Power losses: What's holding back European electricity trade?

- More electricity trade is urgently needed to curtail Europe’s risky dependence on gas imports – from Russia, the US and the Gulf – and to speed the transition to net zero. During the gas crisis and the curtailment of France’s nuclear fleet in 2022-23, the integrated European grid kept the lights on, by allowing electricity to flow to countries with severe power shortages. But, as intermittent renewables rise in the power mix, more cables will have to be built to allow power to flow from sunny, windy areas to cloudy, becalmed ones.

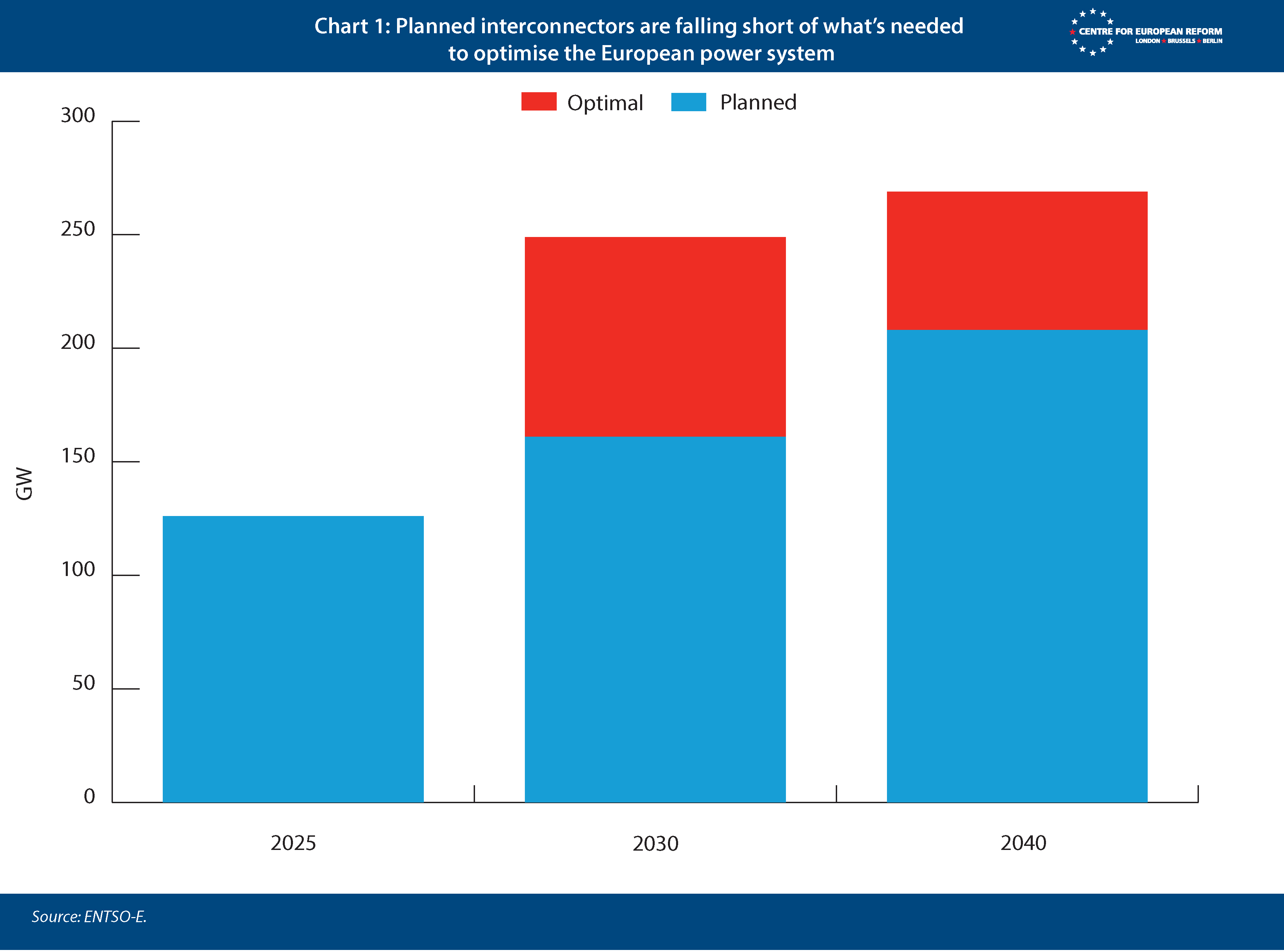

- The roll-out of interconnectors – the technical term for cables between Europe’s wholesale electricity markets – is too slow. To optimise the European grid by 2030, Europe needs a third more interconnectors than those that are currently in the planning and construction stages. A recent surge in agreements between governments means that gap will shrink to a fifth by 2040. But interconnectors take about ten years to build, so lag times are long, making rapid action now all the more important.

- There are five things that European governments can do to hasten integration.

- Recycle more of the profits from interconnection back to electricity consumers in exporting markets. Norway, which participates in the EU’s internal electricity market, has considered curtailing interconnection because high prices in Germany are leading to higher prices in southern Norway, as the strained German grid sucks in power. More of the profits the owners of interconnectors make from electricity trade could be used to cut consumer bills, helping to quell household and industry dissent.

