by CBAM and may need additional EU support in adapting their industry to a net zero future – such as India, Vietnam, Brazil and Ukraine. And while smaller lower-income countries make up a smaller share of overall EU imports, CBAM-affected goods may be important sectors for their economy – as in the case of Mozambique or Zimbabwe.

- The EU should listen to developing countries and reconsider ways to lessen CBAM’s impact on them. It should make use of CBAM revenues to fund policies for technology transfer and decarbonisation support for least developed and developing countries. Additionally, the EU should reconsider exempting from CBAM (at least temporarily) least developed countries, as well as Ukraine, which is under attack from Russia.

- The EU needs to engage with its trade partners to support countries that want to adopt carbon pricing systems, helping them design and implement such systems. Countries that have carbon pricing in place, such as the UK, should seek bilateral deals with the EU to be exempted from CBAM and avoid its red tape. This may require those countries to negotiate with the EU to link their emissions trading systems with the EU ETS.

- The EU cannot simply focus on clean industrial policy at home and not lead the industrial revolution abroad: the Commission should make concrete support for industrial decarbonisation, from financial support to technology transfer, a key part of its climate diplomacy and external investment strategy.

The von der Leyen Commission approved over a dozen climate policy proposals in its first term, as part of the ‘Fit for 55’ package that was designed to deliver on the EU’s 2030 emissions targets. The new policies largely strengthened existing ones – for example, some reforms increased renewables and energy efficiency investments and expanded the EU Emissions Trading System, or EU ETS, to cover maritime transport. But the Carbon Border Adjustment Mechanism, or CBAM, broke new ground.

The CBAM is the EU’s attempt to ‘level the playing field’ between carbon-intensive goods that are produced in the EU and those produced elsewhere. The EU applies a carbon price to such goods via its ETS. However, in a world where producers outside the EU face lower carbon prices or none at all, carbon pricing disadvantages those that produce in the EU. This may lead producers to move their production outside the EU (an effect called ‘carbon leakage’). To avoid this risk, which comes with the threat of deindustrialisation, the EU has granted heavy industry free emissions allowances, meaning these producers have been largely exempt from carbon pricing so far. This has mitigated the risk of carbon leakage. At the same time, this approach weakens decarbonisation incentives for European industry, and means the EU foregoes substantial revenues, estimated at €331 billion between 2023 and 2033.1

CBAM is part of the EU’s strategy to withdraw free allowances, gradually exposing its heavy industry to a carbon price to accelerate decarbonisation, while exposing foreign producers of the same goods to the same price. As the name suggests, importers of selected goods from outside the EU must pay a fee aligned with the price of carbon emissions in the EU ETS and proportional to the carbon emissions embedded in imports. CBAM applies to a few goods which, in the EU, are subject to carbon pricing: cement, iron and steel, aluminium, fertilisers, electricity and hydrogen. With the exception of electricity and hydrogen, all other CBAM goods today benefit from (largely) free carbon emissions allowances, so implementing CBAM would let policy-makers remove free allocations while still addressing the risk of carbon leakage.

CBAM was enacted in October 2023, and it is now in a transitional phase: importers are required to declare the quantity and emissions embedded in imported goods, but do not yet have to pay a fee. The focus is on direct emissions from production, and, for a subset of goods, on indirect emissions from electricity consumed during production. Currently, the aim is to help importers become familiar with the CBAM bureaucracy, including its reporting requirements and carbon accounting methodologies. At the same time, the transitional phase allows the Commission to observe implementation, gather feedback and correct problems if necessary. From January 2026, importers will need to purchase CBAM allowances by paying a carbon price aligned with the EU ETS.

Reactions of the EU’s trade partners to CBAM’s introduction have not been particularly positive. Some, including China, have labelled CBAM as a protectionist measure.2 At the WTO, some have expressed concerns about CBAM’s potential to create trade barriers and discriminate against certain countries, both because of onerous reporting requirements and because European producers have been granted free emission allowances that will only be phased out gradually. India has threatened to file a complaint to the WTO,3 as has South Africa.4

The administrative impact of CBAM is already being felt by EU importers and by their suppliers.

The EU is confident that CBAM is compatible with WTO law. It is designed to be non-discriminatory, applying to all imports regardless of origin. The EU also emphasises that the CBAM is a border adjustment mechanism based on its domestic carbon price, not a traditional tariff: technically this is true, though economically, CBAM results in a fee raised at the border. CBAM’s gradual phase-in aims to help trade to adjust.

Some countries have also criticised CBAM for the opposite reason – that is, for being too non-discriminatory. The Paris Agreement talks about the principle of ‘common, but differentiated responsibilities’, meaning that developed countries should assume greater responsibility for solving the climate crisis. This principle asserts that governments should design their own path to decarbonisation through their climate plans (or Nationally Determined Contributions). These reflect their policy preferences (for example, some may favour carbon pricing and others regulation or subsidies), and their emissions profile, which will vary according to which sectors of the economy are the largest emitters. By treating imports from poorer and richer countries in the same way, through the application of the same carbon price, CBAM is compliant with WTO law, but arguably at odds with the burden-sharing principle.

Other countries decry its administrative complexity, as CBAM reporting requires carbon emissions accounting that businesses need not undergo otherwise. And some, for instance in the US,5 disagree with CBAM focussing on the need to level the playing field relative to carbon pricing without recognizing that other climate policies involve implicit costs for businesses too.

The Commission has tried to communicate openness to feedback and a willingness to adjust CBAM if necessary, which makes the transitional phase all the more important.

What do we expect from CBAM?

While CBAM payments will not kick in until 2026, the administrative impact of CBAM is already being felt by EU importers, and by the producers they source goods from. Importers need to comply with reporting obligations and to familiarise themselves with carbon accounting rules. Whether the added administrative burden alone is going to lead some importers to stop sourcing some goods from outside the EU is an open question.

Once foreign producers are exposed to a CBAM carbon price, they may react in different ways:

Stasis: Continue trading with the EU as usual, without altering production processes nor prices. In this scenario, producers would absorb the cost associated with CBAM fees without transferring it onto their customers, leaving prices unchanged. This is possible for producers that export a relatively small share of their goods to the EU, allowing them to spread the extra cost of CBAM on their full production.

Change in trade patterns, not in production patterns: Redirecting their ‘cleaner’ products towards the EU at a price premium while exporting their more carbon intensive goods to other destinations. This practice, called resource shuffling, aims to reduce a producer’s CBAM burden without cutting production or entirely decarbonising their production patterns.

More clean investment: Investing in green production to reduce their goods’ carbon intensity and continue exporting to the EU. While these producers would not avoid CBAM entirely – reporting duties would still hold for low-carbon goods – they would be subject to lower CBAM fees thanks to their goods’ lower carbon intensity.

The likelihood of each scenario depends on a range of factors: the specific sector, the competitive advantage of the producer vis-à-vis its European counterparts, and the added cost of CBAM.

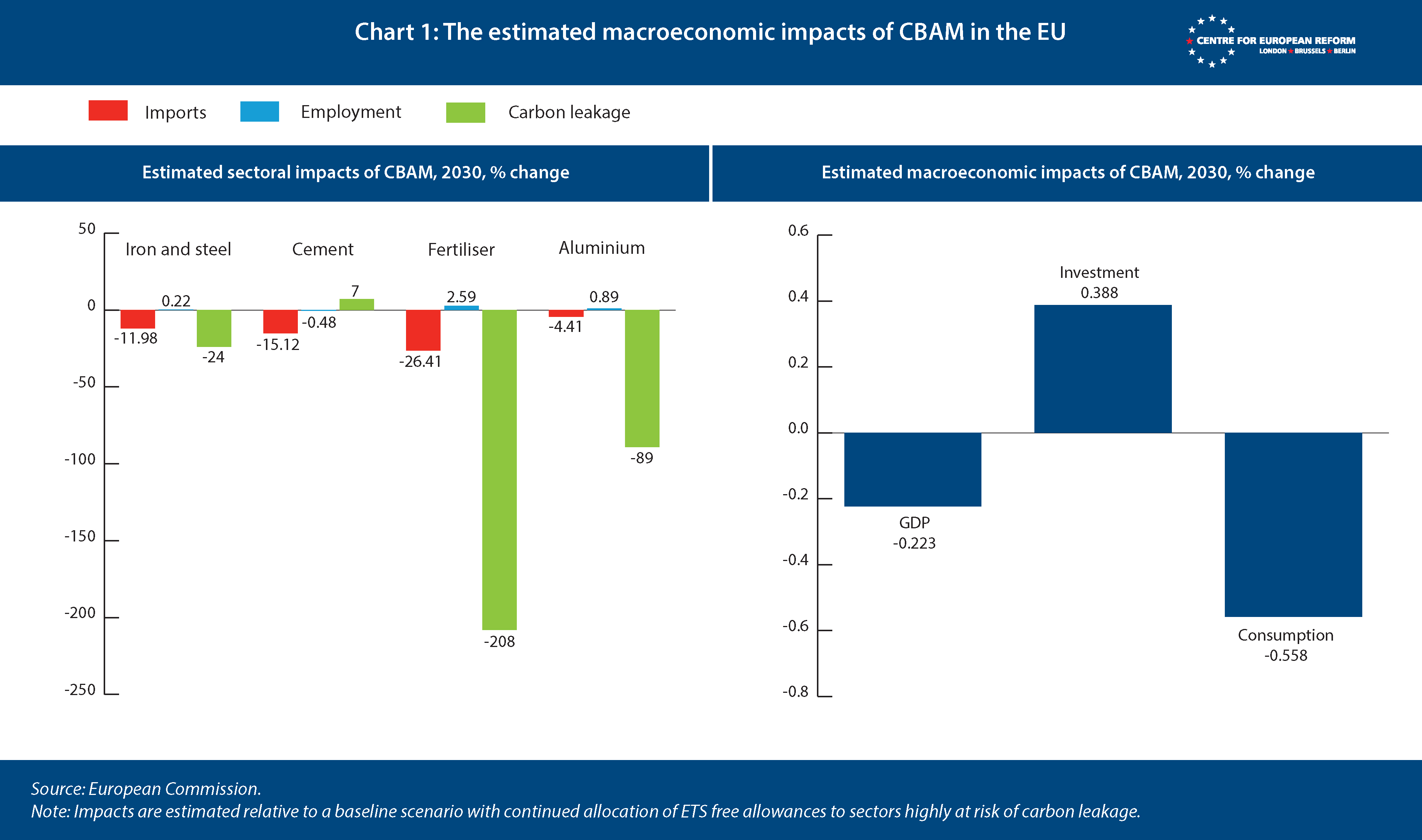

In the longer term, CBAM will affect trade flows and production patterns, and have systemic impacts on the European economy and on the economy of its trade partners. While the macroeconomic impact for Europe is small, the sectoral repercussions will be substantial – particularly as imports of CBAM goods will contract. As illustrated in Chart 1, the European Commission estimated that by 2030, CBAM will lead to a contraction of EU GDP by 0.22 per cent – a meaningful but smaller drop than under the baseline scenario of continued free allocation of ETS allowances. CBAM is estimated to reduce EU imports of CBAM goods by between 4 per cent (for aluminium) and 26 per cent (for fertiliser).

