How to combat Europe's economic slowdown

Europe is experiencing an economic slowdown at an exceptionally bad time, but has the tools to fight it and should use them soon.

After two years of decent growth, all the indicators suggest that the European economy is cooling, though not yet heading towards a recession. The OECD’s composite leading indicator for Europe, which compiles economic data predicting GDP growth, is at its lowest level since the depths of the euro crisis in 2012. The purchasing managers’ index, which measures business activity and conditions, has fallen in both the eurozone and the world economy for most of 2018. Now the International Monetary Fund has revised its economic forecast down for eurozone and global growth.

The economic downturn underway is hitting Europe at an exceptionally bad time. Europe should start fighting it early.

To a large extent, China and the US are driving the slowdown in the world economy. The Chinese government is gradually moving China’s growth model away from exports and credit-fuelled investment towards domestic consumption. This difficult process is bound to reduce growth, which had been remarkably high for a middle-income country. It will reduce Chinese demand for imports.

The Trump administration has cut taxes, as promised to voters and the Republican party – a fiscal stimulus that the US economy did not need. The Federal Reserve has therefore continued to raise interest rates, dampening the effect of the stimulus on the US economy and increasing the dollar’s value. US demand for foreign goods and services, and the trade deficit, have consequently increased. Trump thus provided an economic stimulus to the world which has now largely run its course.

For the world, the slowdown is a return to normal. For Europe, that is bad news. Over the last five years, the eurozone has grown 1.9 per cent per year on average. The expansion was mostly driven by stronger domestic demand (see Chart 1), fuelled by the collapse in oil prices, which boosted consumers’ real incomes, and by less restrictive fiscal policy and more aggressive monetary easing by the European Central Bank (ECB).

But in the five years before that, the eurozone followed Germany’s export-led growth model: between 2008 and 2013, the only meaningful source of European growth was net exports, growing 0.5 per cent a year on average (see Chart 1). As a result, the eurozone’s current account surplus grew to more than 4 per cent of GDP – and remained there despite the recent period of strong domestic growth. A slowdown in the world economy, especially in such important trading partners as the US and China, will therefore hit Europe disproportionately hard.

Politically, 2019 promises to be a challenging year for Europe. In France, President Emmanuel Macron’s approval rating has tanked to the low 20s; and the ‘yellow vest’ protest movement is causing economic disruption. If the economic slowdown means that the potential benefits of Macron’s reforms are not immediately felt by voters, there may be serious political resistance to any further reforms he attempts.

If Brexit goes ahead as scheduled, it will coincide with an economic slowdown in Europe. The damaging repercussions of Brexit on the UK economy will therefore be more tangible than they have been for the past two years. At the time of writing, any outcome is possible, from a no-deal Brexit to no Brexit at all. The CER’s John Springford calculates the Brexit vote has already taken its toll on the British economy, leaving it more than two per cent smaller than it would have been had the UK voted to remain. But strong growth in Europe and the world masked that economic hit.

Germany continued to grow in 2018, but at the slowest pace in years, and buoyed by a large increase in the workforce. On a GDP-per-worker basis, it grew by just 0.2 per cent. Optimism in the German manufacturing sector is fading, according to the IFO survey of business sentiment, and growth in industrial production and turnover is weakening. However, of all eurozone members, Germany is best-placed to deal with an economic slowdown, as wages are growing, unemployment is very low and the government is spending its budget surplus on electoral promises.

Italy’s populist government, meanwhile, is focusing on redistributive policies, such as lowering the pension age and introducing an embryonic basic income. It is neglecting measures that might help to boost the country’s economy, such as reforms to the justice and education systems, and the bureaucracy; or strengthening Italy’s fragile banks and resolving the bad loans that still weigh on banks’ balance sheets. A downturn in Europe would hit Italy badly, probably causing the government to escalate its anti-EU and anti-migrant rhetoric.

Elections to the European Parliament will take place in May 2019. Populists from left and right, who are contemptuous of EU values, are likely to do better than ever. Established parties will win even fewer votes amid an economic slowdown.

The ECB should implement a temporary price level target, to commit to keep rates low for longer.

Despite the economic backdrop, the ECB has ended its quantitative easing programme, under which it has bought €2.6 trillion worth of assets, mostly government bonds. Its attempt to ‘normalise’ its monetary policy – though there was nothing abnormal about lowering interest rates or buying long-term assets – comes amid declining inflation and a weakening economic outlook.