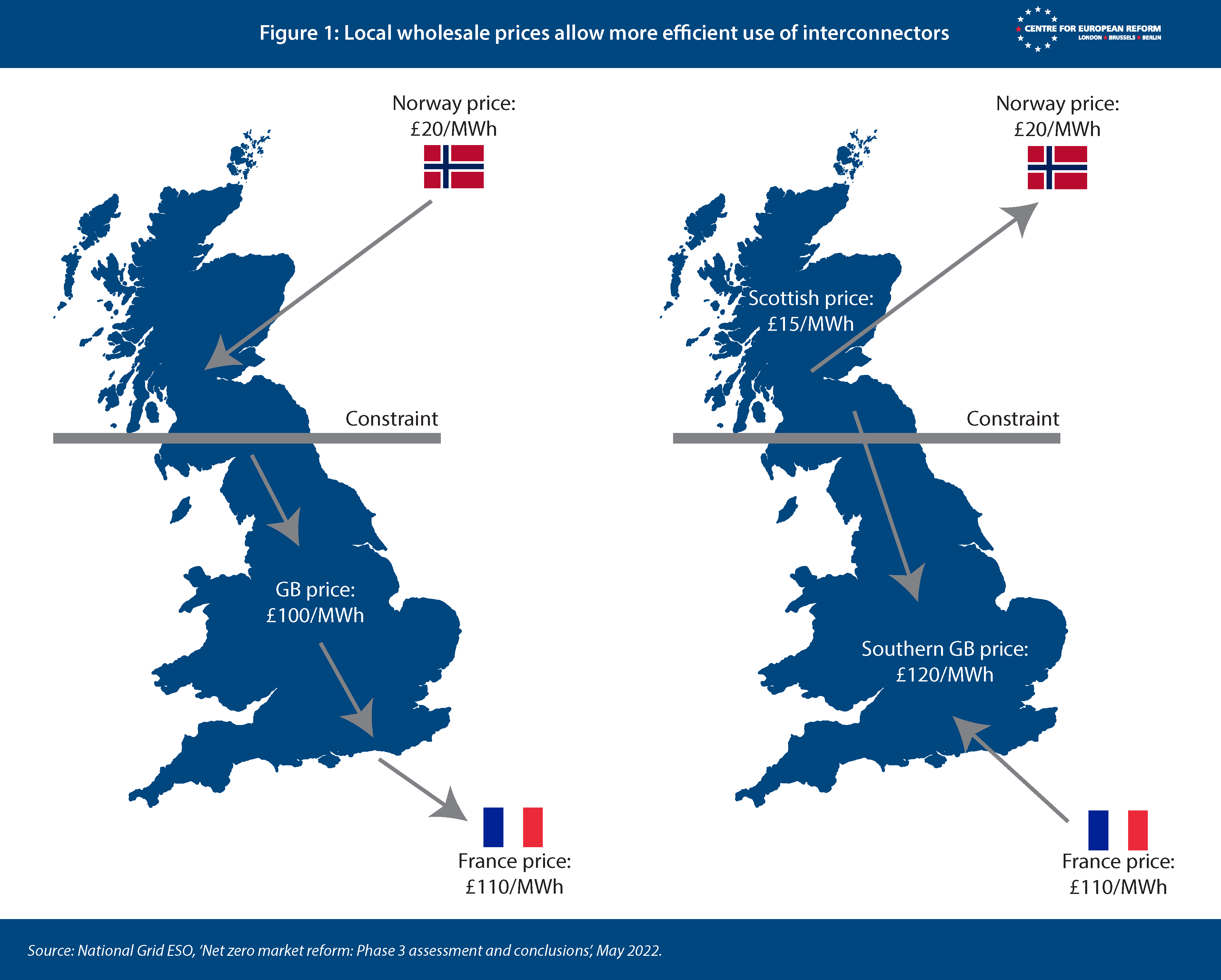

- Break up large national wholesale markets into smaller regional ones. In Germany and the UK, congestion in the domestic grid means that wholesale prices are high, despite Northern Germany and Scotland having abundant wind power. If the huge German market were broken into regional ones, the wholesale price in wind-abundant Northern Germany would fall, allowing electricity to flow into Scandinavia and other neighbouring countries. Smaller, more interconnected wholesale markets would reduce huge payments to wind generators to turn off power when it cannot be transmitted to consumers in congested national markets. Local price signals would also encourage more power plants in regions with demand that outstrips supply, for consumers to use power when it is cheap, and for energy-intensive industry to move to regions abundant in renewable power.

- Fund more interconnection through the EU budget. From the perspective of electricity exporting countries, some interconnectors fail cost-benefit analyses even though they would lead to net benefits across both trade partners. That is because interconnectors are expensive, and they can push the wholesale price up in the exporting country in the short term. The EU could help by raising funding for interconnection from the current measly level of less than €0.6 billion a year.

- Strengthen arrangements for policing failures to follow rules. EU member-states are supposed to allow 70 per cent of transmission infrastructure to be used for electricity trade by the end of 2025. That target will almost certainly be missed in several countries. There are also insufficient arrangements for co-ordinating shut-downs of plants for maintenance, which can cause supply issues in neighbouring states. Enforcement of rules is piecemeal and slow, because member-states claim that they are making efforts to resolve grid congestion and ask for more time, or because they blame each other.

- Expand grid integration with third countries, especially the UK. The North Sea will be by far the most important location for offshore wind power in Europe and will provide more power than nuclear or fossil fuels by 2050. The UK has left the internal electricity market, which makes trading less efficient, adds to wholesale costs in Britain and its trade partners, and weakens incentives to co-operate on exploiting the North Sea basin with a web of interconnectors. But if the UK links its emissions trading scheme and carbon border adjustment mechanism with the EU’s, and aligns with EU rules on electricity markets, the EU should allow it to recouple with the single electricity market. Alignment of regulation and market design with North Africa and Turkey – regions with huge solar potential – would also encourage the construction of more cables crossing the Mediterranean and the EU’s south-eastern border.

Alongside the European Coal and Steel Community, Germany, Switzerland, France, Italy and the Low Countries started to hook up their electricity grids in the 1950s. By trading electricity, especially Alpine hydro power, they could reduce the coal needed for power generation and put it to use in industrial plants. The development of nuclear power and North Sea oil and gas in the 1970s and ‘80s gave further impetus to the European grid, with French and German nuclear plants and British, Dutch and Norwegian gas plants providing cheap exportable power. Now, climate change and the rise of renewables are forcing Europe to go further and faster in integrating electricity markets.

Renewable energy has two characteristics that make European grid integration important. First, countries have different endowments of territory suitable for renewables. The shallow North Sea is a critical wind power resource for north-western Europe but not all countries have access to the basin. The Iberian peninsula and north African countries are sunnier and less populated than northern Europe, making the export of solar power a win-win for everyone. Second, wind and solar power are weather-dependent. Cloudy or calm conditions can be dealt with by using batteries, pumped storage and other power sources, such as nuclear, ‘green’ hydrogen (hydrogen can be made using renewable power, making it ‘green’) and gas-fired plants with carbon capture and storage. But periods of low generation can also be offset by electricity trade, because when the North Sea is becalmed, the Baltic may not be, and power can flow from one region to the other.

However, there are several drawbacks to electricity trading, which is why authorities have been slow to build interconnectors. Interconnectors allow electricity to flow from countries (or, as we shall see, internal price regions called ‘bidding zones’) where generation is abundant and prices low to countries where generation is not sufficient to meet demand, and prices are high. That means that prices rise in the low-price country as electricity flows out, and prices fall in the high-price country as electricity flows in.

These price effects have recently had political implications: Norway has seen prices rise substantially as it exports hydropower to Britain, Denmark and Germany in periods of Dunkelflaute – cloudy, windless days in winter, when renewables generation collapses. High gas prices have also pushed up electricity prices via interconnectors, even in countries like Norway that use little gas for power generation. Norwegian political parties have started to compete on the issue, with Labour and the Centre party saying they want to turn off the interconnector with Denmark when it comes up for renewal in 2026, and to renegotiate contracts for new interconnectors with Germany and the UK.

Interconnectors expose countries to the price effects of each other’s energy policies, which is why Norway – and Sweden, which has also struggled with periods of high prices – are vacillating about further integration of the European grid. Angela Merkel’s decision to phase out nuclear power, the reduction in Russian gas imports after Putin’s brutal invasion of Ukraine, the UK’s relatively high gas consumption, and Denmark’s extremely high share of wind in generation, have all exposed Norway to higher prices in becalmed periods in winter.

Sometimes the politics are difficult for a second reason – because imported electricity can imperil the finances of domestic plants. Until recently, France had been resistant to more interconnectors with Spain, because it would mean opening its market to cheap Spanish solar power. Commentators in Spain – and other countries – have suspected France is trying to protect its state-owned nuclear power industry. That – as well as bureaucratic planning and ‘NIMBYism’ (residents saying ‘not in my back yard’ to solar farms on their doorstep) – has constrained Spain’s expansion of solar power, despite its abundant sun and relatively sparsely populated land. Thankfully, France’s position seems to be shifting, as it became a net electricity importer while several plants in its ageing nuclear fleet had to be closed for servicing in 2023, and as its nuclear plants are re-engineered to allow their electricity output to become ‘dispatchable’, falling during periods of high renewables output and rising on cloudy, windless days. More cables are now in the planning stages, but it took six years to agree the cost-sharing arrangements for building a new subsea interconnector.1 Spain’s interconnectors only amount to 3 per cent of installed generation capacity, against an EU target of 15 per cent by 2030.2

The final problem is that interconnectors are expensive and take a long time to build. Planning also takes a long time, because of protests against pylons, assessments of environmental impact and finding sites for plants to convert power for domestic use. Typical lead times are around a decade, compared to five years for a wind power plant and less for solar.

All of these difficulties explain why, despite good progress on interconnection over the last two decades, the pan-European grid is now being developed too slowly (see Chart 1). According to ENTSO-E, the institution of national grid operators that includes 36 countries inside and outside the EU, planned interconnectors in 2030 will fall short by a third of what’s needed to minimise the costs of the European electricity system, and by a fifth in 2040.