This would cause a small uptick in employment in CBAM sectors in the EU, except for cement. Carbon leakage, measured as the ratio between the increase in sectoral emissions outside the EU and the drop in emissions in the same sector in the EU, is estimated to drop substantially, particularly for fertiliser.

The flipside to this is that CBAM will encourage shifts in trade flows that favour countries where heavy industry is already more carbon efficient, and that have the fiscal space to subsidise decarbonisation efforts – namely, developed countries. A case in point is the United States, which has boosted public support for investment in green industry with the Inflation Reduction Act. With CBAM in place, developing countries, which lack these fiscal means and house more carbon intensive industries, will face a drop in real income.6

To keep climate diplomacy afloat, the EU needs to provide tangible support to developing countries for industrial decarbonisation.

While business responses to CBAM fees may be visible in trade flows relatively quickly, policy responses by the EU’s trading partners may take more time. Some countries, including Türkiye and Brazil, are considering introducing domestic carbon pricing systems to reduce the CBAM exposure of their businesses, and to retain carbon pricing revenues ‘at home’ instead of seeing them flow to the EU.

The following sections aim to shed light on the early impacts of CBAM, and on the policy responses it has prompted abroad in the trade and in the climate sphere. It does so by building upon three case studies – the iron and steel sector, which is the largest global industry facing CBAM charges, and the cases of Brazil and India, both large exporters of steel to the EU.

As the European Commission prepares for the first revision and possible expansion of CBAM, we suggest that it supports its developing trade partners in decarbonising their industry – through policy advice, technology transfer and financial support funded through CBAM revenues. If the Union is serious about its climate leadership role, it needs to provide tangible support to developing countries for industrial decarbonisation – above all if it wishes to keep climate diplomacy afloat.

Early CBAM impacts

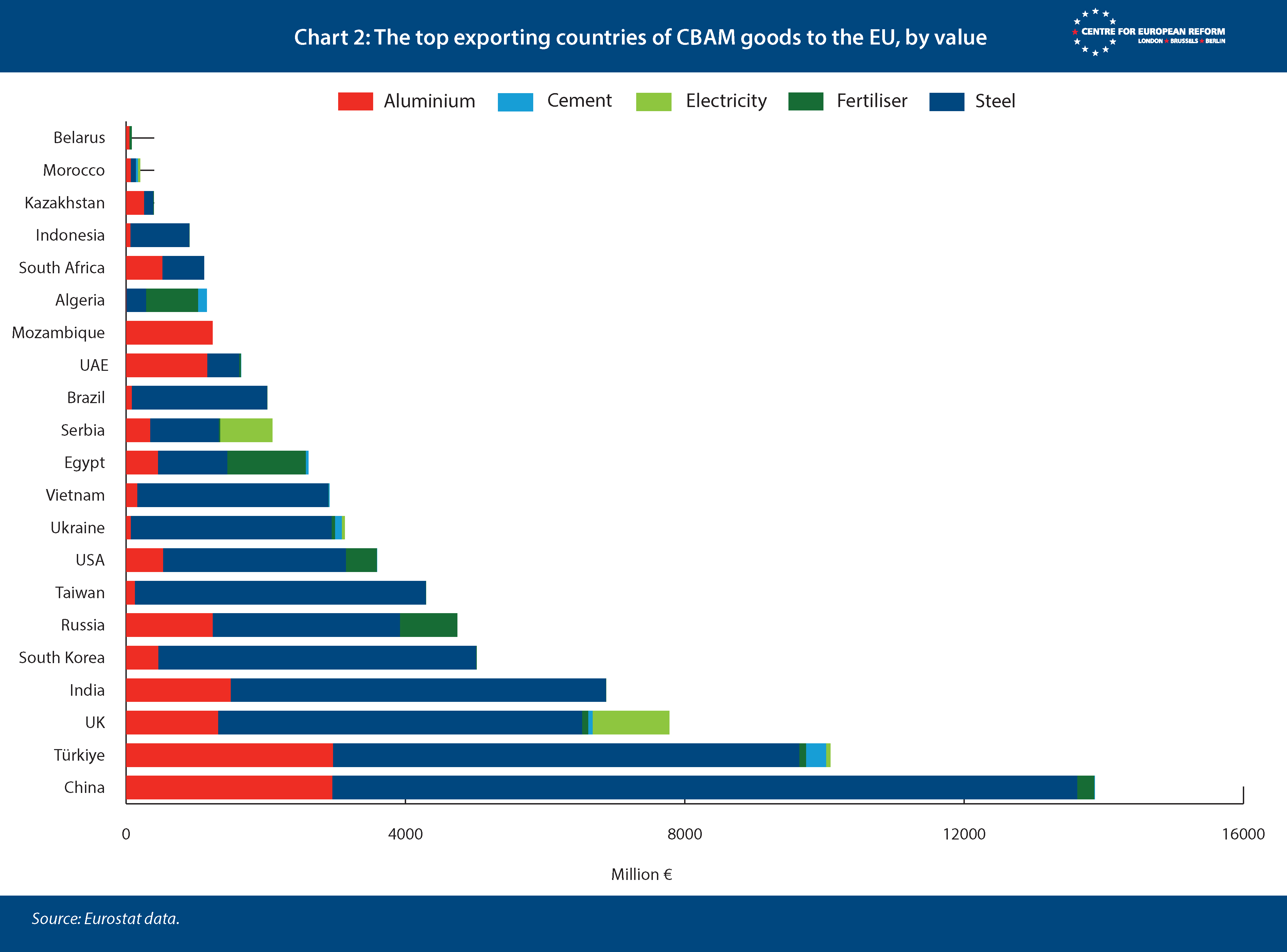

In terms of overall value of exports of CBAM-subject goods to the EU, the countries that will be hardest hit are large economies, mostly in the high- or middle-income category: China, Türkiye, Russia, the UK, the US (Chart 2). These countries have the means to adapt to CBAM – implementing or strengthening their own carbon pricing system (like China, Türkiye and the UK), subsidising industrial decarbonisation (like the US has been doing with the Inflation Reduction Act) or merely absorbing the loss (in the case of Russia).

But observing the ranking of top exporters of these goods to the EU, we also see large economies that may need additional support from the EU in upgrading their heavy industry towards a net zero future – for example India and Vietnam, Brazil and Ukraine. And while smaller lower income countries take up a smaller share of overall EU imports, CBAM goods may be important sectors for their economy, as in the case of Mozambique or Zimbabwe. These countries are rightfully concerned, and the EU should concretely support them in decarbonising their industry to retain their export capacity.

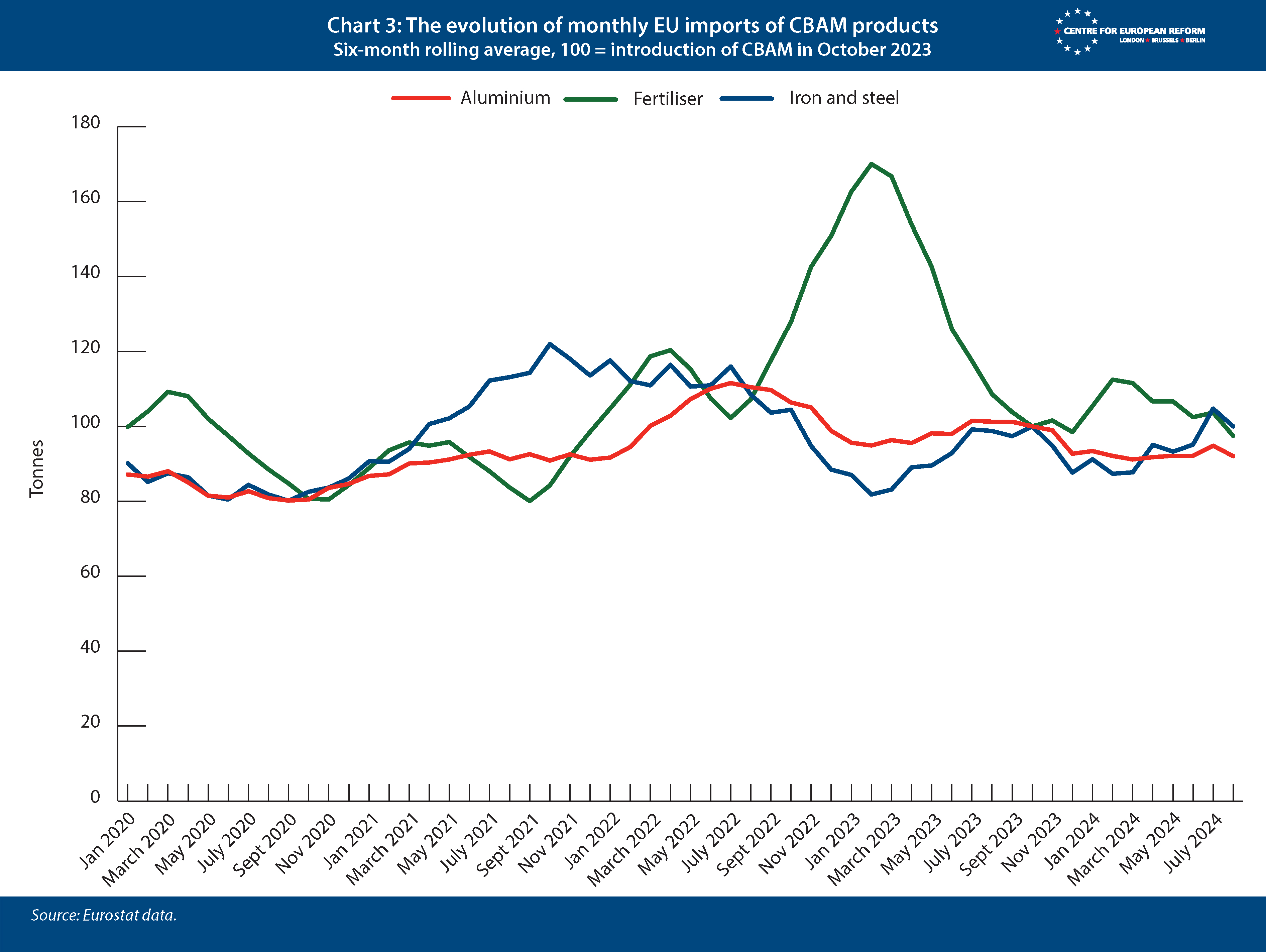

But these perspectives have not yet materialised: since its implementation in October 2023, CBAM has not caused any discernible changes in imports of affected goods. This does not mean that the worries of our trade partners should be dismissed, just that trade flows have not yet reacted to the CBAM-imposed administrative burden.

