A tale of batteries, Brexit and EU strategic autonomy

Recently leaked proposals suggest the EU wants to use the EU-UK trade deal to help on-shore an electric vehicle supply chain. But this heavy handed approach risks undermining its claim to be a world leader on climate change and green technologies.

In an ideal world, the EU’s trade policy would complement its other strategic, environmental and economic objectives. But this is not always the case. And despite the EU’s environmental ambition, its free trade agreements (FTAs) contain rules that discriminate against trade in lower-carbon electric vehicles (EVs). While normal cars readily qualify for tariff-free trade with the EU’s FTA partners, EVs struggle because the FTAs tend to include a local content, or rules of origin, threshold of 55-60 per cent, which is too high for EVs to clear. This is due to the battery of an EV accounting for a significant percentage of the final value of an electric vehicle (35 to 45 per cent), and invariably being sourced from outside the EU (usually Asia). Recently leaked European Commission proposals suggest the EU intends to tackle the issue in its trade negotiations with the UK. But rather than loosening the rules to accommodate trade in EVs, the proposed rules of origin suggest the Commission spies an opportunity to use the trade agreement to further its ambitions of ‘strategic autonomy’, and cajole European industry into hastily developing an on-shore domestic battery industry.

EU free trade agreements inadvertently discriminate against trade in lower-carbon electric vehicles. The trade talks with the UK offer an opportunity to fix this.

The EU has long viewed the creation of a purely domestic battery value chain, and a reduced technological dependence on other countries, as a strategic imperative. In 2017, European Commission Vice President Maroš Šefčovič launched the European Battery Alliance (EBA). The EBA consists of the Commission, interested member-states, the European Investment Bank and over 120 interested industrial groups and companies. EBA members have signed onto a strategic action plan which commits to “make Europe a global leader in sustainable battery production and use, in the context of the circular economy”. The EBA has led to the approval of €3.2 billion of funding for battery research. But creating a domestic battery industry from the ground up was always going to be a challenge. McKinsey estimates that in 2018 only 1 per cent of the demand for EV batteries was supplied by European companies, with 97 per cent being supplied by companies in China, Japan and South Korea. And despite making positive noises, European car makers have been slow to branch out into battery and cell development.

But the EU’s rules of origin proposal for EVs and batteries traded under a future EU-UK FTA suggest that the Commission is prepared to use other tools to pressurise European companies into aligning with the bloc’s strategic objectives. Table 1 breaks down the criteria by which EVs would qualify as ‘local’ to either the EU or UK, and thus for tariff-free trade, in the years following the introduction of an EU-UK FTA. For the first six years the Commission is proposing that for an EV to be considered of EU or UK origin, only 45 per cent of its value is allowed to consist of non-EU (or UK) inputs (or rather, 55 per cent of its value must be locally produced). This is consistent with the EU’s general approach to rules of origin and cars, and matches the criteria for, say, the EU’s trade agreements with Canada and Japan. However, from 2027 onward, not only would the 45 per cent threshold remain, but also the EV battery would have to originate in the EU (or UK). As will be discussed below, this requirement means that the entire EV battery supply chain will have to be domiciled within the EU by 2027, if an EV is to qualify for tariff-free trade under these rules of origin.

An EV battery consists of many components. The battery pack contains many smaller battery cells, which contain a number of components including a cathode, anode, electrolyte solution and separator. The EU’s proposal suggests two options for battery packs and battery cells (see Table 2). In the first period, until 2023, 56 per cent of the final value of the pack is allowed to come from third countries, but that share declines to 30 per cent by 2027. For battery cells, 70 per cent of the final value is allowed to come from elsewhere to begin with, but drops to 35 per cent by 2027. Sourcing battery components from abroad will thus become less feasible over time.

The other option is to demonstrate a change in tariff heading (CTH). A CTH occurs when a product is altered via a manufacturing process to the extent that its classification (tariff heading) changes. For example, an imported mixed lithium-nickel-cobalt-manganese oxide, used as an active material to create the cathode in a battery cell, has a tariff heading of HS2841. But when it is turned into a battery cathode the tariff heading changes from HS2841 to HS8507, the heading for EV batteries and battery parts. This demonstrates that enough work has been carried out locally. If an EU company imported the active material from, say, China and turned it into a cathode, the cathode could be treated as EU-origin, and qualify for tariff-free trade.

However, changing the tariff heading will not work for the next step: transforming the cathode into a battery cell or the cells into battery packs (the manufacturing stage that tends to take place in a so-called ‘gigafactories’). There is just one classification or tariff heading (HS8507) for batteries and its components, including the cells, the anode, the cathode etc. This means that turning imported cell components into a battery cell is not enough to confer origin, because the tariff heading remains the same. From 2024 on, even that first step – turning chemicals into cathode or anodes – will be made impossible under the CTH method because it is explicitly excluded. The only CTH opportunity available would be when creating the active cathode material from the imported primary raw materials. Such ambition relies heavily on companies like German chemicals firm BASF being able to scale up existing capacity.