How, then, could progress be accelerated?

The economics

The economics of electricity trade, like trade in manufactures, is driven by comparative advantage: countries have different energy resources, topographies, population density, climates and weather patterns, and so have different advantages in power generation. Countries also have different political preferences over energy sources: France’s nuclear fleet is a source of national pride, as well as exports of engineering knowhow and technology, while Germany has decided to phase out nuclear power. Interconnection allows electricity to flow to countries with fewer endowments and by doing so it raises the efficiency and productivity of the European power sector as a whole. The European grid is developed enough that this can happen in real time, allowing cross-country flows to offset intermittency in renewables.

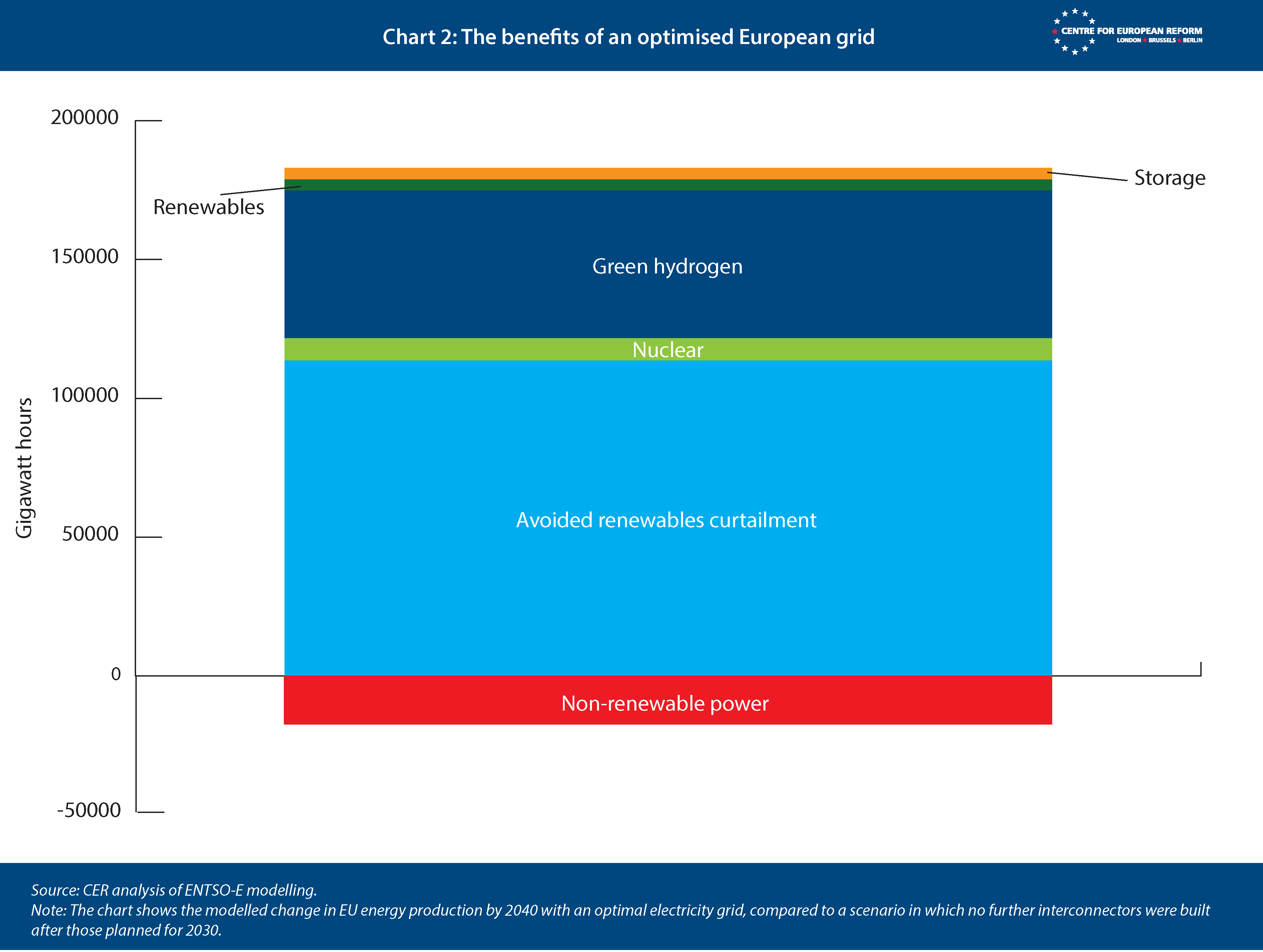

The benefits of trading electricity are large. According to modelling by ENTSO-E, raising interconnection to an ‘optimum’ level – defined as the level that minimises the cost of running the entire European electricity system – would lead to more abundant electricity generation and large capital expenditure savings in the form of unneeded investment in additional domestic plants.3 Electricity would be more abundant because power from wind and solar farms would not have to be switched off so often. Generation is curtailed when supply is higher than demand, and with more interconnection that surplus electricity could flow to cloudier and becalmed regions of the continent. There would be less need for gas plants to operate as back-up, so there would be sizeable savings in carbon emissions (or expensive carbon capture and storage). And more abundant renewable power would allow more ‘green’ hydrogen to be electrolysed. So is higher interconnection a no-brainer, at least in economic terms?

Not necessarily – it depends on one’s point of view. From the perspective of European consumers as a whole, there are large benefits to a more integrated grid: cheaper and more secure power. But from the perspective of individual countries, run by governments who want to get re-elected, cost-benefit analyses are not so clear-cut. The construction of interconnectors – large, expensive capital projects, compared to an individual solar farm – is largely financed by charges on consumer bills, with the ‘beneficiary pays’ principle determining which country’s consumers pay most. This means that net importing countries pay more, because their consumers are the ones that are getting the benefit of access to cheaper power in another country. But more imported power can render some domestic power plants uneconomic, which entails costs in the form of wasted capital expenditure, lost jobs and lower tax revenue for governments, with plants being shut down before the end of their life. New interconnectors can ‘cannibalise’ older ones, too, with cheaper power from a new country undercutting imports via another cable. Again, that entails wasted capital expenditure. When all of these risks are factored in, some proposed interconnectors fail cost-benefit analyses from the perspective of national governments.

A more integrated grid is good for Europeans as a whole, but not always for national governments.

On top of that, there are the costs associated with exposure to decisions made by the regulators and grid operators at the other end of the cable. Norway’s political furore about interconnection with the German grid are caused by energy policy decisions in Germany which Norway has little control over.

How to resolve these problems

The usual method for European trade integration is to align regulation, so substandard or dangerous products made in one country do not provide a reason for another to keep them out, and to enforce compliance by member-states so they do not engage in protectionism. As we have seen, electricity markets are more difficult to integrate.

Because energy supply is a critical function of the state – it is needed to keep people safe and to protect prosperity – the EU has had weaker control over energy markets than in the supply of other goods, with national governments determining the energy mix while agreeing to common decarbonisation targets. There is also a range of different bilateral and multilateral institutions for electricity trade, including Nord Pool – a common, integrated trading area between the Nordic states, the single Germany-Luxembourg electricity market, and the bilateral post-Brexit arrangements covering the UK’s interconnectors with France, Ireland, Belgium and others.

However, a more integrated EU electricity market can deliver large long-term gains for Europe as a whole. Policy needs to focus on speeding interconnection while preventing the problems from slowing down interconnector construction or worse, curtailing or ending the use of existing ones.

There are five solutions:

- Arrangements to recycle export revenues in low-priced markets back to consumers facing higher bills.

- More efficient domestic markets in large countries, to prevent high prices due to grid constraints from spilling over into smaller ones.