We know that the bulk of trade in CBAM goods is composed of intra-EU flows, making up for more than 60 per cent of the total for iron and steel and more than 70 per cent for cement, for example. Imports of these goods from outside the EU makes up 30 per cent of the EU’s consumption. Chart 3 indicates that imports of fertiliser and aluminium from extra-EU countries have been rather stable in the past four years. While fluctuating more, iron and steel imports have been hovering at their pre-CBAM level. And in the past year, intra-EU trade has slightly ticked downwards: if CBAM had already started to alter trade flows, we would expect the opposite to happen, given the policy would increase the competitive advantage of EU-origin goods.

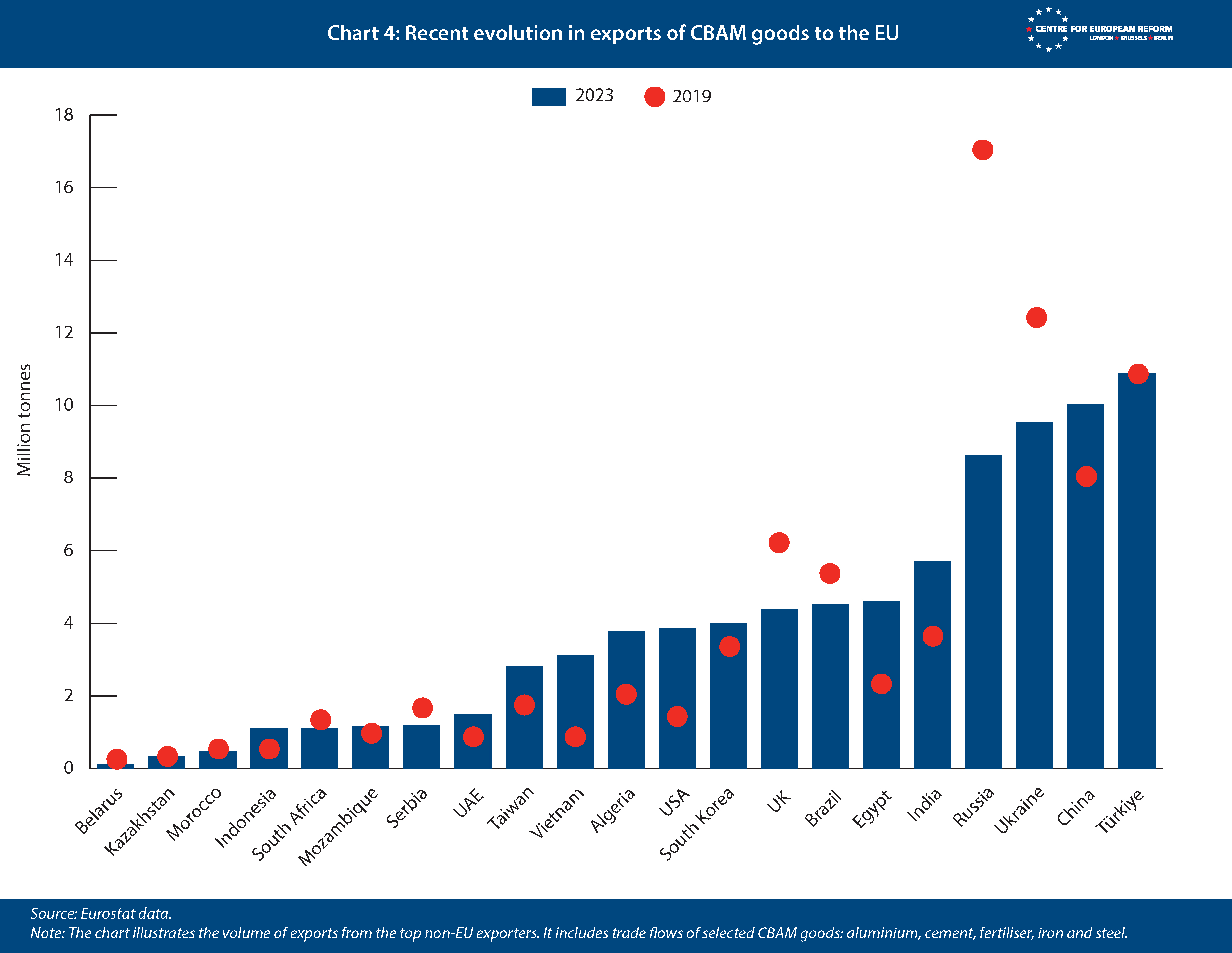

Trade flows in CBAM goods to the EU have seen few but important changes in recent years – but these changes are not due to CBAM (Chart 4). Russia’s war on Ukraine caused exports from Russia, Ukraine and Belarus to drop. The Brexit impact is visible too, with a drop in exports from the UK of about 40 per cent. Exports from most major trade partners to the EU have instead increased.

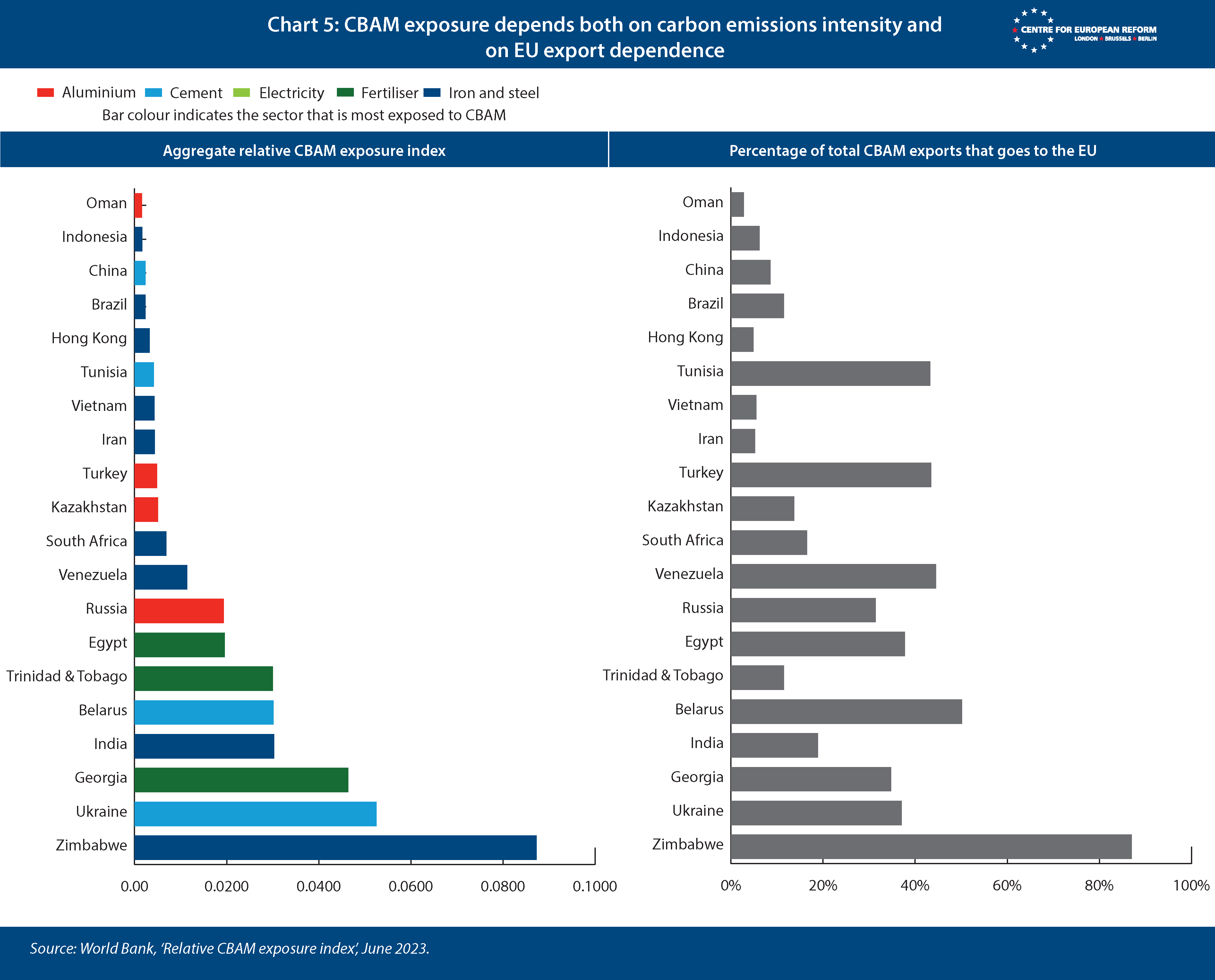

But the volume of CBAM exports to the EU is not the only factor to consider in gauging a country’s exposure to this policy. The World Bank has created a CBAM exposure indicator that can be applied to specific CBAM sectors or to an entire economy.7 It considers both ‘trade dependence’ on the EU, as the relative importance of a country’s CBAM exports to the EU compared to total exports, and the ‘carbon bill’ that it is expected to pay for those exports, based on the carbon emissions intensity of its production and on the expected cost of CBAM fees. The WTO’s indicator does not consider whether a country applies its own carbon price, which, being deducted from CBAM fees, would reduce its exposure to the policy.