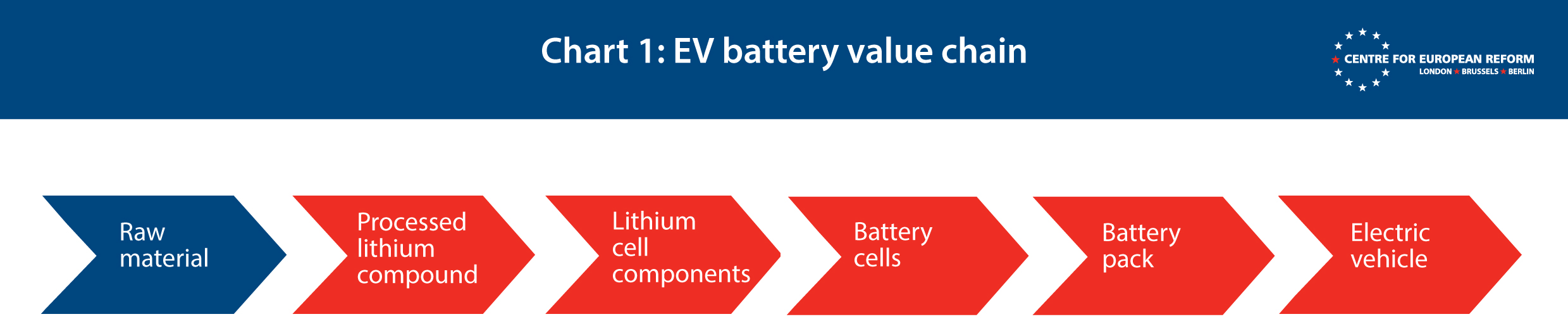

In sum, for a battery cell, and thus a battery pack, and thus an electric vehicle to qualify for tariff-free trade under a future EU-UK FTA, the vast majority of the battery supply chain from stage 2 (the red bits in Chart 1 below) onwards would need to be located within the EU or UK. Not only would battery pack, cell and component production need to be domiciled, but also the creation of the chemical compounds used to create the components. While there are European companies situated across the supply chain, they do not currently produce on a scale necessary to meet the demand of the EV industry. The EU’s ambition to create an entire domestic battery supply chain by 2024/2027 is laudable, but as it stands, doing so is not something EU industry is even close to being able to deliver.

The EU seems to want to move faster than its own industry can manage. It is unlikely that EU or British EVs would be able to meet the proposed rules of origin criteria on day one of an FTA, meaning EVs sold between the two will be subject to tariffs, whereas petrol and diesel powered cars will not. And in the medium-term, EU and British businesses may end up being overwhelmed by the challenge of onshoring an entire battery supply chain by 2024 and resign themselves to a permanent 10 per cent tariff on trade in EVs between the EU and UK. The Society of Motor Manufacturers and Traders estimate that a 10 per cent tariff increases the price of UK produced EVs sold in the EU by £2000, and EU produced EVs sold in the UK by £2800. If this were to happen, the EU’s broader environmental objectives could suffer collateral damage.

Leaked rules of origin proposals suggest the EU is prepared to use trade rules to pressurise European companies into aligning with the bloc’s strategic objectives, and desire for an onshore battery industry.

The UK also wants to nurture an onshore battery industry, but it has not been so aggressive in its rules of origin proposals (also leaked). The British government has prioritised tariff-free cross-channel trade in EVs, rather than using them as a de facto tool of industrial policy. Arguably this could be down to the differences in market size, and the UK having a realistic assessment of the extent of the EV supply chain it will be able to ultimately achieve. The EU is unlikely to accept British proposals, which would mean initially allowing 70 per cent of the value of EVs to be non-originating. But it should consider meeting the UK halfway, seeing as EVs produced in the EU and UK will both not be able to meet the EU’s preferred threshold of 55 per cent local content by the 1st January 2021. The UK also wants to allow 75 per cent of battery cells and packs to be foreign, subject to review after six years. Again, the EU might quibble with the threshold, but Britain’s desire for a review clause is sensible. And if the EU and UK do indeed land on rules of origin criteria for EVs and batteries similar to those proposed by the EU, it would be wise to embed statutory review periods prior to any tightening of provisions, to ensure that European and British industry is able to comply.

The EU should view the negotiations with the UK as opportunity to make the first step towards righting a wrong, and ensuring that its EVs can trade on an equal footing to non-electric. And the focus should be foremost on ensuring that EVs qualify for tariff-free trade, not pressurising the European car industry into onshoring EV production. The EU should also review and update its existing FTAs, under which EVs currently do not qualify for preferential treatment, so that they do not put lower-carbon cars at a disadvantage compared to petrol and diesel. Indeed, it cannot claim to be a world leader on climate change and green technologies if its FTAs continue to favour trade in incumbent, fossil-fuel intensive, alternatives.

Sam Lowe is a senior research fellow at the Centre for European Reform.

Add new comment