- European funding for part of the cost of interconnection in order to defuse arguments about who pays.

- Stronger cross-border arrangements to prevent actions in one market from straining grids in another.

- Agreements with countries outside the EU/European Economic Area but with high renewables potential – most importantly, the UK and North Africa.

The next sections analyse each of these solutions in greater detail.

Recycling the revenues from electricity trade

Electricity trading over interconnectors is a complex business, but in short, traders buy power from electricity generators in one, cheaper market, and offer it to traders in another for a higher price. These trades can happen from one year ahead – or longer in some cases – all the way to within-day trading.

Supply and demand for electricity on a grid must always be balanced: power going into the cables must match power consumed, or the grid infrastructure will be damaged (if there is too much power supplied) or there will be black-outs (if too much is demanded). Thus electricity trade is determined by very short-term price signals. Because of the variations in supply and demand, and the need to balance domestic grids, near-instant trading is needed.

As the Norway-Germany problems demonstrate, these trades can cause social and political problems in lower-priced market, especially when demand is high and supply constrained in the higher-priced one. Traders make money by buying cheap electricity in one market and selling it in the other, with the company running the interconnector – which is often the grid operators of the two countries – taking a cut. When these trades affect the wholesale price in the lower-priced market – which can happen when the importing market is much larger, and the price difference is big, the revenues made by traders and the owner of the interconnector could be subject to charges to keep bills down in the lower-priced market.

The most effective way to recycle revenues back to electricity users in the low-priced market is a ‘cap and floor’ regime. If the price of electricity being exported over the interconnector rises above the cap, the interconnector operator pays the excess back to the transmission system operator in the exporting market. That is then used to lower transmission charges that electricity consumers must pay on their bills. The floor works in reverse: if electricity export prices are lower than the floor, the system operator pays the company running the interconnector the difference. This floor provides an incentive for interconnectors to be built in the first place, because revenues will be more certain, while the cap forestalls consumer backlash in the exporting country. Between the cap and the floor, prices are set by the market, otherwise electricity would not flow at all.

It is not easy to determine what level the cap and floor should be set at, and how wide the band between them should be. If the cap is too high, revenue will not be recycled back to consumers in the lower-priced market, breeding discontent. If the floor is too high, the incentives to build the interconnector are weak, because the revenues will not cover the cost of construction and operation. If the band is too narrow, the benefits of interconnection are more limited, because the price differences between markets that drive electricity trade will be throttled.

But more interconnectors will be built if revenues are certain, and there are limits imposed on price rises in lower-cost markets. While such a regime is difficult to calibrate in practice, it can overcome some of the incentive problems that are slowing down interconnector construction.

More efficient domestic markets

In order to maximise the benefits that electricity trading would bring, European countries with large, national wholesale electricity markets may have to break them up into several smaller ones.

The wholesale power price is set by bids by electricity retailers and industrial consumers on the one hand and offers by generators on the other. While Germany has a single bidding zone, Norway and Sweden each have several. In the northern Norwegian zones, there is abundant hydropower, but there is not enough transmission capacity to get all of that power to the south, which typically has higher prices because it has less hydropower and, because it is more populous, higher electricity demand. Multiple zones raise efficiency, because the congestion on the transmission lines between north and south is eased by stronger incentives for generators to build new plants in high-priced zones, and southern Norwegians to save energy or use it when prices are low. Cheaper power also provides incentives for industrial plants and data centres that use a lot of electricity to locate production in the north, where power supply is abundant. In this way, more efficient use of the existing grid means that high-cost investments in new north-south transmission lines are avoided.

Germany’s single zone, on the other hand, has spillover effects on Scandinavia’s efficient markets. The single bidding zone means that northern Germany pays higher prices and southern Germany lower than they would in a system in which prices were determined locally. Northern Germany has more renewables capacity and less heavy industry than the south, and if it had its own wholesale price, electricity would flow more often into Scandinavian markets, reducing prices there. But the single zone means that wholesale prices are determined by supply and demand across the country, and congestion in delivering wind power from the north to the south pushes up prices to the extent that the German price is almost always higher than in southern Norway and Sweden.

The gas price shock and the closure of Germany’s nuclear plants has made this situation worse, by further raising its wholesale price.

EU law is intended to prevent this situation from happening, but enforcement has been slow and ineffective. The rules state that 70 per cent of each member-state’s transmission capacity must be made available for electricity trade by the end of 2025. The Norwegians and Swedes complain, with reason, that they meet that target for trade with Germany, but Germany fails to meet the target for flows going the opposite way, thanks to its single price zone. Countries missing the target must either strengthen their grids so that internal congestion does not prevent electricity flowing out because it raises prices across the entire zone, or break their single bidding zone into regional ones.

Structural congestion problems inhibiting cross-border trade were first identified in 2019. Germany says it will meet the 70 per cent target at the end of 2025, although there is scepticism that it will do so – in 2022, it was only between 20 and 50 per cent (depending on prevailing levels of supply and demand).4 If it fails, there will be a round of discussion between Germany and its neighbours’ authorities about how to address the issue, either through grid expansion in Germany, or by breaking up the German zone. If an agreement cannot be reached, the European Commission will decide.5

This may take several more years, and the outcome is uncertain.

That is because, while there is a powerful logic for smaller bidding zones, the political blowback for enacting them is high. German industry, already battered by high gas prices and Chinese competition, is strongly opposed, because it would raise electricity prices in southern Germany where most industry is located.

A fierce debate about local pricing has broken out in the UK, where the government is considering breaking up the country’s single bidding zone into several. That is because it suffers from similar north-south grid congestion as Germany – it also has the best wind potential in the north, but wind farms off Scotland are frequently, and expensively, paid to turn off the power so the grid is not overloaded.

Most of the British debate has been parochial – about the impact of local pricing on the build-out of new renewables plants and incentives for consumers to be more flexible about when they use electricity. On build-out, the more local wholesale prices that a southern English bidding zone would produce would encourage more solar and battery storage to be installed in the south, easing north-south transmission congestion. Data centres and green hydrogen plants would be encouraged to set up in Scotland, where electricity would be cheaper.

But multiple bidding zones also allow interconnectors to be used more efficiently and encourage more to be built if it is economic to do so. That would also reduce overall capital expenditure in new plants, because electricity can be imported from other countries with a surplus; and lessen the curtailment of renewable plants that already exist.

As this diagram shows, the incentives to build expensive transmission lines, both internally and externally, would be strengthened by more local prices, maximising efficiency. Surplus renewable electricity, constrained by the limited transmission between Scotland and England, would flow to Norway, where prices were higher, rather than power from wind farms being switched off. Electricity would flow in from France, as the southern English price would rise above the wholesale price in France.

Across Europe, opponents of regional bidding zones point out that more transmission lines would reduce curtailment of renewables, but from an efficiency perspective, it would be better to be agnostic about whether transmission lines were domestic or international. Practically, planning decisions should be determined by the cost of the transmission infrastructure and the benefits of lower capital expenditure and more secure supply.

There are, of course, other, non-trade issues to consider. More local pricing would also expose consumers in regions with less generation to higher prices, potentially leading to a backlash. There are models of redistribution between low and high-priced regions that only expose businesses to those prices, rather than consumers, but industrial interests would push back against that, and consumers are less likely to respond to higher prices by buying EVs and domestic batteries that charge at low-priced times of day, for example. Caps and floors on prices, on the same model as interconnectors above, can also help to reduce some of the price risks that business and consumers would face.

The uncertainty about future prices and volumes of sales that zonal pricing would instil might deter investment in new plants. That is because local wholesale markets would be smaller, and prices might change once new plants are added. Uncertainty would be reflected in a higher cost of capital, because investors would demand higher interest rates to cover for the fact that their plant might be cannibalised by a new one. There is a continuing debate about whether those risks are worth the potential benefits; and how to reduce the risks.