Large emerging economies from India to Ukraine need EU support in adapting their industry to CBAM.

Chart 5, based on this data, shows a slightly more complex picture relative to export data alone. For example, Zimbabwe is the most exposed country to CBAM. While its trade flows to the EU are far from the largest, it has a large trade dependence on the EU: over 80 per cent of its CBAM goods exports, which are mainly iron and steel, go to the EU. The issue that CBAM poses for a country like Zimbabwe could go unnoticed when observing solely export volume data. But considering country exports to the EU relative to their total exports, together with other indicators such as carbon intensity provides a more complete picture of the reasons why small developing countries are rightly concerned about CBAM.

Jointly observing both aggregate trade data and granular indicators such as sectoral emissions intensity, export dependence on the EU and relative exposure to CBAM can provide a more complete analysis of CBAM’s expected impact. If China and OECD economies may be able to withstand the coming CBAM shock, other large emerging economies – such as India, Vietnam, Brazil, Ukraine and Türkiye – will be affected by CBAM and may need additional EU support in adapting their industry to a net zero future. Finally, small lower-income countries such as Mozambique or Zimbabwe constitute a smaller share of overall EU imports, but because CBAM-affected goods are important for their economy, they may need tailored solutions and support from the EU.

Case studies

Iron and steel

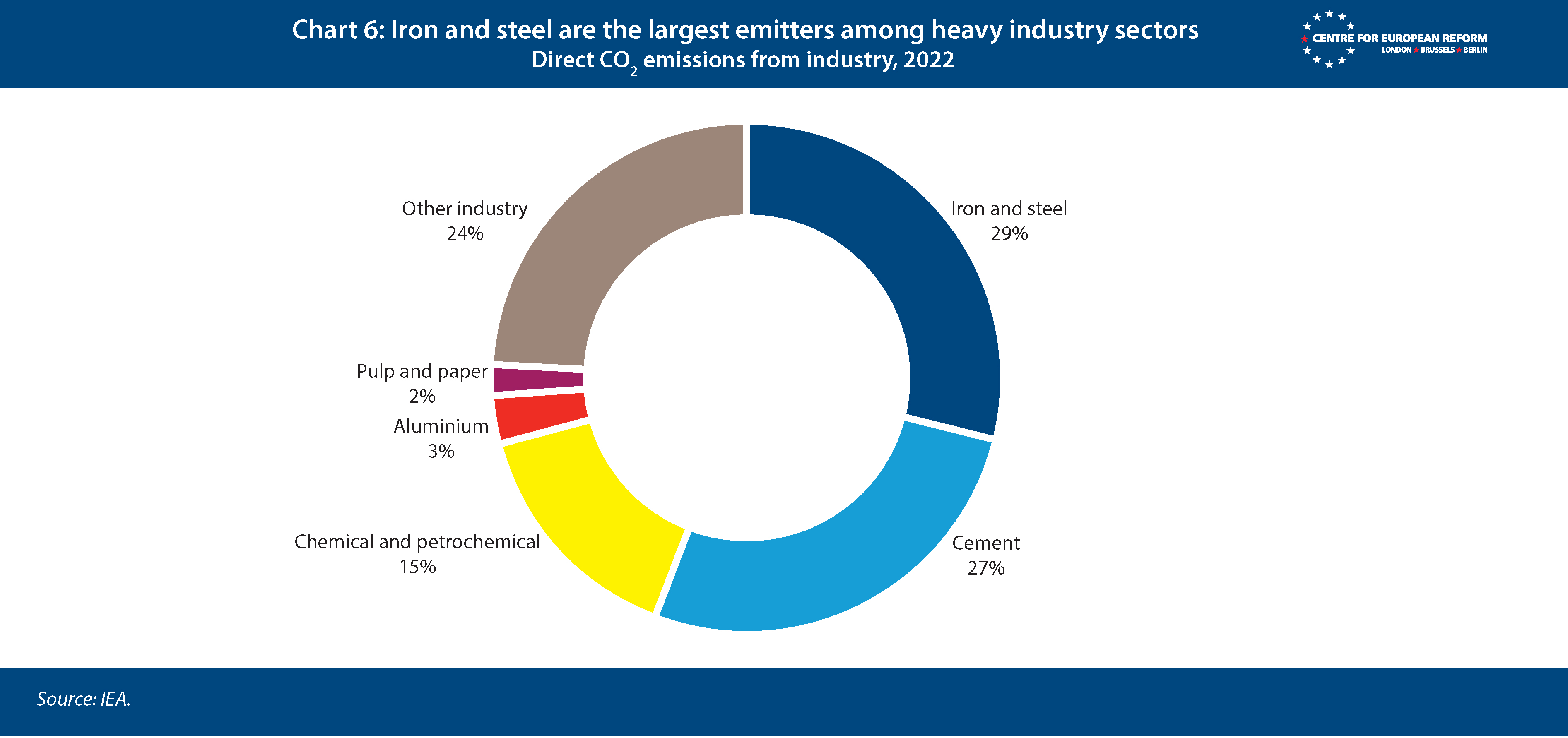

The steel industry accounts for about 7-9 per cent of global emissions8 and it is the highest emitting among heavy industry sectors (Chart 6). The investment incentives that CBAM provides can have large repercussions in a sector like steel, whose annual emissions footprint is comparable to that of the EU itself.

The decarbonisation of steel production is already underway, as producing steel with scrap is already possible and less energy-intensive than producing it with iron ore – but the limited availability of quality scrap means this is not a fully scalable solution.9 The next frontier for decarbonised steel production lies in processes that do not require fossil fuels, replacing them instead with green hydrogen, or electric arc furnaces powered by clean electricity.10 Nearly half of global steel capacity under development as of April 2024 concerns electric arc furnaces, which shows a positive advancement towards the IEA’s net zero target for steel.11