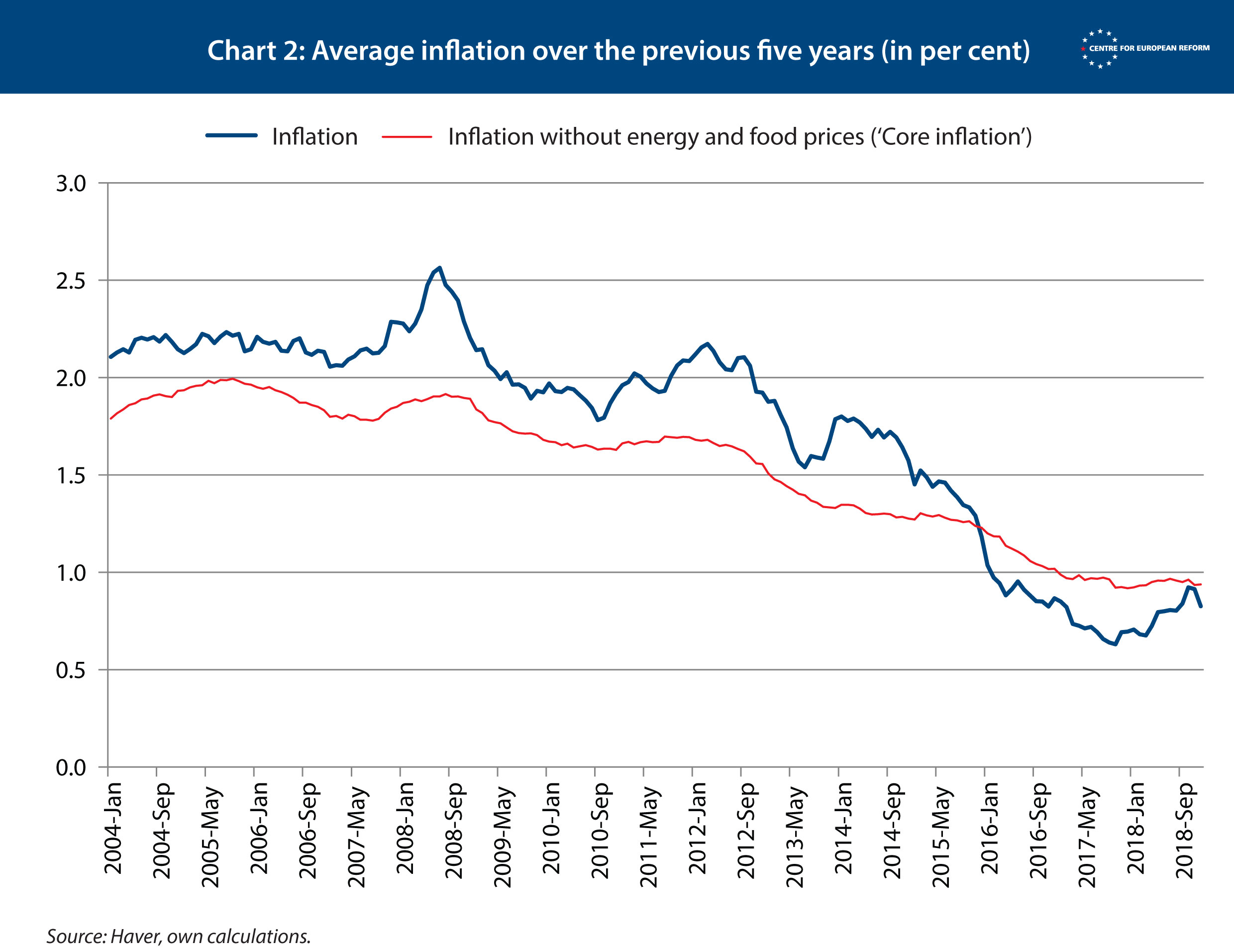

Europe should start fighting the slowdown now. First, the ECB needs to pre-empt a further fall in inflation. Though it stopped its large-scale asset purchase programme prematurely, restarting it would damage its credibility. Instead, the ECB should commit to keeping interest rates low for longer. The best approach would be to announce a temporary price-level target, which the CER has long argued for. Under such a policy, the ECB would change its inflation target from ‘close to but less than’ two per cent inflation per year, to two per cent inflation on average for, say, five years. If inflation continued to undershoot, the ECB would commit to loosen future monetary policy – mildly overheating the economy in order to overshoot two per cent inflation and make up lost ground. Were such a policy in place, the ECB would not contemplate raising interest rates any time soon: over the last five years, eurozone inflation has averaged less than one per cent (see Chart 2).

Second, the eurozone should acknowledge the pro-cyclical bias of its fiscal framework, and fix it. Europe’s fiscal rules do not allow enough stimulus in a recession, and allow too much spending during a boom. Moreover, the rules fail to protect investment spending, which is usually the first to be cut in a downturn. And the eurozone’s method for calculating fiscal limits is itself pro-cyclical: temporary downturns are interpreted as permanently lower growth, limiting governments’ freedom to impart a stimulus. An overhaul of the fiscal rules to protect investment spending and prescribe strongly counter-cyclical policies would help to counter the current slowdown.

Europe should not be complacent: the wounds inflicted by the last economic crisis have not completely healed, while the tools to fight the looming slowdown are limited. Europe should fight this downturn early and aggressively to avoid further political damage to the European project.

Christian Odendahl is chief economist at the Centre for European Reform.