But there is little doubt that local prices would lead to greater benefits from interconnection – benefits that will only grow as renewable power becomes increasingly traded over the next 15 years.

European funding

As noted above, an integrated European grid has large benefits for Europeans as a whole, but there are potential losers in countries with lower electricity prices, at least in the short term. There are also financing risks from building interconnectors – large, capital-intensive projects – because future differences in prices between the two markets are uncertain.

The unequal benefits and costs across countries, alongside the uncertainty about future revenues, are reasons for more funding at a European level, since the benefits are shared across the continent. However, the budget line for common energy projects in the Connecting Europe Facility (CEF) is small, at €6 billion over the entire 2021-2027 European budget (the Multiannual Financial Framework, or MFF) period – that is €0.9 billion a year, and only a part of that money is spent on interconnection. Data on commitments made under the CEF is scant, but 60 per cent of energy investment goes to electricity transmission and generations, taking the figure available for cross-border grid expansion to about €0.6 billion annually (and some of that money is for domestic upgrades and renewable projects, not interconnectors per se).6 According to ENTSO-E, the additional investment needed to optimise interconnectors between 2030 and 2040 would be an extra €6 billion a year.

Investment in cross-border electricity grids has clear benefits, in the form of lower investment in domestic transmission and generation, so it makes sense that domestic bills should provide the revenue streams to pay back the capital cost of construction, with national governments, the European Investment Bank or, less often, private sector vehicles providing the capital. But reorienting more of the CEF to interconnector construction makes sense, given the shared European benefits and the uncertainty about future price differences between markets.

Cross-border rules and institutions

It is important to recognise that the European electricity market has become much more integrated in the last two decades, even if progress has been slower than needed. Grid connections between central and eastern European countries – and between that region and western Europe – have improved. The Baltic countries have cut connections to Russia and have joined the continental European grid. There are connected markets across the EU, with an algorithm providing near-instant trading of electricity across interconnectors.

All of these advances have required a common set of rules across the EU, to govern congestion management, balancing markets (to ensure supply and demand are matched), what to do when black-outs in one country affect another, and so forth. But that rulebook remains incomplete, because electricity regulation is still largely in the hands of national regulators, who disagree with each other, and worry about actions in another jurisdiction affecting their electricity supply in their own market. It takes a long time to agree to new ‘network codes’, as common rules are called, through an institution called the Florence Forum which brings grid operators together to hammer out new ones each year.

The standard procedure of EU policy-making – harmonise rules to allow trade to take place – is difficult when control over the energy mix remains at the national level. If France imports more renewable power from other countries, that affects the operation of its nuclear plants. The French system has to be upgraded in its own way, given the very high share of nuclear, in order to deal with renewables. At the same time, rules for market trading of electricity, balancing the grid, and paying for back-up power are different there than in Denmark, with its much higher share of offshore wind.

Standard EU policy-making – harmonise rules to facilitate trade – is difficult when energy mix decisions are national.

This puts a greater premium on bilateral and regional co-operation than in other European markets. For example, the Swiss sometimes curtail interconnector inflows to deal with domestic supply-demand mismatches. The appeals procedure against this decision is pursued through an organisation that includes all the grid operators that surround Switzerland, rather than the European Commission.

Officials in the Commission are comfortable with regional arrangements to ensure that EU rules are met. EU regulations set out obligations that national system operators must meet, such as making 70 per cent of transmission capacity available for cross-border trade. Enforcement is slow because national systems need to be changed, or because system operators on either side of the border blame each other or transitional problems that will be resolved later. The Commission says that appeals and enforcement procedures can be bilateral or regional – they do not have to be run by the Commission itself – and the growing web of interconnectors between neighbouring countries may have different arrangements, as long as the over-arching targets are met. But more rapid moves to meet the rules are needed to speed the integration of the European grid.

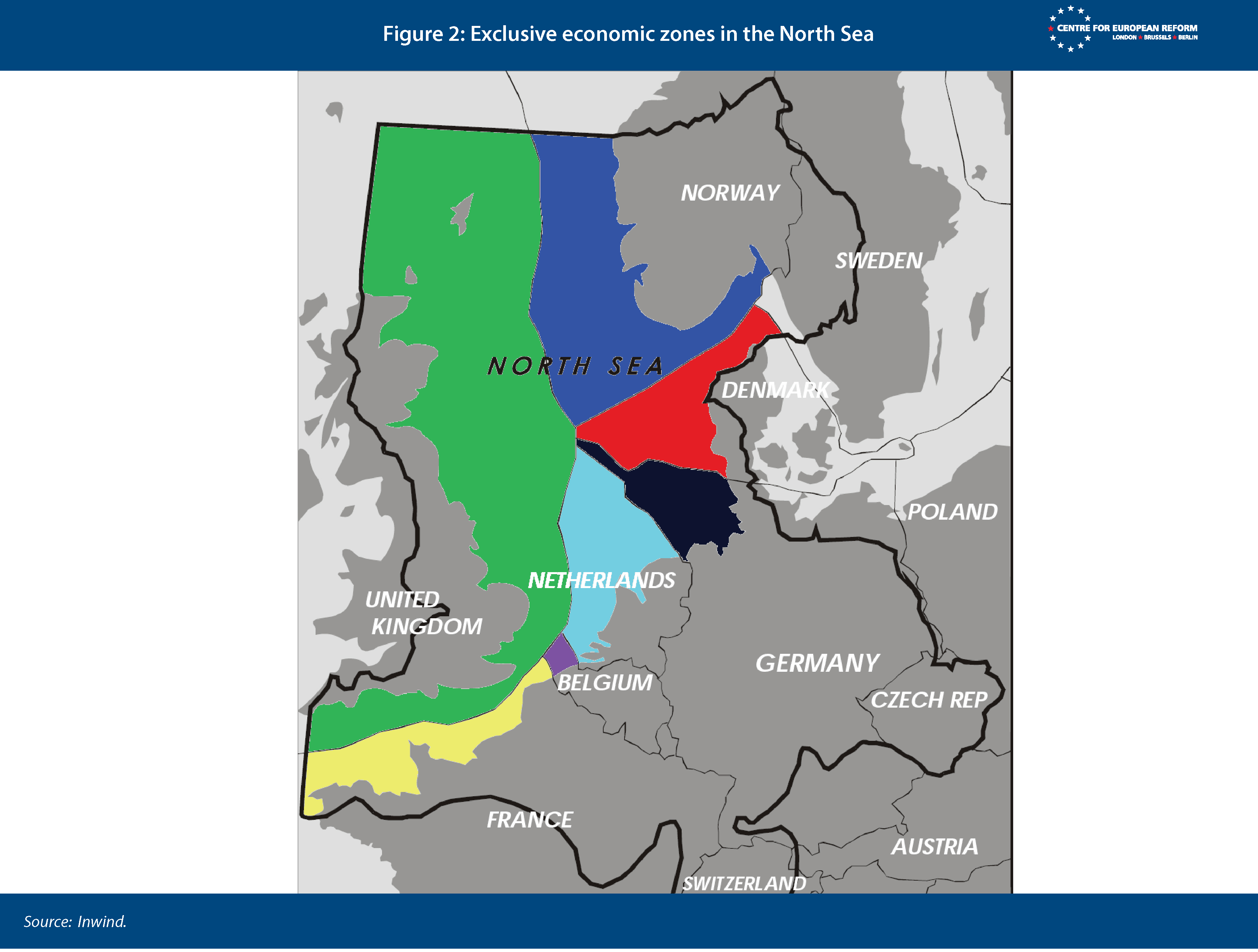

There are growing multilateral efforts to develop wind power in the North, Irish and Celtic Seas through the North Seas Energy Co-operation, with which the UK co-operates through a post-Brexit memorandum of understanding. Given the importance of North Sea wind for the energy transition, and the size of the UK’s exclusive economic zone (Figure 2), co-operation will be essential, as the next section discusses.