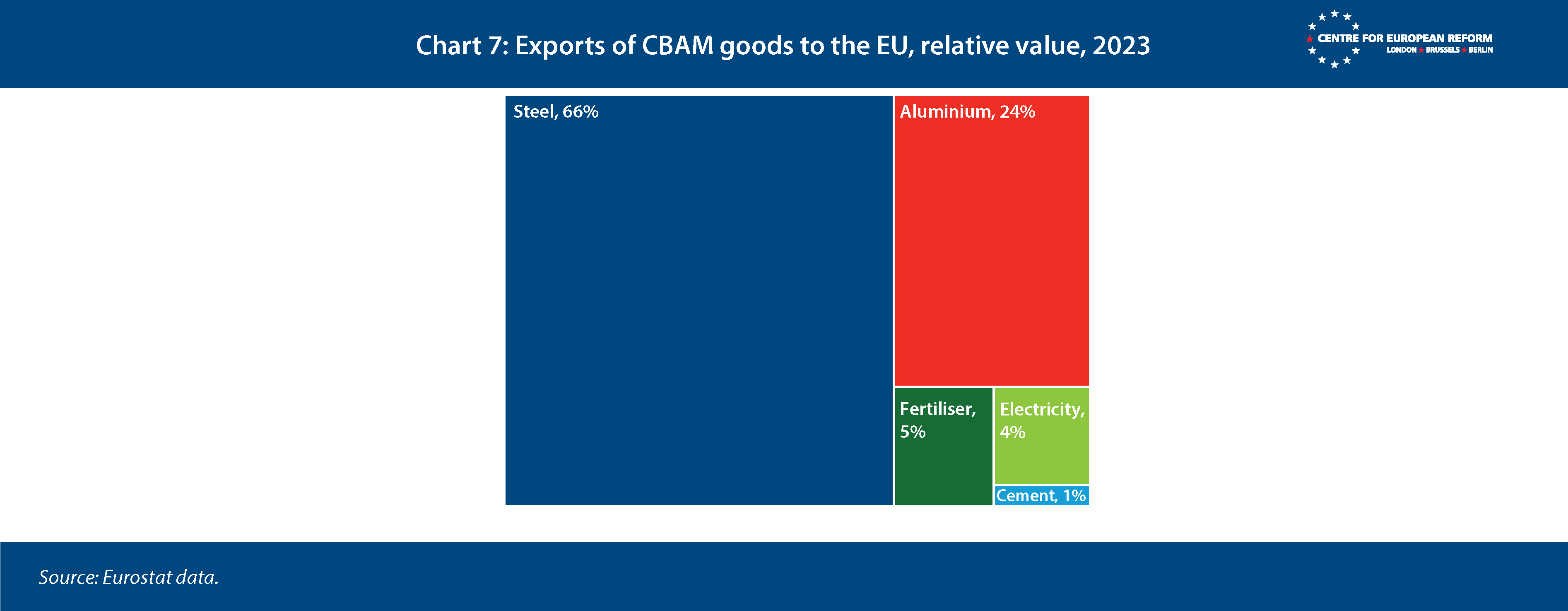

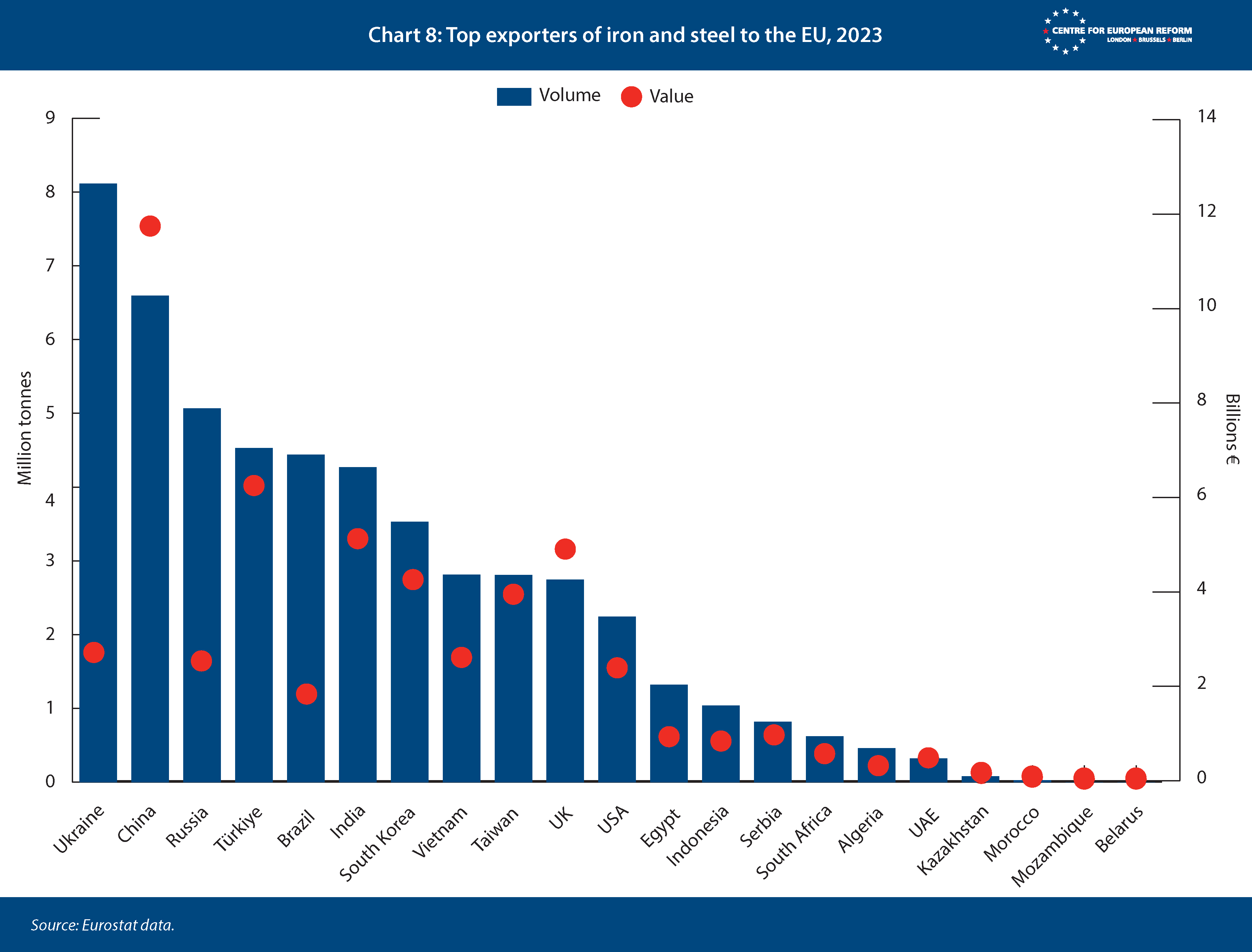

A sector on the brink of a decarbonisation transformation, the iron and steel sector is the largest, most exposed sector to CBAM (Chart 7), accounting for €45 billion of extra-EU imports in 2023, for about 45 billion tonnes in volume. In terms of export volume, the most CBAM-affected countries include both EU neighbours, such as Ukraine and Türkiye, and top global producers, such as China, India and Brazil (Chart 8). But observing steel carbon intensity, a more complex picture emerges, as this indicator varies substantially among exporters to the EU: as such, it is difficult to fully predict who would retain primacy in trade flows once CBAM fees are in place, and who would be fastest in repurposing their industry to cater green steel to the EU.

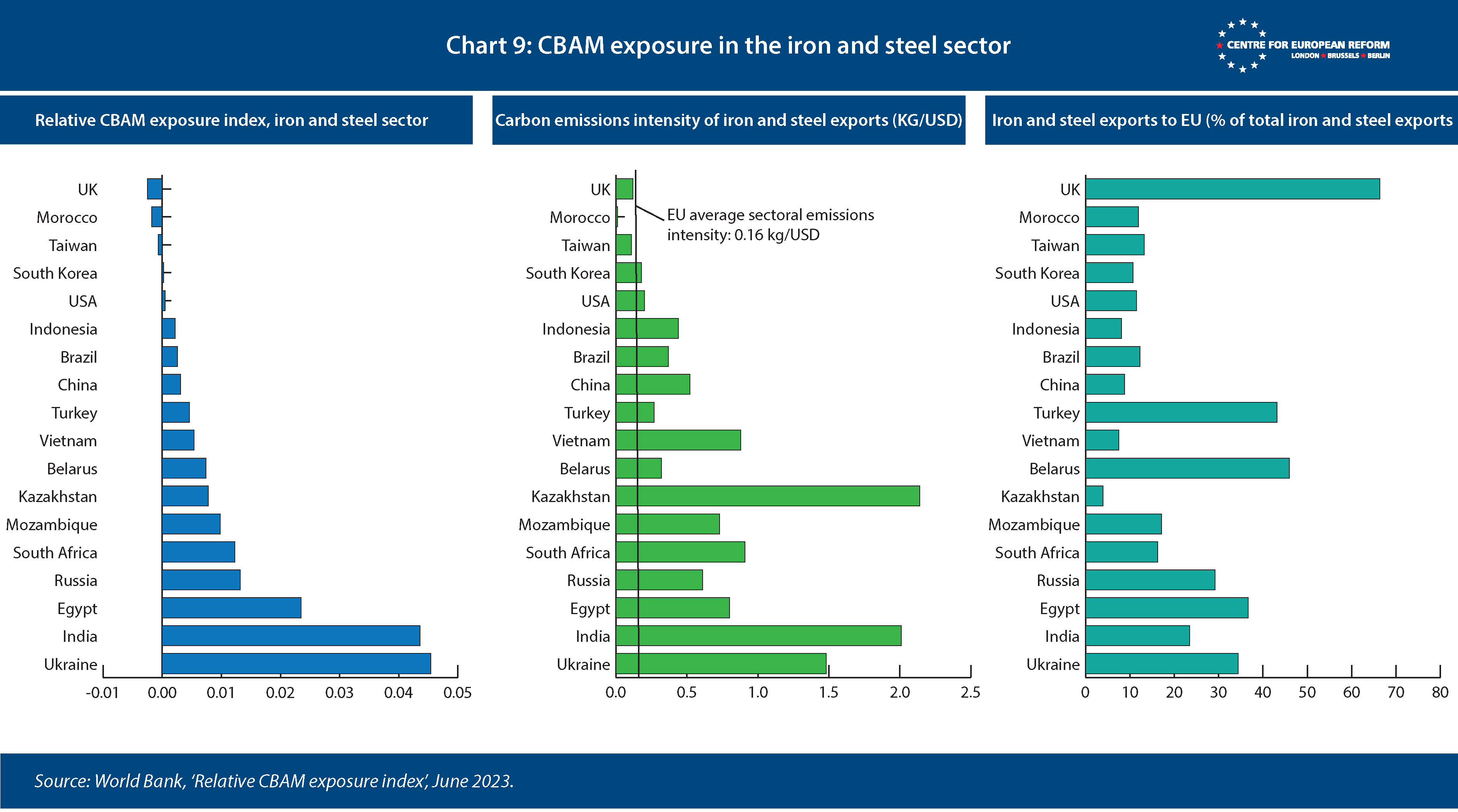

In fact, CBAM exposure does not depend exclusively on export volume. Chart 9 illustrates the relative iron and steel exposure to CBAM for the largest exporters of those goods to the EU. This indicator is the product of the proportion of total iron and steel exports that the country exports to the EU and of the ‘carbon bill’ that a producer in a certain country would need to pay given its carbon emissions intensity and the EU emissions price (which here is assumed to be €100 per tonne of carbon equivalent).

CBAM exposure does not depend exclusively on export volume, but also on emissions intensity and export dependence on the EU.

Per this indicator, the country with the most exposed iron and steel sector is Ukraine, given that its carbon emissions intensity is 900 times higher than the EU average sectoral one (1.48 kg/USD as opposed to 0.16 kg/USD, respectively), and that 34 per cent of its iron and steel exports go to the EU. Steel is Ukraine’s largest CBAM export to the EU, so this exposure is of concern for a country at war, and certainly a reason for the EU to consider temporarily exempting it. India has a similar level of CBAM exposure: its share of sectoral exports going to the EU is lower than Ukraine’s, but its iron and steel carbon intensity is higher. It is noteworthy that the UK is given a negative value for the CBAM exposure indicator in the iron and steel sector: this is because even though 66 per cent of its iron and steel exports go to the EU, its emissions intensity is slightly lower than that of the EU, and it also applies a carbon price to this sector due to an ETS that largely mirrors the EU’s (though the price is now lower than the EU’s).

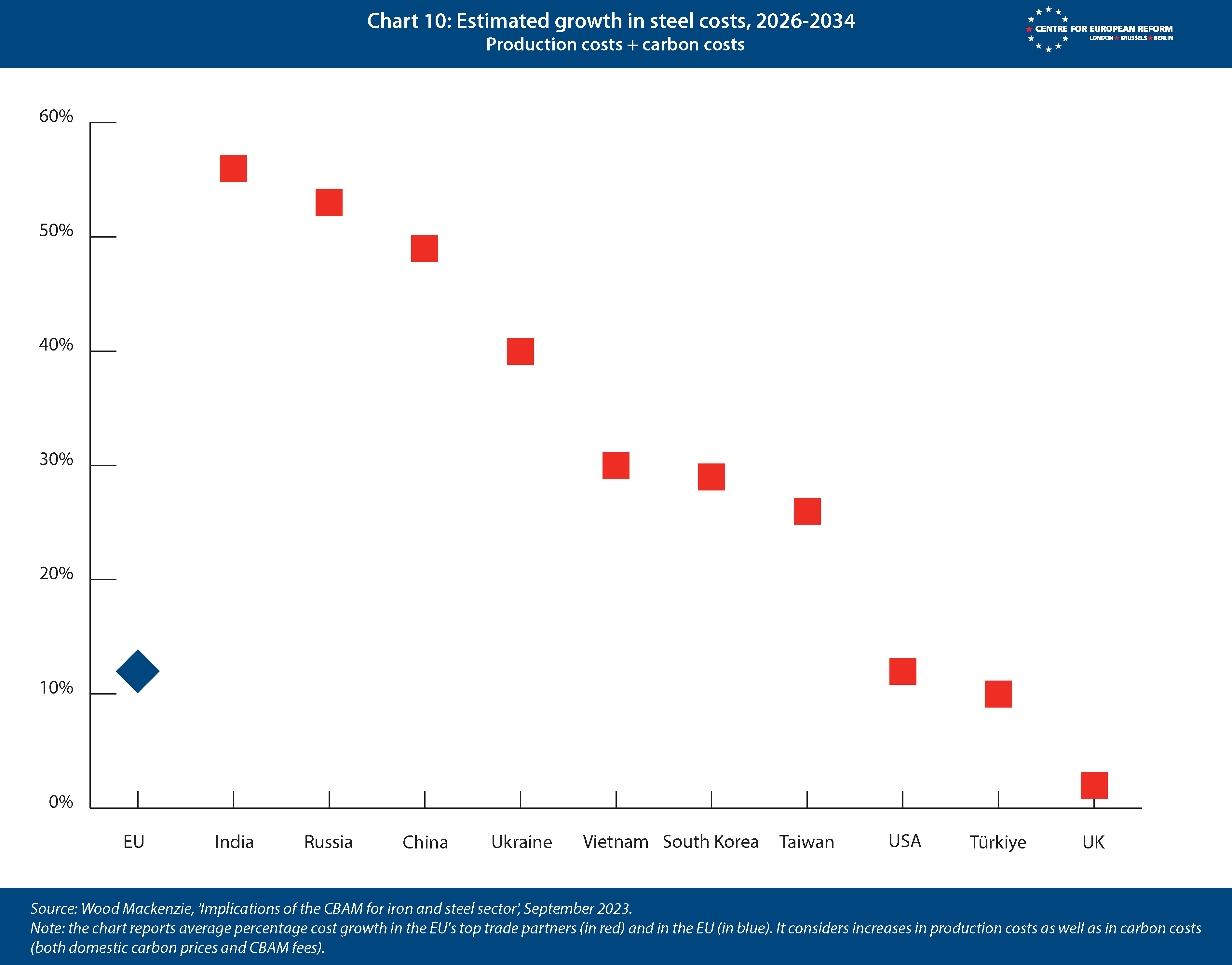

The CBAM exposure indicator gives a sense of the cost increase that steel producers worldwide can expect due to CBAM. By 2034, when CBAM fees will fully expose foreign producers to the EU carbon price, this will translate into cost increases of around 50 per cent relative to 2026 in both India and China (Chart 10). At the same time, EU-based producers will also be facing a cost increase between 2026 and 2034 due to the elimination of free emissions allowances, but that is estimated to be lower, at around 12 per cent.

CBAM fees should be understood as transition costs for the iron and steel sector. These costs will spur investment in green steel manufacturing – both in the EU, once free allowances for this sector gradually fade, and outside it, once CBAM fees enter into force. In the short term, lower carbon-intensity steel products will be redirected towards the EU, and carbon-intensive products will instead be exported to other destinations. This would de facto generate a ‘two-tier market’ until green steel becomes globally competitive with legacy steel.12 But the promise of CBAM is that in the longer term, the incentive to decarbonise steel production will be felt across the world, both because of increasing pressure via carbon prices and because of growing demand for green steel. Lowest-cost producers of traditional steel may manage to retain a cost advantage for some time even with a CBAM markup. But as demand for green steel builds up and its cost gradually decreases with deployment at scale, that may prove to be a temporary advantage.

Brazil

The Brazilian government has criticised CBAM both on the grounds of trade and climate policy. On the trade front, it considers CBAM as a potential violation of the non-discrimination principles at the heart of the WTO. On the climate front, it fears that it may disrespect the principle of common but differentiated responsibilities at the heart of national climate efforts as enshrined in the 2015 Paris Agreement.

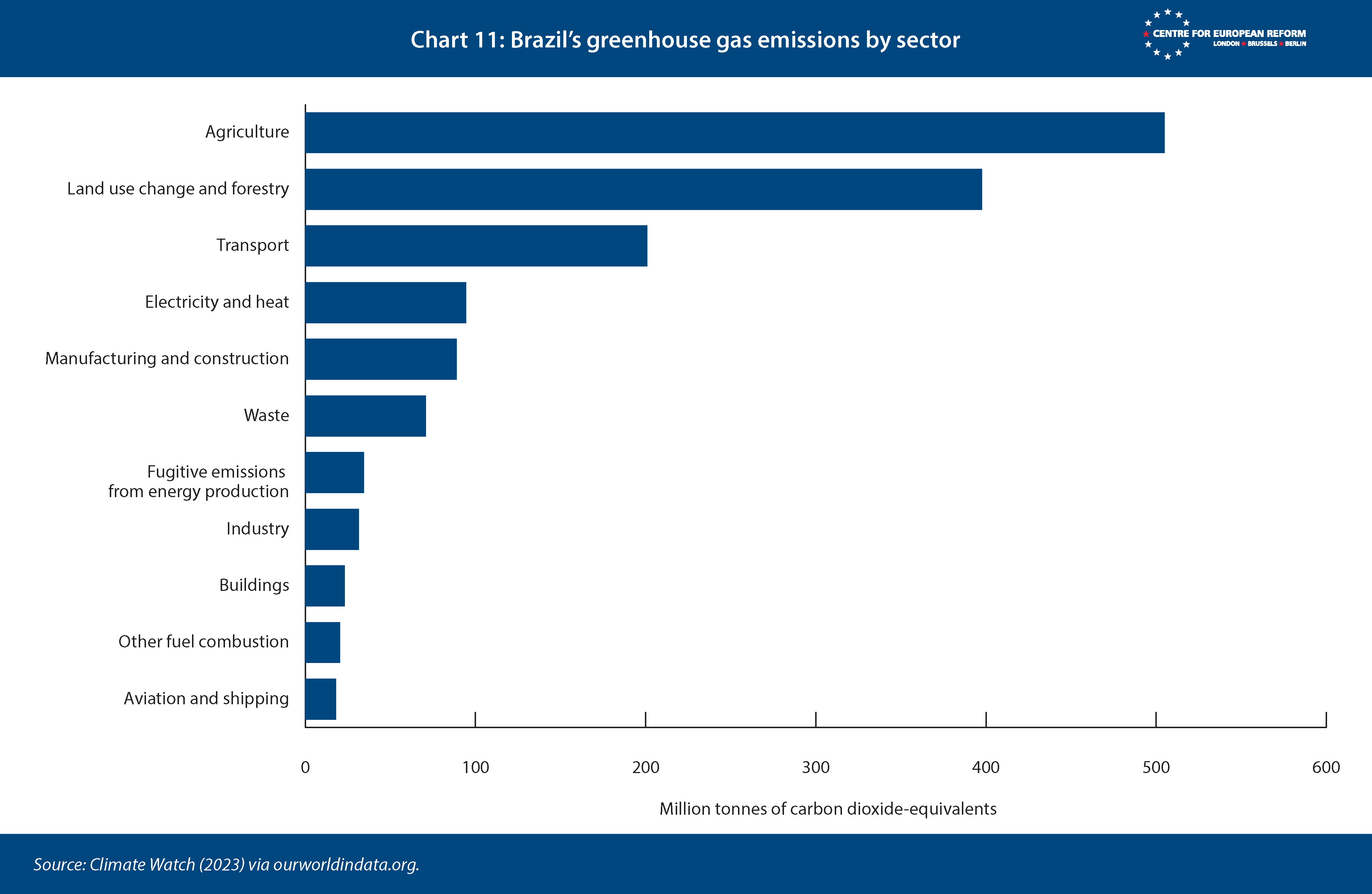

While contesting CBAM in the WTO, the Brazilian government is also developing its own domestic carbon pricing scheme in order to retain revenues domestically by reducing Brazil’s overall ‘CBAM bill’.13 This is likely to apply to power generation and industry, mirroring the sectoral focus of the EU ETS. This points to CBAM having ambivalent effects: on one hand, it is encouraging the EU’s trade partners to adopt a market-based approach to climate action, but on the other hand, the sectoral focus seems to be driven by the EU’s own approach as opposed to the emissions intensity of each country. More specifically, over 60 per cent of Brazil’s greenhouse emissions are due to agriculture and land-use change (Chart 11) – yet these are unlikely to be part of the forthcoming carbon pricing scheme. This is unsurprising, given that CBAM focuses on heavy industry. But CBAM’s broader impact on global emissions could become larger if carbon pricing schemes that start out focusing on a handful of sectors today were to be expanded in the years to come.

When it comes to CBAM, in 2023, Brazil ranked 13th in the ranking of countries most affected by it, considering the value of its exports of CBAM goods to the EU. Most Brazilian CBAM exports to the EU are in the form of steel: in 2023, Brazil exported about 4.4 million tonnes of iron and steel goods to the EU, for a total of €1.8 billion in value.14

Brazil is the 9th largest steel producer globally, but the EU is only its third largest destination for exports, absorbing only an average 6.3 per cent of Brazil’s iron and steel exports in 2020-2022, following the US (24.6 per cent) and Argentina (9.6 per cent).15 This means that CBAM is going to add a price signal on a significant but small share of its overall steel production.

Despite directly impacting a relatively small share of Brazilian steel production, CBAM does add an incentive for this sector to decarbonise. In fact, the emissions intensity of Brazil’s iron and steel sector is 0.37 kg/USD, over twice the EU average (0.16 kg/USD) but lower than China’s (0.52 kg/USD) and Russia’s (0.61 kg/USD), as shown in Chart 9.

India

As the previous charts illustrate, India is uniquely exposed to CBAM, both due to the volume of its exports to Europe, their carbon intensity and the fact that it does not yet apply a carbon price domestically. But India has announced it is going to adopt carbon pricing in response to CBAM, which indicates its willingness to adapt its own climate policy to provide additional decarbonisation incentives to its industry. Simultaneously, India has become the top steel developer globally and it is still investing primarily in coal-based production.16 This may prove to become a vulnerability in a sector that is both characterised by significant global overcapacity and pressure to decarbonise.

India has become the top steel developer globally and it is still investing primarily in coal-based production.