Agreements with Britain, Turkey and North Africa

After Brexit, the UK left the EU internal electricity market. Electricity flows across interconnectors continued, but in a less efficient way: the UK ‘decoupled’ from the EU market, meaning that it lost access to the European regime that provided a single price for trading UK electricity across borders, and automatically balanced bids and offers for UK electricity trade through an algorithm. Britain reverted to separate auctions for each connected country.

The North Sea is forecast to be the site for the bulk of European offshore wind investment.

The decoupling of the UK market meant that traders had to commit to trade more electricity in advance. Given the variable prices of electricity in Britain and its trade partners from day to day, that meant that, after Brexit, electricity sometimes flows from higher-priced markets to lower-priced ones, because traders had made errors in their assumptions about price differences, sometimes because weather forecasts were wrong. If traders had expected the wind to be blowing more strongly in Denmark than in the UK, and on the day the reverse was true, electricity would flow from higher priced Denmark to Britain.

The cost of this efficiency loss is large, with one study putting it at £560 million a year in generation costs, or 1.5 per cent of the total.7 Those costs will grow as renewable power takes up more of the mix, because near-instantaneous trading is more valuable as generation becomes more intermittent.

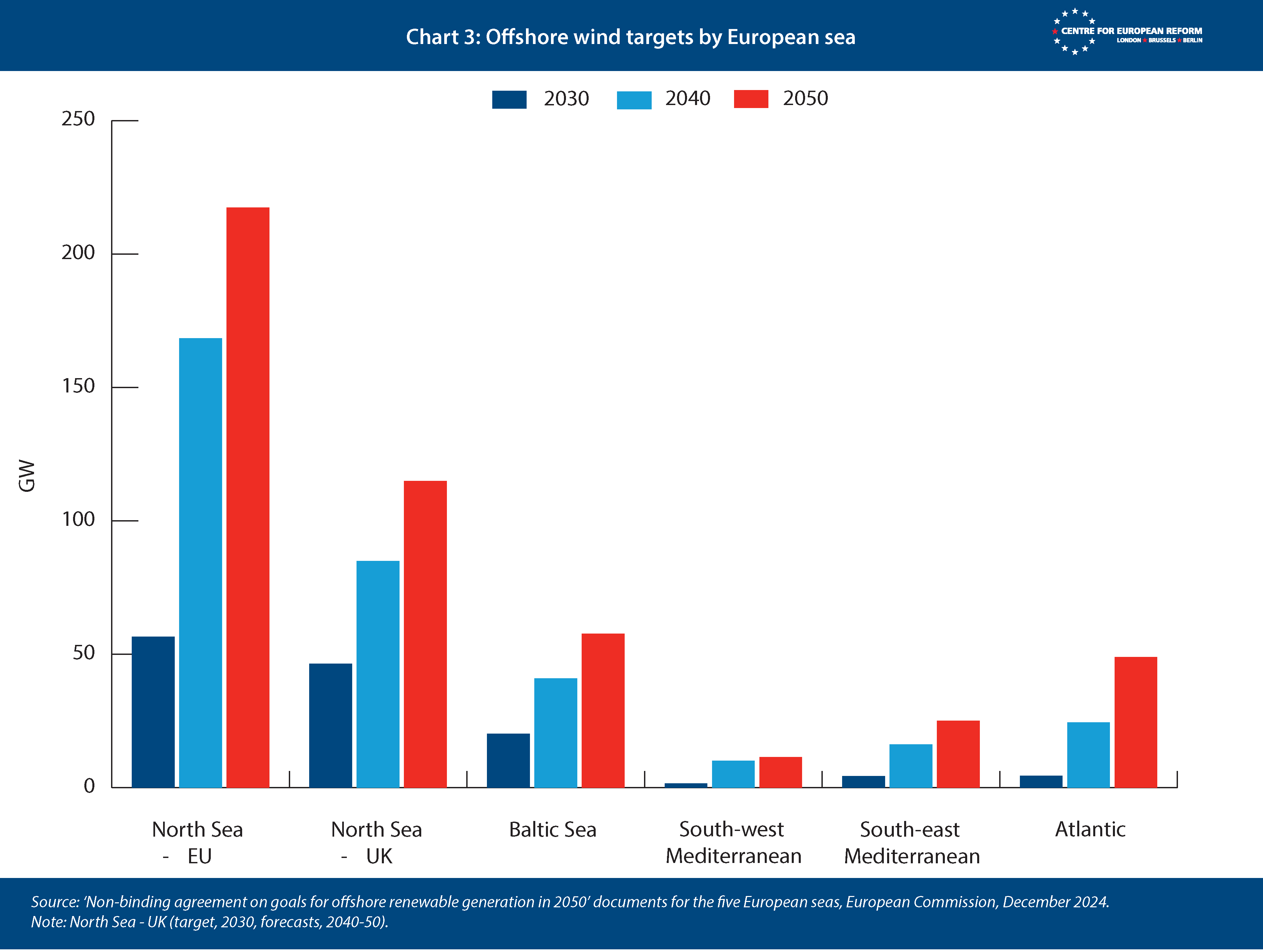

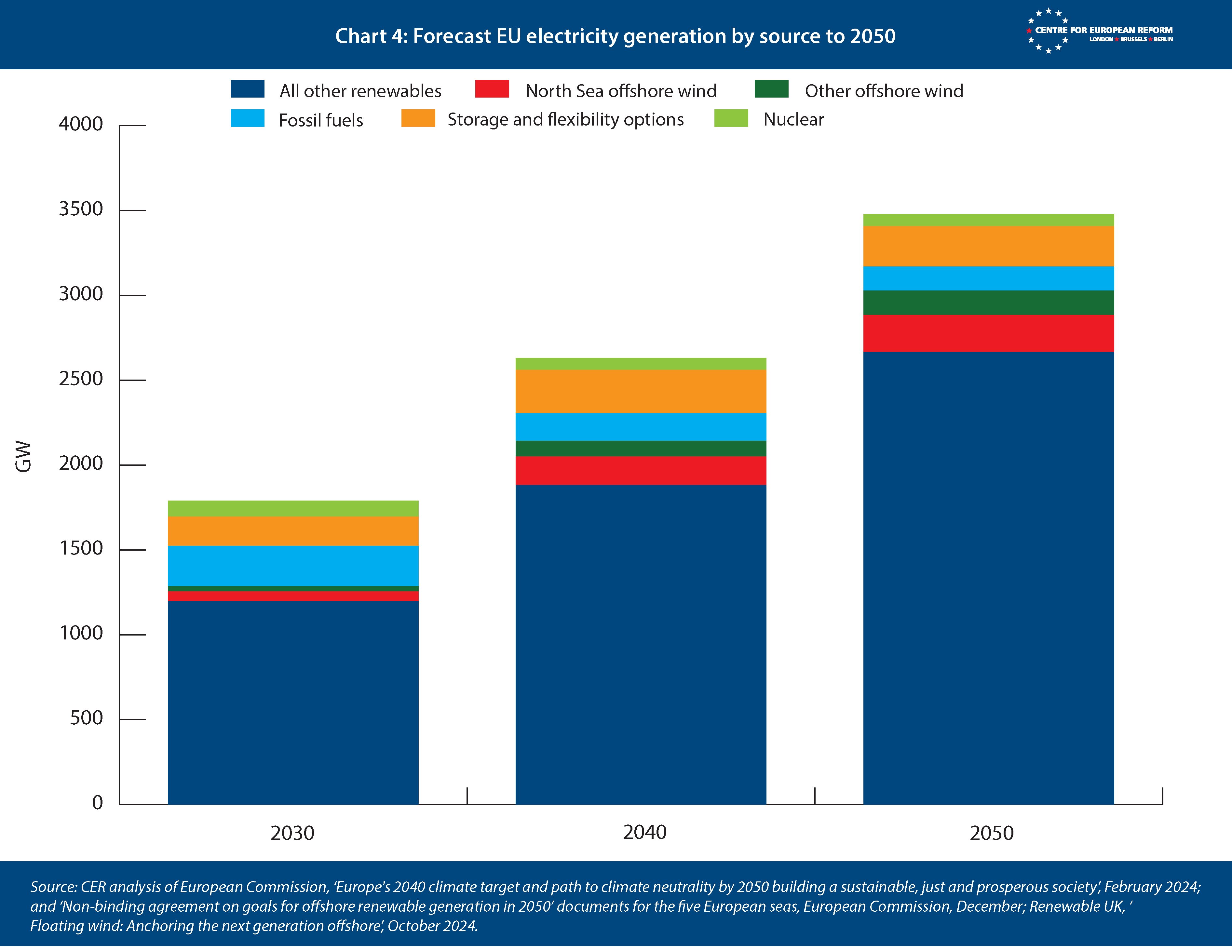

North Sea wind is an important part of Europe’s plans to decarbonise power. It is shallower than other seas and more windy than the Mediterranean, so it is forecast to be the site for the bulk of European offshore wind investment (Chart 3). By 2050, the North Sea is forecast to provide 6 per cent of all electricity generation in the EU, more than nuclear power or fossil fuels (Chart 4).

Six EU countries and the UK own the North Sea (see Figure 2), and there is a strong logic towards sharing the resource and minimising the cost of investment in offshore wind and of trading the electricity produced. There are plans for so-called hybrid interconnectors that distribute electricity directly from North Sea wind farms to two or more countries (current interconnectors simply run from land-mass to land-mass, without stopping to collect offshore wind power on the way). This type of interconnector would allow power to flow directly from wind farms to relatively high-priced markets, reducing transmission and curtailment costs.

Little progress has been made on improving electricity co-operation since the UK left the EU.

Despite the savings from more interconnectors and the inefficient post-Brexit trading arrangements, little progress has been made on improving electricity co-operation since the UK left the EU. That is despite the fact that the Trade and Co-operation Agreement (TCA) allows for new arrangements to be developed to govern UK-EU electricity trading. The Commission insists that participation in the internal electricity market should be part of the package of four freedoms – goods, services, capital and people, and that is why Norway is part of the electricity market but the UK cannot be. That political commitment may be difficult for the UK to unpick, but the need to get to net zero as quickly and cheaply as possible, in a period of unstable global politics, should prompt more pragmatism on both sides.

The EU’s carbon border adjustment mechanism (CBAM) promises to make electricity trading harder too. The CBAM aims to level the playing field between EU producers, who must pay for emissions allowances under the EU emissions trading scheme, and imports that are not subject to an equivalent carbon price. Imports of electricity from the UK may be subject to charges to make up for the difference in carbon prices between the two jurisdictions. As things stand, the charge will be based on historical carbon intensity of the UK electricity sector, rather than the contemporary intensity, which is falling rapidly.

The British government has said that it is considering linking its emissions trading scheme with the EU’s, so that the carbon price in both jurisdictions is identical. This would mean that CBAM charges would not be due, but it would require the UK to sign up to EU decisions on the issuance of carbon allowances.

As the renegotiation of the TCA gets underway in 2025, it may be possible to persuade the EU to allow the UK to recouple with the European grid, in exchange for linked emission trading. That would reduce wholesale electricity prices in the UK and across north-western Europe. But it would require the EU to consider more market integration beyond its borders and those of the European Economic Area.