In 2023, India was the 4th most exposed country to CBAM in terms of the value of its exports of CBAM goods to the EU, which reached over €6.4 billion (Chart 2). These exports account for 0.1 per cent of India’s GDP.17

Iron and steel represented 78 per cent of India’s CBAM exports to the EU in 2023, for a value of over €5 billion, while aluminium accounted for 22 per cent of CBAM exports, for a value of €1.4 billion. India is the second global producer of both crude steel (7 per cent of global production) and aluminium (6 per cent of global production), following China. The EU is a significant destination of its steel and aluminium exports: iron and steel exports to the EU represent 23.5 per cent of India’s sectoral exports, and for aluminium this figure is 9.1 per cent.

In fact, India has been a vocal critic of CBAM, referring to it as a ‘trade barrier’.18 It has repeatedly criticised CBAM‘s compatibility with WTO principles, and argued that the EU has ignored the principle of common but differentiated responsibilities and respective capabilities (CBDR-RC) under the Paris Agreement. India’s claim is that the EU disregards the CBDR-RC principle by requiring its trade partners to pay a carbon price, even though their climate strategy may be based on approaches other than market-based policies.

It also fears that SMEs may be hardest hit by CBAM’s administrative burden and carbon price.19

Still, the Indian government and the European Commission continue to engage in discussions on CBAM’s impact on Indian businesses during its transitional phase. This exchange may provide a useful channel for India’s government, corporate sector and environmentalists to provide direct feedback to the European Commission in the context of CBAM’s soon-to-come revision.20

While carbon pricing is not India’s main climate policy approach, starting in 2022 the Indian government has taken steps towards setting up a national Carbon Credit Trading Scheme (CCTS). The scheme will gradually replace an existing mandatory energy efficiency programme that covers over 1000 entities from energy-intensive sectors. It will slightly differ from the EU ETS in that rather than setting an overall emissions cap for selected sectors, it will set an annual emissions intensity target for a three-year period for each firm covered by the CCTS. Despite these technical differences, the CCTS will eventually lead to a carbon price for selected energy-intensive industries, including CBAM-exposed ones such as aluminium, cement, fertiliser, iron, steel and petrochemicals, but also petroleum refinery, pulp and paper and textiles. This means that Indian exports of CBAM goods to the EU will eventually be exposed to a lower CBAM fee, given that the domestic carbon price they have already paid will be deducted from it.

An alternative approach that the Indian government is also considering is a carbon tax at the point of export for CBAM goods. This would likely require simpler administration than a trading scheme, and it would have the merit of allowing India to retain the carbon pricing revenues that otherwise would flow to the EU through CBAM.21

Trade policy responses

In the years since CBAM was conceived, the global trade context has changed significantly: the Biden administration is on its way out, to be replaced by Trump 2.0. Both the US and the EU have increasingly adopted a more confrontational trade position towards China. And, last but not least, the EU’s trade ties with Russia have been severely disrupted due to Putin’s aggression against Ukraine. Trump’s return to power is highly likely to introduce further tension into a trade system that is already highly fragile, with continued dysfunction at the WTO.

CBAM has been designed to be WTO-compliant, but a WTO case against it could nevertheless lead to adjustments.

The US and the EU have spent the last few years under the Biden administration trying to bridge the gap between the EU position, in which carbon pricing is a key foundational element of any climate solution, and the US position, which is more heavily reliant on subsidies and implies a ‘green club’ of like-minded countries that would not necessarily all need carbon pricing. This gap proved impossible to bridge under Biden, and under Trump it is likely to widen into a chasm, with the US unlikely to have climate as a priority at all. The Trump administration will instead focus on reducing the US trade deficit and implement new tariffs to reduce US imports. Given Trump’s approach to trade, he will likely see CBAM as a purely protectionist measure from an EU that already enjoys a large trade surplus with the US. CBAM only affects just over 1 per cent of EU-US trade, but steel is a sector that is already causing frictions between the EU and US, and one in which carbon intensity of production is lower in the US than in Europe.22 For this reason, CBAM is likely to prove an irritant over the coming years.

With respect to the rest of the world, there is a good chance that China, India or other countries like South Africa or Brazil will mount a WTO challenge to CBAM. The BRICS countries have for instance called CBAM a “punitive and discriminatory protectionist measure, that [is] not in line with international law.”23 After the US refusal to nominate judges to the WTO Appellate Board, the dispute settlement mechanism has been inoperative. This means that legal cases in the WTO system cannot be brought to their conclusion as there is no Appellate Board in place to settle appeals. However, some countries have agreed to a voluntary replacement called the Multi-Party Interim Arbitration Agreement (MPIA). Participants in this ad-hoc system include several WTO members affected by CBAM such as Brazil and China, in addition to the EU itself. A WTO case that is appealed to the MPIA is therefore possible. If that happens, the EU should welcome the chance to prove that it is acting in accordance with international law. CBAM has been designed to be WTO-compliant, and the core of the system is likely to withstand any challenge since it is non-discriminatory and equalises the carbon price between EU producers and importers. However, a WTO case could nevertheless lead to adjustments. There are, for instance, legitimate questions about the heavy reporting requirements CBAM entails, as well as the extended phase-out of free emission allowances in the EU that could give domestic producers at least a temporary advantage.

But beyond the legal risk, there is also a political risk that CBAM, regardless of its merits as a climate mechanism, is perceived as primarily a protectionist tool. The risk is heightened as CBAM comes at a time of generally increased protectionism. Additionally, the EU is simultaneously trying to implement other regulations, such as the Deforestation Regulation, that also restrict imports from many partners. The EU should continue dialogue and technical co-operation with its trade partners to help them comply with CBAM. The perception of climate protectionism would also be counterbalanced if the EU showed it was willing to open its markets in other respects, including through the upcoming EU-Mercosur free trade agreement and by continuing negotiations and engagement with countries like India. The EU can take some comfort in the fact that the Mercosur agreement does not seem to have been significantly impeded by CBAM. This gives ground for cautious optimism that most partners see CBAM as a climate-related policy and not a protectionist mechanism.

The thorniest issue in the short-term will be whether it is possible to grant exemptions from CBAM without imperilling the coherence of the system. There will certainly be political pressure to find a bilateral deal with the US. However, this would be difficult in the absence of a US federal carbon price, and a deal without the US introducing a national carbon price could risk breaching WTO rules on non-discrimination. A stronger case instead could be made for exempting Ukraine, which is heavily reliant on exports to the EU market and in a difficult situation because of the war. The CBAM regulation does allow for exemptions in exceptional circumstances, which Ukraine would fall under. For coherence, any such measure would have to be transitory in nature with a clear end point. The EU could also consider similar limited exemptions on a case-by-case basis for vulnerable developing countries, but exemptions must be limited to maintain the logic of the system as a whole. The EU’s long-term focus should instead be on helping countries through the green transition with investment and technical assistance.

For CBAM to be truly successful in the long-term, it should encourage partners to adopt carbon pricing schemes that lead to sustained incentives to reduce carbon emissions worldwide. So far, several countries have adopted carbon pricing or carbon adjustment measures following the implementation of CBAM (see next section), but the incentive to copy the EU system will increase once CBAM is fully implemented and carbon prices start to be charged.

Climate policy responses

CBAM is encouraging the uptake of carbon pricing worldwide

The EU emissions allowance price is the highest carbon price originating from an emissions trading scheme – the few countries that have higher carbon prices have implemented carbon taxes instead.24 This means that aside from a handful of countries, virtually all the EU’s trade partners would need to pay a positive CBAM fee due to having a lower or no domestic carbon price.

CBAM has already led governments worldwide to initiate or accelerate the establishment of their own carbon markets.

But the European Commission has stated several times that CBAM would be successful if it prompted EU trade partners to establish their own carbon pricing mechanisms, even though that would curb CBAM revenues. If emissions related to production of CBAM goods were priced domestically, exposure to CBAM fees would be reduced or entirely avoided, depending on the level of the domestic carbon price relative to that of the EU ETS price of allowances.

For this reason, the EU has always described CBAM as a climate policy tool to address carbon leakage by levelling the global playing field relative to its domestic carbon price, rather than a trade or tax measure aimed at raising revenues. In fact, CBAM is expected to raise about €1.5 billion per year as of 2028.25 This is about 0.8 per cent of the current EU annual budget of €190 billion – not risible, but not big. CBAM’s larger and more durable impact on the EU budget will be indirect and will appear in the longer term: once the free ETS allocations to heavy industry are fully phased out, auctions of carbon allowances could raise an estimated €15.9 billion annually.26

The direct impact of CBAM on emissions might be small – reduced carbon leakage would amount to an emissions cut of less than 0.2 per cent globally.27 But by enabling the phase-out of free emissions allowances in the EU, CBAM is also a way for the EU to signal on the global stage that its carbon price is going to be an ever-stronger decarbonisation incentive for its domestic industry. And by encouraging the implementation of carbon pricing outside the EU, CBAM has the potential to accelerate more cost-efficient decarbonisation efforts at the global level. While still in its transitional phase, CBAM has already led governments worldwide to initiate or accelerate the establishment of their own carbon markets. Some scholars have referred to this as positive “policy spillovers”.28

For example, China, the country with the highest value and volume of CBAM exports to the EU, already has a national ETS scheme that exclusively covers the electricity sector, but it has announced that this will be expanded to cover cement, steel and aluminium – all CBAM goods – by the end of 2024.29 India, as mentioned above, is building a carbon market too, as is Türkiye, the country most affected by CBAM in the EU’s immediate neighbourhood.30 In South America, Brazil is also planning its own ETS, and Chile is considering carbon pricing to meet its carbon neutrality goal.31

Some countries where a carbon price is already in place, such as Australia and Canada, are also considering implementing a carbon border adjustment.32 Similarly, the UK has announced that it will launch its own CBAM in 2027. This follows the implementation of the UK’s own ETS in 2021, after leaving the EU ETS post Brexit. The UK ETS closely mirrors its EU counterpart, as it applies to energy intensive industries, electricity generation and aviation. The UK CBAM will have similar sectoral coverage to the EU CBAM: the main differences are that it will not cover electricity, while it does include glass and ceramics. Because of their similar approaches, the UK government should consider linking its ETS to the EU one. Linking the two ETSs would allow UK exports to the EU to entirely bypass EU CBAM fees and administrative burdens. A UK-only CBAM would level the playing field for UK producers relative to imports into the UK, but it would not remove the reporting duties to which UK businesses are exposed due to the EU’s mechanism.

CBAM has accelerated the joining up of discussions between the trade and climate communities.