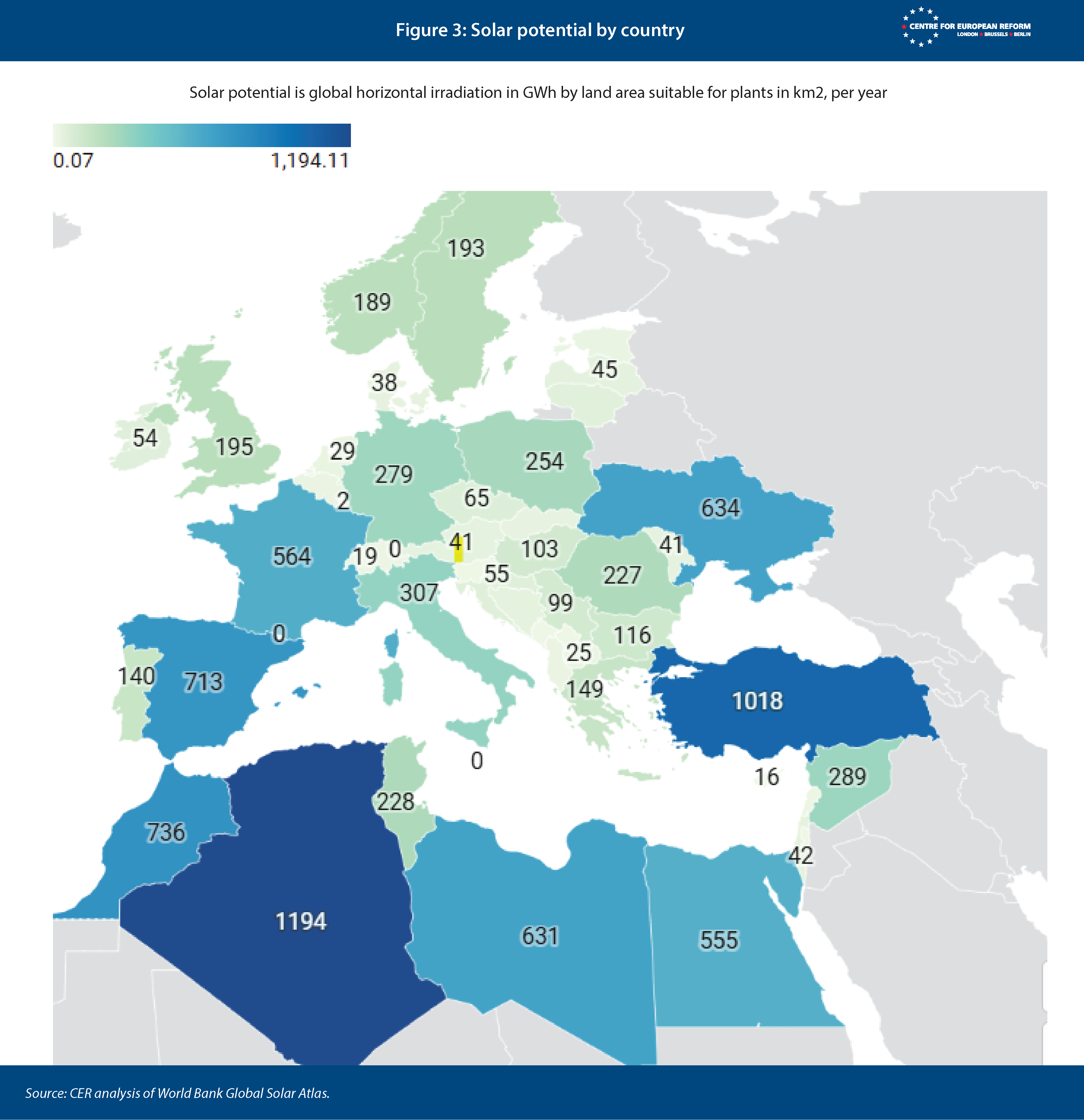

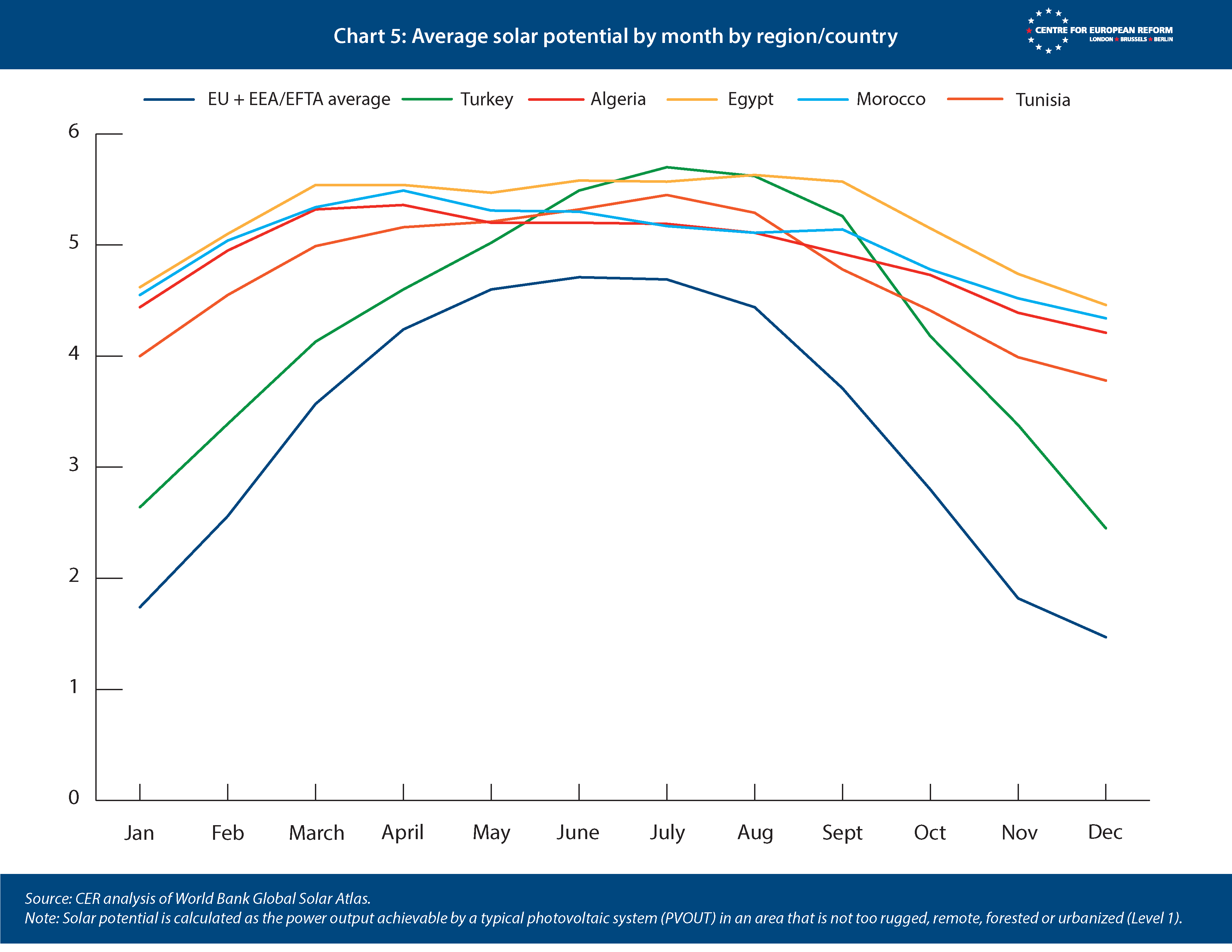

There are compelling economic reasons for more EU trade in electricity with a wider set of partners, although the politics are difficult. Morocco and Tunisia – two relatively stable North African countries – have excellent solar potential, and with Turkey, they could provide as much solar power as Spain, France, Italy and Germany combined (Figure 3).

Year-round sunshine makes North African solar power much less seasonal than European and Turkish power (Chart 5). If more interconnectors could be built between Morocco, Tunisia, Spain, France and Italy, it would allow those countries to reduce investment in storage, nuclear and other forms of back-up power.

Integration of these countries into the internal electricity market is more difficult than it is with the UK, where the problems are entirely political. They would have to adopt equivalent EU rules on market trading, electricity subsidies, emissions, the break-up of state-owned vertically integrated generation and transmission companies, and there would have to be shared institutions to enforce the rules. But even if integration falls short of that, and more cumbersome arrangements for trade are put in place, the potential benefits for both sides are very large. Countries outside the EU would gain export earnings and access to cheaper capital investment in solar plants – which would help their own decarbonisation efforts. The EU would gain cheap, reliable power, helping to reduce the cost to achieve its emissions reduction goals.

The difficulty is that, even without full integration into the market, powerful institutions would be needed to make countries to stick to the rules to keep electricity flowing and ensure security of supply. Without those institutions, EU member-states would not be able to reduce investment in generation and storage in their own jurisdictions. There are justified fears about becoming dependent on authoritarian states for power, after the Russian gas crisis. But imports from these countries will be a growing part of the mix – a third interconnector between Morocco and Spain is planned – and stronger regulatory alignment would allow more to be built. And since renewable power production is inherently more geographically dispersed than gas, where a small number of often autocratic states outside Europe are responsible for most of supply, the result would be less dependence on external states, not more – even if they are authoritarian states or flawed democracies.