Following the announcement of the EU scheme, discussions about setting up a CBAM emerged in the US too. Between 2021 and 2023, several bills were put forward in the US Congress with varying approaches to pricing emissions of certain categories of imported goods.33 This activity prompted some surprise in Brussels, given that the US does not have a federal carbon pricing mechanism comparable to the EU ETS. Some bills suggested introducing and then slowly ramping up a carbon price on both domestic and foreign emissions in selected categories of goods – while others targeted only foreign emissions, exempting countries that have a free trade agreement with the US. However, given the incoming Trump administration’s climate denialism, it may well be that none of these initiatives will move forward – unless Trump decides to adopt a CBAM as an additional tool in his trade protectionism kit.

CBAM has advanced discussions on trade and environment at the WTO

CBAM’s positive policy spillovers, in the form of the introduction of new carbon pricing and carbon border mechanisms, will take time to deliver credible carbon price signals – and to translate into carbon emissions cuts. Conversely, the discontent that the EU CBAM has prompted among developing end emerging economies is already affecting bilateral and multilateral discussions, from trade talks to climate negotiations. For instance, China led criticism of carbon border mechanisms at the COP29 climate conference in Baku in November 2024.34

At the same time, CBAM has accelerated the joining up of discussions between the trade and climate communities. The head of the WTO, Ngozi Okonjo-Iweala, recently stated that the WTO aimed to advance the creation of an international carbon pricing system with the IMF, OECD and UN. Instead of pursuing a global price, the system would allow for regional differentiation, with a carbon price in the south lower than in the north.35

The idea of a harmonised framework for carbon pricing would be an improvement relative to the current patchwork situation. This effort would encourage the interoperability of carbon taxes, emissions trading schemes and various marked-based instruments resulting in carbon prices worldwide – there are currently 110 in force globally.36 As such, a harmonised framework would help businesses face comparable and predictable conditions worldwide. However, it is not obvious that all countries, particularly developing countries, are equally keen on adopting carbon pricing measures. The EU, as a leader in the early adoption of emissions trading, should offer its experience and advice with trade partners that want to adopt a similar approach – but it should acknowledge that alternative policies, from subsidies to regulatory standards, may be better solutions in other countries.

Conclusion and policy recommendations

CBAM has not yet reached its final configuration. The guiding principle of CBAM should continue to be maintaining the prevention of carbon leakage. CBAM should expand to other ETS-covered sectors that are at risk of carbon leakage. This would expose a broader set of EU industries to a carbon price, as free allowances are removed. The expansion of CBAM from essentially raw materials to more complex goods should be guided by the same principle – but it should also weigh the benefits of carbon pricing and the administrative costs of delivering it.

The EU should use CBAM revenues to support industry decarbonisation in least developed and developing countries.

For now, over one year after its implementation, CBAM has not yet had visible impacts on trade flows. Referring to the taxonomy of potential impacts outlined earlier in this paper, it seems we are still in a phase of stasis: business continues as usual, as producers of CBAM goods are absorbing implicit CBAM implementation costs (related to carbon accounting and reporting requirements) and continuing to trade with Europe.

Looking ahead, once CBAM fees enter into force in early 2026, foreign producers will probably respond in the short-term by shifting ‘cleaner’, lower-carbon products towards the EU, while redirecting more carbon intensive ones elsewhere. That would not immediately curb emissions, but investments in decarbonising production of CBAM goods will receive a clear boost, leading to cleaner exports to the EU.

It is unclear whether CBAM by itself will be a sufficient incentive to drive demand for green CBAM goods across the world – or whether it will lead to a period of resource reshuffling and split markets, until low-carbon goods become globally competitive with their traditional carbon-intensive counterparts. In this sense, the fact that CBAM has already prompted policy spillovers by encouraging other governments to implement carbon pricing and carbon adjustment mechanisms indicates that the incentives for industrial decarbonisation will only become stronger across the world.

The Commission needs to engage with trade partners to support them on the implementation of carbon pricing with whoever is keen to adopt this approach. But it would be incoherent to engage in clean industrial policy at home and not to lead in this industrial revolution abroad: the Commission should make financial and technological support for cleaner industry a key part of its climate diplomacy and external investment strategy.

The EU should not disregard the regressive impact that carbon border adjustment can have on lower-income countries. The need for financial support is very clear, given the negative response that CBAM has elicited. The EU should listen to developing countries and reconsider ways to lessen CBAM’s impact on them. Just as ETS revenues are used to attenuate its regressive impacts through the Modernisation Fund and Innovation Fund, the EU should make use of CBAM revenues to fund policies for tech transfer and decarbonisation support for least developed and developing countries. These financial transfers could be tied to the implementation and follow-up of industrial decarbonisation plans. As has also been suggested by others, this way CBAM revenues could be part of climate finance efforts.37 Finally, the EU should reconsider exempting (at least temporarily) least developed countries from CBAM.

This proactive role of the EU is a prerequisite for ambitious decarbonisation efforts to take place worldwide. It is also necessary for the discussion on harmonising carbon pricing globally to advance. As long as the EU does not show willingness to use its CBAM revenues to support its developing trade partners, there will be little enthusiasm for others in the developing world to embrace its climate policy ambitions.

2: Joe Cash, ‘China urges EU to ensure new carbon tax complies with WTO rules’, Reuters, September 14th 2023.

3: Manoj Kumar and Neha Arora, ‘India plans to challenge EU carbon tax at WTO’, Reuters, May 16th 2023.

4: Wendell Roelf and Kate Abnett, ‘South Africa considers complaining to WTO against EU carbon border tax’, Reuters, May 23rd 2024.

5: Sarah Jackson, ‘US perspectives on carbon border adjustment mechanisms’, E3G briefing paper, September 2021.

6: UNCTAD, ‘A European Union carbon border adjustment mechanism: Implications for developing countries’, 2021.

7: World Bank, ‘Relative CBAM exposure index’, June 2023.

8: Molly Lempriere, ‘Steel industry makes ‘pivotal’ shift towards lower-carbon production’, Carbon Brief, July 20th 2023.

9: IEA, ‘Tracking Clean Energy Progress 2023’, July 2023.

10: Stefan Ellerbeck, ‘What is green steel and why does the world need more of it?’, World Economic Forum, July 11th 2024.

11: Marie Armbruster, Astrid Grigsby-Schulte, and Caitlin Swalec, ‘Pedal to the Metal 2024: Building momentum for iron and steel decarbonisation’, July 2024.

12: David Stanway, ‘New green steel firms could reap rewards as EU carbon tariffs loom’, Reuters, November 8th 2024.

13: Sam Morgan, ‘Europe’s emissions trading mission goes global’, Foresight Climate & Energy, August 14th 2024.

14: Eurostat.

15: Steel production statistics from the World Steel Association. Trade statistics from Comex Stat 2023, as reported in IISD, ‘Global Dialogue on Border Carbon Adjustments: The case of Brazil’, July 2024.

16: Marie Armbruster, Astrid Grigsby-Schulte and Caitlin Swalec, ‘Pedal to the Metal 2024: Building momentum for iron and steel decarbonisation’, July 2024.

17: World Bank, ‘Relative CBAM exposure index’, June 2023.

18: John Reed and others, ‘India denounces ‘stifling’ EU carbon tax on imports’, Financial Times, October 9th 2024.

19: World Trade Organisation, ‘Minutes of the meeting of the Council for Trade in Goods, 30 November-1 December 2023’, published on January 30th 2024.

20: European Commission, ‘EU-India advance co-operation on CBAM’, July 5th 2024.

21: Abishek Law, ‘India wants to charge its own carbon tax on the lines of CBAM from exporters’, The Hindu Business Line, September 24th 2023.

22: Charlotte Unger and Rainer Quitzow, ‘Dream or reality: Where is the club for green steel?’, npj climate action, June 14th 2024.

23: XVI BRICS Summit, ‘Kazan Declaration: Strengthening multilateralism for just global development and security’, October 23rd 2024.

24: World Bank, State and Trends of Carbon Pricing Dashboard.

25: European Commission, ‘Questions and Answers: An adjusted package for the next generation of own resources’, June 20th 2023. This figure is from 2018 and assuming a carbon price of €80 per tonne, which is higher than the current one.

26: Adrien Assous and others, ‘A storm in a teacup: impacts and geopolitical risks of the European carbon border adjustment mechanism’, report by Sandbag, E3G and Energy Foundation, August 2021. The estimate assumes a carbon allowance price of €60 per tonne.

27: UNCTAD, ‘A European Union carbon border adjustment mechanism: implications for developing countries’, 2021. Cyn-Young Park and others, ‘European Union Carbon Border Adjustment Mechanism: Economic Impact and Implications for Asia’, ADB Brief, November 2023.

28: Kimberly Clausing and others, ‘How Carbon Border Adjustments Might Drive Global Climate Policy Momentum’, RFF report, October 2024.

29: International Carbon Action Partnership, ‘China to expand national ETS to cement, steel and aluminum in 2024’, September 12th 2024.

30: International Carbon Action Partnership, ‘Türkiye envisions central role for ETS in 2024-2030 climate strategy’, June 10th 2024.

31: International Carbon Action Partnership, Chile factsheet.

32: International Emissions Trading Association, ‘International reaction to the EU’s carbon border adjustment mechanism’, April 2024.

33: Sanam Rasool, William Alan Reinsch, and Thibault Denamiel, ‘Crafting a Robust US Carbon Border Adjustment Mechanism’, CSIS Brief, August 2024.

34: Joe Lo, ‘Emerging economies set up COP29 agenda fight over trade measures’, Climate Home News, November 6th 2024.

35: Andy Bounds, ‘Global carbon pricing needed to avert trade friction, says WTO chief’, Financial Times, September 16th 2024.

36: World Bank, State and Trends of Carbon Pricing Dashboard, consulted on November 18th 2024.

37: Trishant Dev and Avantika Goswami, ‘Carbon Border Adjustment Mechanism (CBAM): The Global South’s response to a changing trade regime in the era of climate change’, Centre for Science and Environment, July 2024.

Elisabetta Cornago is a senior research fellow and Aslak Berg is a research fellow at the Centre for European Reform.

This paper is published with the support of the Open Society Foundations.

December 2024

View press release

Download full publication