Conclusion

Europe has limited fossil fuel resources of its own, and is still too reliant on expensive energy imports – imports that make the continent vulnerable to extortion and aggression by authoritarian petro-states, or, in the case of the US, backsliding democracies. To achieve energy independence and net zero it must rapidly expand its electricity grid. The proposals set out in this policy brief are challenging politically – especially splitting up large national wholesale markets, which industrial interests are strongly against, and close integration with the UK, which both Britain and the EU find difficult for their own reasons. But the prize is large: fewer wind and solar farms standing idle because their power cannot be transmitted to consumers; lower capital expenditure on back-up power; and lower electricity prices for consumers across Europe. Net zero will be difficult to achieve if politicians cannot provide voters with abundant, cheap and green electricity, and more electricity trade is needed to maintain the fragile consensus on climate action.

2: ‘Why is the Iberian peninsula an energy island?’, AleaSoft Energy Forecasting, March 2022.

3: ‘Opportunities for a more efficient European power system by 2050’, ENTSO-E, January 2025.

4: ‘Cross-zonal capacities and the 70 per cent margin available for cross-zonal electricity trade (MACZT)’, European Union Agency for Co-operation of Energy Regulators, July 2023.

5: Christine Bader, ‘Heavy industries go light: The end of uniform electricity prices in Germany?’, Watson Farley and Williams, November 24th 2024.

6: European Commission, ‘EU invests over €1.2 billion in cross-border infrastructure contributing to build our Energy Union and to boost competitiveness’, January 30th 2025.

7: Joachim Geske and others, ‘Elecxit: The cost of decoupling bilateral British-EU electricity trade’, Energy Economics, January 2020.

John Springford is an associate fellow at the Centre for European Reform.

April 2025

View press release

Download full publication

This article has been supported by the European Climate Foundation. Responsibility for the information and views set out in this article lies with the author. The European Climate Foundation cannot be held responsible for any use which may be made of the information contained or expressed therein.